In some ways, David Eiswert’s working life has been very different in the months since “coronavirus” became a household word. Eiswert, who manages the $2.4 billion T. Rowe Price Global Stock Fund, works from a home office instead of the firm’s busy Baltimore headquarters. He’s expanded his personal IT setup with an additional computer monitor and a new iPad. As he manages $15 billion in the firm’s global focused growth strategy for the fund and institutional investors, his four children sit downstairs attending school remotely.

Yet in other ways, things are pretty much the same as they’ve always been. The firm’s army of analysts around the world remain available by phone, videoconferencing or video chats. His local team members, who once gathered weekly in-person, now connect through the digital channels as well. “There’s a little less spontaneity than in-person discussions, and of course traveling has been halted,” he says. “But otherwise things aren’t that different.”

Lately, Eiswert has been using global disruption to pick up what he considers great stocks at great prices from countries around the world, including the United States. He’s aggressively raising the cash to do that by paring back or eliminating positions in stocks that could face debt-related challenges in the grueling months ahead, or that have simply lost their comparative allure.

Boeing, whose balance sheet was loaded with more debt than Eiswert felt comfortable with going into a likely recession, got the boot in February as the potential for an economic fallout came into clearer view. China multinational conglomerate Tencent Holdings and Chugai Pharmaceutical were also eliminated around that time because better opportunities came along.

These sales early in the crisis made way for what Eiswert considered to be high-quality stocks selling at compelling valuations, names better suited to the difficult, fast-changing environment. By mid-to-late March, he had turned his attention from selling to buying stocks, mostly in the health-care and technology sectors.

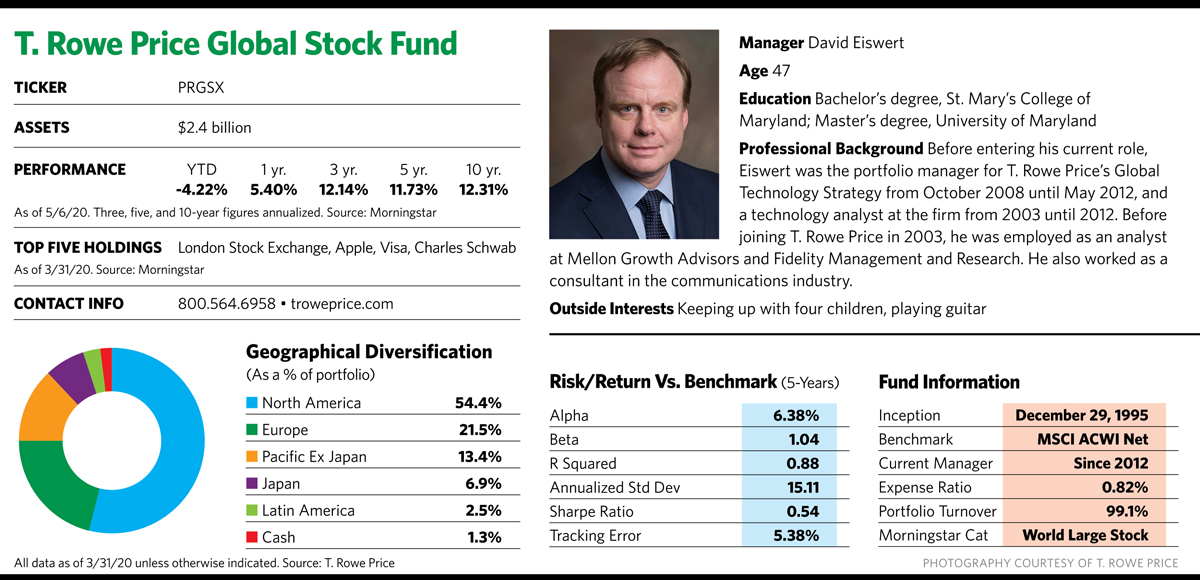

This recent flurry of activity reflects his willingness to sell off ideas that he thinks have run their course and move on to greener pastures. His annual portfolio turnover of 100% or more isn’t that unusual for the fund, and with the recent activity there’s a good chance the turnover will run on the higher end of the fund’s historic range.

“When one of our analysts brings in a new, compelling stock, we have a terrible time deciding what to sell so we can buy it,” he says. “But we won’t hesitate to sell a good idea to buy a great idea.” The portfolio of 70 to 80 stocks create a fund with an 85% active share, giving it only a passing resemblance to the holdings in its benchmark, the MSCI All Country World Index.

