Are you a risk manager? If you are reading this article, chances are good that you are a financial advisor or work in a profession aligned with the financial services industry. Financial advisors and others working in associated occupations give professional advice and guidance to clients to help them manage their finances. But is risk management included in your job duties?

Before I share my opinion, let’s establish a framework. The words “risk management” are bandied about across industries, occupations and in the news. Stockbrokers claim to help clients manage their financial risk, insurance agents tell customers that they will help them transfer certain risks to insurance companies to help avoid risk and scientists develop serums to help the public avoid pandemic health risks such as influenza and swine flu. A good working definition of risk management is, “to protect clients from financial harm by identifying, analyzing and controlling risk.”

Does this definition change your initial answer? If you believe that risk management is not one of your primary roles as a financial advisor, I strongly disagree. You are in a unique position to not only map a plan for your clients to proactively meet their financial objectives, you are also in a strategic position to identify, analyze and control client risks through education and other means that you feel are appropriate.

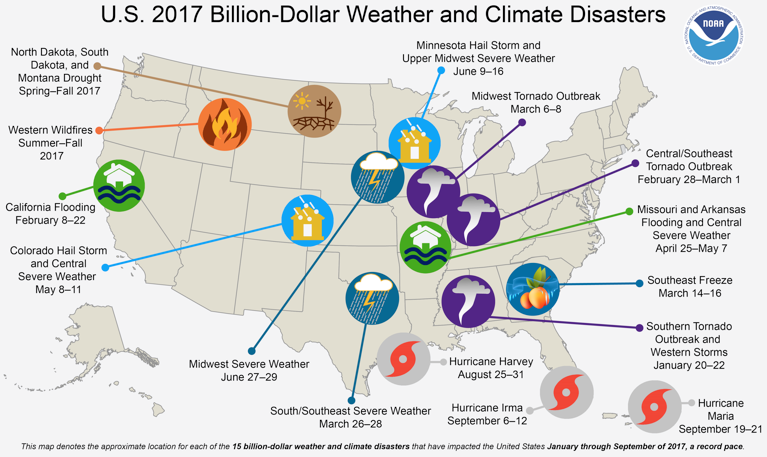

There is a myriad of risk exposures facing individuals but the focus of this article is one event that everyone is exposed to—natural disasters. During the first nine months of 2017, the United States has experienced 15 separate billion-dollar weather and climate disasters. As a result, 2017 falls behind only 2011 (16) in the number of billion-dollar disasters for the year-to-date. The 2017 events include two floods, a freeze, seven severe storms, three tropical cyclones, a drought and wildfire.

Hurricanes in the news have included Harvey, Irma and Maria, but these accounted for only 3 of the 15 billion-dollar disasters. With such substantial damages, you may personally know someone who lived through a disaster. If not, don’t ignore the fact that it is possible for a disaster to impact anyone.

And while the focus of this article is on property damage, keep in mind that many natural disasters also include loss of life. The United States natural disaster death toll through the first nine months of 2017 stands at 9,905, with the real possibility that this number will be even higher by year’s end.

Certainly, geographical location plays a part in some natural disasters. It is common knowledge that hurricanes occur more frequently in the state of Florida than in the state of Iowa. But this doesn’t mean that the central states are immune to natural disasters. Case in point, the states of Minnesota, Wisconsin, Iowa, Illinois, Kansas, Missouri and Nebraska were subject to severe hailstorms in June that amounted to $2.5 billion in damages. Add flood, severe freezing, tornadoes, drought and wildfires, and it is clear from NOAA’s chart that that no one is safe from the adverse impact of mother nature’s wrath (NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2017), https://www.ncdc.noaa.gov/billions/).

While the facts show that everyone is at risk of experiencing the devastation that disasters bring, few truly understand what happens after disasters strike. While federal disaster assistance is somewhat complex—after all, it involves the federal government—here are some points to keep in mind after a natural disaster occurs.

First, in order for federal disaster assistance to be granted to impacted areas, a presidential declaration is generally required. Without it, no federal assistance is provided.

Second, the most common form of federal disaster assistance is a loan, which must be paid back with interest. Loans are provided through the Small Business Administration (SBA) for both homeowners and businesses, and the interest rate is determined by law (https://www.fema.gov/disaster-declaration-process). Loan interest rates are based upon resources available to applicants. Currently the rates will not exceed 4 percent at the lowest for those most in need, while others are charged the current market rate, not to exceed 8 percent.

Third, it is important to know that both loan amounts and the length of the loans are limited. Generally, a dollar limit of $200,000 is available to repair or replace a primary home, while the length of federal disaster loans can be extended up to 30 years.

Do the math. $200,000 at 8 percent interest with a 30-year timeframe amounts to a repayment of $1,468 per month, with $528,310 paid over the life of the loan. This is a far cry from the “free money” that some people have in mind when they hear that residents of a disaster stricken area have been awarded federal disaster assistance.

But doesn’t insurance step in to pay for some of the losses that occur during natural disasters? Perhaps. A great number of people do carry property insurance, and it pays for fire, wind and hail damage. But few people carry flood insurance. And some people decide not to carry insurance on certain properties, such as secondary residences.

So, yes, property insurance may provide monetary assistance after a disaster. But what about the loss of life? While some of the nearly 10,000 people who died during the 2017 disasters had life insurance, that is of little consolation to their surviving family members.

Thus far, it has been established that:

• Large scale natural disasters can occur with great frequency

• Such disasters can be severe, resulting in large property losses, as well as loss of life

• Disasters can happen anywhere so everyone is at risk

• Individuals can experience financial hardships for many years after a natural disaster strikes

Once again, back to my original question: are you a risk manager? Do you feel that you should help your clients protect themselves against potentially catastrophic losses? If so, have you ever discussed disaster planning with your clients?

Disaster planning, also referred to as “catastrophe planning,” should be a primary consideration for each and every one of your clients. It is concerned with saving the life of your client and their families, as well as preventing or reducing loss to their real and personal property.

There are several resources available to both individuals and businesses that can assist with preparing for disasters and dealing with the aftermath. A simple Google search for “disaster planning” will result in a plethora of websites with valuable catastrophe planning information. The federal government also has a number of helpful websites. During your research focus on departments that deal with disasters, such as FEMA and the SBA. Here are a few suggested websites to visit:

1. www.fema.gov/plan. The purpose of this site is to provide information on strategic and operational disaster planning. The intended audience for this page is individuals, families, communities, and both the private and nonprofit sectors.

2. www.ready.gov/business. This site provides business-focused information about program management, planning implementation, testing and exercises, program improvement, and more.

3. www.sba.gov/node. Here you can find information on various aspects of emergency preparedness. It contains both general information and specific disaster information. Topics include hurricanes, winter weather, earthquakes, tornadoes, wildfires, floods, workplace hazards and first aid, and even cyber security.

None of these sites are perfect for all clients, but my point is this: encourage your clients to take action. Follow risk management protocols. The risk exposure of natural disaster has been identified and analyzed in this article. Now is the time for you to help your client control the disaster risk by educating them and encouraging them to take further steps to protect themselves, their family and their property.

Kevin L. Glaser, CPCU, CIC, SCLA, ARM, AAI, AIC, ARM-P, AIS, is a nationally recognized speaker on the topics of insurance and risk management and is author of Inside the Insurance Industry - 3rd Edition. He is president of Risk & Insurance Services Consulting LLC, a national fee-only P&C insurance consulting and expert witness firm, and Right Side Creations LLC, owner of the RISC Analyzer, a product that allows financial advisors to identify client P&C insurance and risk management exposures. Glaser can be reached by email at [email protected] or by phone at 262-569-0929.