Are you a risk manager? If you are reading this article, chances are good that you are a financial advisor or work in a profession aligned with the financial services industry. Financial advisors and others working in associated occupations give professional advice and guidance to clients to help them manage their finances. But is risk management included in your job duties?

Before I share my opinion, let’s establish a framework. The words “risk management” are bandied about across industries, occupations and in the news. Stockbrokers claim to help clients manage their financial risk, insurance agents tell customers that they will help them transfer certain risks to insurance companies to help avoid risk and scientists develop serums to help the public avoid pandemic health risks such as influenza and swine flu. A good working definition of risk management is, “to protect clients from financial harm by identifying, analyzing and controlling risk.”

Does this definition change your initial answer? If you believe that risk management is not one of your primary roles as a financial advisor, I strongly disagree. You are in a unique position to not only map a plan for your clients to proactively meet their financial objectives, you are also in a strategic position to identify, analyze and control client risks through education and other means that you feel are appropriate.

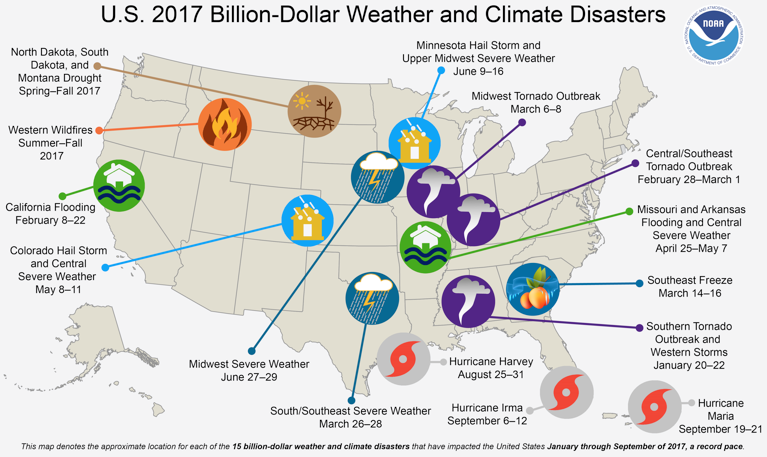

There is a myriad of risk exposures facing individuals but the focus of this article is one event that everyone is exposed to—natural disasters. During the first nine months of 2017, the United States has experienced 15 separate billion-dollar weather and climate disasters. As a result, 2017 falls behind only 2011 (16) in the number of billion-dollar disasters for the year-to-date. The 2017 events include two floods, a freeze, seven severe storms, three tropical cyclones, a drought and wildfire.

Hurricanes in the news have included Harvey, Irma and Maria, but these accounted for only 3 of the 15 billion-dollar disasters. With such substantial damages, you may personally know someone who lived through a disaster. If not, don’t ignore the fact that it is possible for a disaster to impact anyone.

And while the focus of this article is on property damage, keep in mind that many natural disasters also include loss of life. The United States natural disaster death toll through the first nine months of 2017 stands at 9,905, with the real possibility that this number will be even higher by year’s end.

Certainly, geographical location plays a part in some natural disasters. It is common knowledge that hurricanes occur more frequently in the state of Florida than in the state of Iowa. But this doesn’t mean that the central states are immune to natural disasters. Case in point, the states of Minnesota, Wisconsin, Iowa, Illinois, Kansas, Missouri and Nebraska were subject to severe hailstorms in June that amounted to $2.5 billion in damages. Add flood, severe freezing, tornadoes, drought and wildfires, and it is clear from NOAA’s chart that that no one is safe from the adverse impact of mother nature’s wrath (NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2017), https://www.ncdc.noaa.gov/billions/).