As financial advisory firms grow, the need to provide efficient ways to hire, manage and properly compensate employees also grows. Some firms that begin as a one or two-person practice can grow to be a much larger firm over time. However, if the same management techniques that were used with the smaller firm are continued with the larger version of the firm, a point can be reached that is called a revenue ceiling. This is where no matter how much money is spent on systems or people, the firm experiences a point above which net profit does not increase. This is because the owners/managers are so consumed with more hands-on management, they find less time to work with clients (which is usually the owner/manager’s best use of time).

Consequently, finding more efficient systems and techniques to manage the larger firm should be a priority. Fortunately, there are lots of choices, but unfortunately this is not a one-size-fits-all environment. Thus, care should be taken in doing research to find which technique, system and/or software is best matched with your company’s needs.

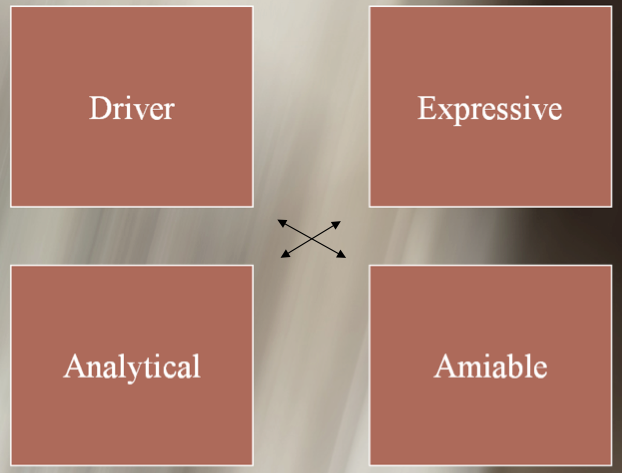

One critical technique to be considered is efficient communications, not only with staff but also with clients. I recently spoke with best-selling author and keynote speaker, Dr. Tony Alessandra, who has published several books on this subject. With his social styles matrix, he outlines how a manager (i.e., financial advisor) needs to become a chameleon, at least with respect to being able to alter his/her social style to best match up with the person being communicated with. The social styles matrix looks like this:

The four blocks represent the dominant social styles. The arrows reflect the receptive style. For example, a “driver” social style may best match up with an “amiable” in communications. The “expressive” style matches up with the “analytical.” Hence, the financial advisor who is talking to an employee or staff person needs to be able to recognize their social style and adapt accordingly to achieve the best communication.

Charts such as this have been written about for years (Non-Manipulative Selling by Tony Alessandra, Ph.D., 1987 Prentice Hall). Yet, on a day-to-day basis, it is often a neglected aspect of management communications. For example, a driver social style may work in communicating with an amiable, but not necessarily with another driver. Thus, recognizing what social style the listener displays can help a leader adjust his/her style to effect better communication with those who are communicated with.

To be most efficient in your role as a leader, leadership must be shared with those who are led. Delegating tasks is one thing, delegating responsibility is quite another. To be most efficient in accomplishing the goals of your financial practice, eventually you will need to embrace the concept of delegating responsibility. To be consistently successful in this, three steps must be accomplished:

• Matching responsibility to the appropriate person—assessing readiness levels

• Holding that person accountable for the expected results

• Following up and providing feedback

Dr. Tony is also the author (with Michael J. O’Connor, Ph.D.) of The Platinum Rule: Discover the Four Basic Business Personalities and How They Can Lead You to Success (recently revised and available on Amazon.com).

Dr. Tony Alessandra has also developed a set of web-based assessment tools to assist in hiring, evaluating performance and determining compensation and benefits (https://www.assessments24x7.com). The site offers two aspects of assessment, The DISC system, which stands for Dominance, Influence, Steadiness and Conscientious (the how) and the Motivators (the why). Dr. Alessandra mentioned that currently 100 universities are using his assessment tools.

It assimilates the findings in an executive summary with custom benchmarks applicable to the organization and its people. Use of the site is fast and efficient. The site also offers various training tools, user conferences and certifications.

Another choice could be Caliper Corp, which also offers talent assessment and management tools. This tool is geared for much larger firms but is highly regarded.

But another piece of this puzzle involves task assignment and workflow processing. Some client relationship management software (CRM) programs have workflow management features. But, they may vary in sophistication based on the software being used.

As an example, Redtail has a flexible workflow management feature with management reports. The software comes with this feature at no additional expense and Redtail is a remarkably inexpensive CRM solution, priced at $99 per month per database for up to 15 users. However, for more sophisticated features, it may not be enough. Another example, Junxure has a more customizable workflow management solution. Their Junxure Cloud CRM version is priced at $65 per user per month. There is also free-standing workflow management softwares, but the concern with those is whether or not they can share data with the financial advisors’ CRM software. Having to type the same information over-and-over again can lead to higher error rates.

Yet another choice, Salesforce is another popular CRM software. Salesforce offers four different versions ranging in price from $25 per user per month to $300 per user per month. Their small business version has some customer support features and is customizable with add-in features and data integration with calendar and email support. Workflow management and employee activity reports can be added at an additional cost.

Advisors Assistant offers a CRM software that includes comprehensive workflow management and reporting capabilities with its contact management, calendaring and email capabilities. They offer several different versions and various modules and download services to tailor it to fit the firm’s needs. Their web-based version runs from $39/month per user to $125/month for 10 users. There is a one-time set-up fee of $50. They also have a mobile app add-on for $5/month for one device and $2/month for each additional device.

Obviously, there are many more choices available. The key to choosing the best platform for your firm is to investigate the options, take advantage of the free trials (where available) and talk to other users. There is a tendency to attend a conference where these companies are represented and choose the latest, supposedly greatest software. However, this can often lead to confusion, delays in learning and populating the software with data, and disgruntled employees who might be charged with the conversion work only to later discover that it was the wrong fit for the firm.

The end goal is to create a methodology for documenting employee activities and client service work combined with a method of assessing the employees work while avoiding micro-management. This, in turn, can provide a way for the firm to grow without the necessity of hiring more people and/or spending more money. The end result should be a more efficient and profitable financial practice with a more harmonious office environment for employees and clients.

David L. Lawrence is founder and president of EfficientPractice.com, a consulting firm that provides financial practices, broker dealers and independent firms with comprehensive, profit-driven efficiency consulting and resources. He is also the author of The Efficient Practice: Transform and Optimize Your Financial Practice for Greater Profits and Success (Wiley).