Key Takeaways

• U.S. economic and earnings growth continue to stand out globally and support our positive view of U.S. equities.

• We continue to see upside potential in emerging markets due to attractive valuations, recent economic growth, and potential U.S.-China trade resolution.

• Our cautious outlook for international developed equities is driven primarily by a lackluster economic growth outlook and structural concerns in Europe.

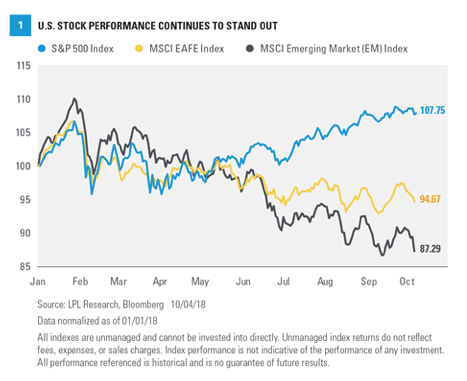

We continue to favor the United States and emerging markets (EM) over developed foreign markets for global equity allocations. We see the U.S. economy as the primary driver of our forecast for 3.8 percent global gross domestic product (GDP) growth in 2018, supported by new fiscal policies, while Europe and Japan may lag. (For more on our 2018 forecasts, please see the Midyear Outlook 2018: The Plot Thickens.) The United States remains a global earnings standout as well. Despite underperformance this year, we continue to see upside potential in EM due to attractive valuations, recent economic growth, favorable demographics, and the potential for resolution to the U.S.-China trade dispute later this year [Figure 1].

International Developed Equities 2018 Outlook

At a high level, when comparing economic and earnings growth in the United States to international developed economies (mainly Japan and Europe), the United States is the clear winner.

Economic Growth

U.S. GDP grew 4.2 percent annualized during the third quarter, may hit 3 percent for the year (based on Bloomberg consensus forecasts calling for 2.9 percent), and is accelerating. Meanwhile, GDP growth in the European Union has slowed each quarter this year and is not expected to reach 2 percent in the second half of 2018. The rise of populism, particularly in Italy, has highlighted the structural challenges and political risk that still exist in the region.

Japan’s economy bounced back nicely in the second quarter after contracting in the first, but consensus forecasts are calling for GDP growth marginally over 1 percent this year and next. Based on the latest purchasing manager’s surveys, Europe and Japan are both losing some momentum (see this week’s Weekly Economic Commentary for more on the economic outlook for international economies).

Earnings

The story is similar for global earnings. Even without the benefit of the new tax law, the S&P 500 Index would be growing earnings at a low-double-digit rate (the tax reform boost to S&P 500 earnings is about 7 percent). That pace is still well ahead of consensus estimates (according to FactSet) for MSCI EAFE Index earnings growth, at about 4 percent this year (EM is better at 7 percent) [Figure 2]. Revisions to developed international earnings estimates have also lagged the United States and, over the past month, EM as well. A strong U.S. dollar has been a drag on overseas earnings, but relative economic momentum in the U.S., buoyed by fiscal stimulus, is playing a bigger role.

Valuations

One of the most popular arguments in favor of developed international equities is cheaper valuations. The MSCI EAFE is currently trading at a nearly 20 percent discount to the S&P 500 on a forward price-to-earnings (PE) basis. That is quite a bit larger than its historical 20-year average discount at 6 percent. However, the sector makeup of the international index suggests that a discount is probably warranted. The international equity benchmark has a higher allocation to sectors that tend to trade at lower valuations, while the domestic equity benchmark (the S&P 500) has more exposure to sectors that tend to be more expensive such as technology and communication services, which now includes the mega-cap internet stocks. The technology sector, which tends to be more expensive, carries a 21 percent weight in the S&P 500 while the weight in the new communications services sector is about 10 percent, compared with 6 percent total in technology in the MSCI EAFE Index.

Also consider that much of the discount for international equities relative to domestic is caused by Japanese stocks carrying low valuations [Figure 3].

Bottom line, while valuations seem very attractive for international developed equities on the surface, peeling back the onion reveals that those markets may not be quite as compelling as they appear. Factoring in fundamentals, we continue to underemphasize developed international in our tactical global equity allocations, though with a preference for Japan given attractive valuations and the potential upside from structural reforms. Strategically, over longer time periods, where valuations tend to matter more, we would be comfortable with more exposure to developed international equities.

Buy The Dip In EM?

We continue to view EM as an attractive opportunity, despite disappointing performance this year. The economic growth outlook for developing economies remains solid, having changed little in recent months amid pockets of financial stress such as Turkey and Argentina. Consensus GDP growth forecasts for EM of 5 percent for 2018 and 2019 (according to Bloomberg) are well above forecasts for the developed world, including the United States. Reasonable expectations for tariff impact suggest relatively limited drag, though we see potential resolution to the trade dispute with China as a potential positive near-term catalyst.

Corporate fundamentals in EM generally look good, where many of the economies are earlier in their economic cycles than developed nations. EM earnings growth expectations are stronger than those in developed international markets (as shown in Figure 2). This year, EM is expected to grow earnings near 7 percent, almost double that of international developed markets (according to FactSet estimates). In 2019, EM earnings growth, at 11.6 percent, is expected to be about 4 percentage points stronger than international developed. EM earnings estimates through 2019 have risen over the past month, which is an encouraging sign and supportive of attractive valuations. The MSCI EM Index is trading at a nearly 10 percent discount to its historical average forward PE and a 35 percent discount to the forward PE for the S&P 500 Index.

Besides escalating trade tensions, primary risks for EM include sharply higher interest rates, further strength in the U.S. dollar, and more potential flare-ups in fiscally challenged EM countries. Because of these risks, we recommend investors keep allocations modestly sized. In terms of the risk of a stronger dollar, we believe the greenback has largely priced in Federal Reserve rate hikes and do not expect it to appreciate much further in the year ahead.

Conclusion

We continue to favor U.S. and EM equities over their developed international counterparts for tactical global equity allocations. The United States remains the standout in terms of economic and earnings growth, while we continue to see solid upside potential in EM. Slowing economic growth and structural concerns in Europe lead us to remain cautious tactically on developed international equities.

John Lynch is chief investment strategist for LPL Financial.