The distinctive approach has paid off. Eiswert’s annualized returns over the last one, three, five and 10 years have beaten those of the index by a significant margin, and the fund’s performance beat 96% of Morningstar’s world large stock peers over the last 15 years (it surpassed 93% of the funds over 10 years and beat 97% of them over five years). The fund’s upside/downside capture ratio of 114/60 relative to its benchmark is also notable, although its volatility has been slightly higher than that of its peers and the index.

Eiswert credits the fund’s success to a large army of analysts who unearth companies that either miss most investors’ radar screens or otherwise offer value that’s been underestimated by the investment community. Pension funds and other institutional investors dominate in the global growth asset space; that competitive environment drives Eiswert’s team to zero in on companies whose stocks are in a good position to outpace the market. The style represents a departure from some of T. Rowe Price’s better-known funds, whose more moderate, middle-of-the-road style appeals to a broader swath of retail and retirement plan investors.

“We are competing with some of the top global managers in the world,” he says. “Institutional investors who mainly use a passive strategy with some assets budgeted for active management want something that’s distinctive and that generates alpha. That’s what we are aiming to do.”

Playing The Downturn

Eiswert, 47, took over as fund manager in 2012 following a stint as a technology analyst at T. Rowe Price and several years as manager of the firm’s global technology fund. Today, he roams the globe in developed, and to a lesser extent, emerging markets to find companies with strong free cash flow, sustainable margins, long product cycles and experienced management teams.

At the end of the first quarter, about 54% of his fund’s assets were in U.S. stocks, with another 22% in Europe and 13% in Pacific markets outside Japan. Many of those stocks are in information technology companies, and his 37% weighting in this sector is about twice the benchmark index’s allocation. Health-care and consumer discretionary companies are also overweight in the fund. Although it’s classified as a large-cap growth offering by Morningstar, Eiswert will sometimes buy less familiar names if he thinks they offer the opportunity for strong returns.

One of the stocks falling into the latter category is Amadeus IT, a major Spanish IT provider for the global travel and tourism industry. The stock, which had been selling at over $80 a share in January, plunged to about half that level when Eiswert purchased it in March after the coronavirus panic ground most travel to a halt.

Other stocks that Eiswert bought during the March correction included those with characteristics that will allow them to piggyback on the trend toward online purchasing that accelerated during the crisis. “This crisis is going to allow for experimentations that could potentially translate into longer lasting behavioral changes within society. Many of these companies are likely to be in the technology and health-care space,” he says.

Portfolio holding Carvana, an online used car dealer, was selling at over $100 a share in February. By the time the fund established a position in the stock in March, its price had sunk to less than half that. By late April, it had bounced back to around $80 a share. Eiswert thinks Carvana’s online car purchasing business model is likely to survive and thrive after the pandemic recedes.

“The virus has forced digital transaction from a supplementary to a primary form of interacting, and accelerated the adoption of innovation,” he says.

Around the same time it bought that stock, the fund also established new positions in UnitedHealth Group and Humana. While these two health-care names had taken a hit because of concerns about the cost of pandemic treatment, the moratorium on most elective surgeries has actually lowered their costs by reducing the number of claims they need to pay out. The emergence of Joe Biden as the Democratic presidential nominee has also made it more likely that managed care options created under the Affordable Care Act would likely continue, rather than be replaced by the Medicare for All plan proposed by onetime presidential candidate Bernie Sanders.

Other stocks the T. Rowe Prince fund purchased during the March correction were Exact Sciences, which makes home colon cancer test kits; Morgan Stanley; and online powerhouse Amazon.

When Will It End?

Eiswert looks at the pandemic as a natural disaster rather than something akin to a credit or technology stock bubble that has burst, a factor that will likely make the aftermath very different. “There hasn’t been a multiyear buildup of disfunction here,” he says. “While there will most likely be a recession, it will be different from those of the past. I believe it will involve a fundamental disconnect between [the] longer-term economic value of a company and the acute impact of short-term financial obligations such as payrolls or interest and principal payments. The question is will policy makers successfully bridge this gap or will value be destroyed?”

He points out that stocks typically bottom out when the economic environment stabilizes, not when economic or earnings data are trending better. To achieve economic stability, the U.S. and other countries will need massive fiscal and monetary stimulus, more ubiquitous testing and treatment, and indications of peaking infection rates. Once these three factors align, stocks are likely to bottom.

“This is the time for active management to shine,” he says. “Our experience and investment framework tell us that if we focus on great assets on the right side of the change, we can potentially reap rewards over the long term.”