All kinds of great things are afoot. Bitcoin is at another all-time high as it continues to head for the moon. The Dow Jones Industrial Average hit a record, while many more useful indexes of American stocks came close to peaks. Breakevens for inflation over the next five years reached their highest in 16 years.

From that list, you would think that growth is on, risk is on and everything is awesome (barring some nerves that inflation is going a little too far). But that’s not how things are. There are any number of discordant notes as growth dwindles in the U.S., inflation in Europe rises to the kind of level that might force the European Central Bank to action—and, most importantly, China appears to be lapsing into its most significant economic slowdown not driven by pandemic disease in a generation. So it’s time for a panoply of charts working out what is going on in the world’s second-biggest economy, and how much it matters to everyone else.

First of all, note that there’s plenty to worry about in China. When people fret about it, they mean one of:

• Slowing economic growth;

• The credit overhang and potential for crisis in real estate thanks to the stricken developer China Evergrande Group;

• China’s problematic relationship with the West and the potential for another “Cold War”;

• Trade and the risk of deeper protectionism;

• The leadership’s distinctly authoritarian clampdown on the private sector under Xi Jinping.

This is quite a laundry list, and the items tend to link with each other. It’s as well to try to keep them separate.

Slowing Growth

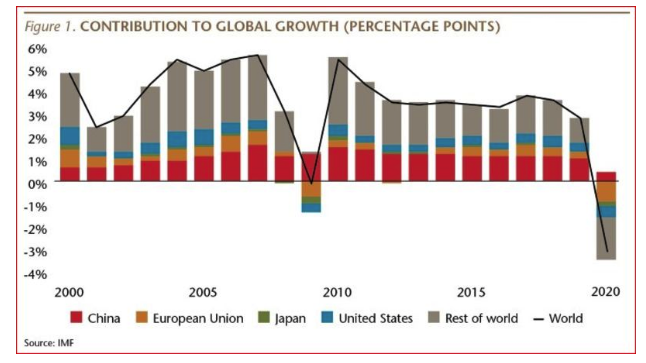

To start with, as everyone knows, China’s growth is special. Since 2001, the country has accounted for more of the increase in global GDP than either the U.S. or the EU every year. It’s been the world’s grower, and spender, of last resort. It even expanded last year. This chart of IMF data, produced by Andy Rothman, chief investment strategist of Matthews Asia, shows just how important China is:

Thus you would think that the plethora of economic data released at the beginning of this week would have caused more than a ripple in financial markets. To start with the one bright spot, exports have resumed their rise after several years of being becalmed. But this may be more a transitory sign of weakness elsewhere than a reason for optimism about China—heavy retail spending in the U.S. may have driven the gain, while China may also have benefited from shortages and supply chain problems for competitors.

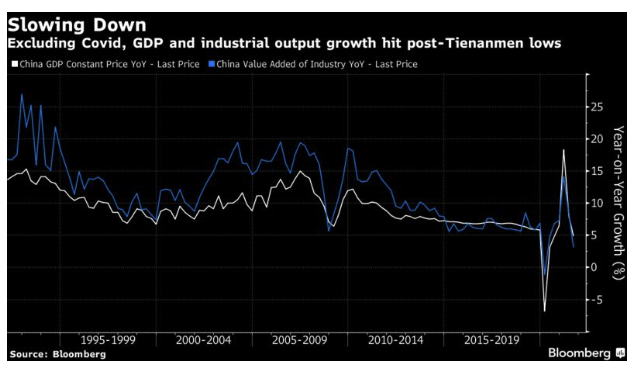

However, growth numbers for GDP and industrial production came in at their lowest levels in three decades. Both dipped below 5% for the first time in the post-Tiananmen era, save only for the brief recession forced by last year’s Covid shutdown:

If we look at annualized two-year changes, to try to get around the base effects created by the Covid shutdown, the pattern of declining growth grows clearer, for both the consumer and manufacturing sectors. This chart from BCA Research Inc. shows two-year annualized growth in retail sales and industrial production: