One key tenet of being a financial advisor is helping clients better understand the real value and costs associated with making some of life’s most important decisions. Clients often look at the world through a straw and do not always realize exactly what the real costs are of a particular financial planning strategy. For many clients, especially those in the high-net-worth category, college planning for their children is among the most difficult and important decisions they will have to make in their lifetime. The emotional stress around this life event is enormous, as it is one of the largest expenses a client and his/her family will make, second only to the purchase of the family home or a business. Why? From a purely economic sense, education is unlike a home or a potentially profitable business because college expenses permanently leave the client’s balance sheet. While the personal pleasure of watching one’s children achieve academic and career success is incredibly satisfying, advisors need to make sure that clients understand the real cost of this momentous decision. Below are some suggestions for helping high-net-worth clients navigate through the emotions, stress and vast expenses associated with funding a child’s education.

The Selection Process—Remember You Are In The Driver’s Seat

Families tend to place a lot of weight on what their 17-year-old child wants during the college search. Looking at this from a financial planning perspective, the idea that a high school student is dictating one of the most significant financial decisions that will impact the entire family can be impractical when you think about the times when this same child struggled with curfew, college applications and doing laundry. At MainLine, we believe that selecting a college is a family decision—one that is comprised of a variety of factors, including, but not limited to, the finances of the family. A decision of this magnitude needs to be contemplated and modeled carefully, without making this the sole decision of a teenager in his/her junior year of high school.

Know Your Choices And Their Financial Impact

Choosing a college is a complex decision, with many factors for a family to evaluate. While it is important to try to incorporate a significant number of those factors into discussions with clients, as an advisor the primary focus should be on the financial impact. How will the financial factors affect the family’s net worth and balance sheet?

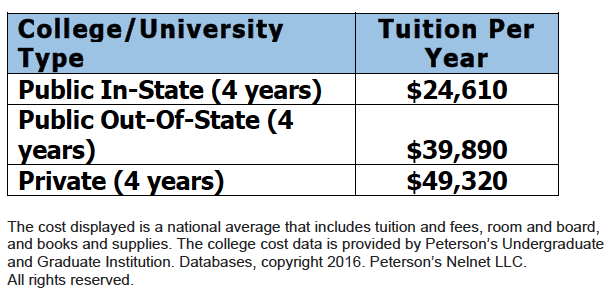

Let’s first examine the current costs of education. For purposes of this discussion, a student’s options will be characterized as public in-state schools, public out-of-state schools and private colleges. According to MoneyGuide Pro as reported by Peterson’s, the 2016 average national tuition for these three representative samples are:

From the start, it is clear that the cost of tuition for a private college is double what you can expect to pay for a public in-state school, with a narrower spread between the two public options. Take for example a sample family with two children, who are two years apart in age. Let’s imagine our family chooses to send both of their children to private colleges or universities. Using the averages provided, each child’s total cost (assuming a year to year annual average 6 percent tuition inflation rate) for four years at a private college or university is $215,756. Over the six years, noting two overlapping years, the actual out-of-pocket cost is approximately $458,180, which is no small number, even to high-net-worth clients. If those same children both opted to attend public in-state colleges or universities, the total cost would be $228,625, which is a difference of $229,254—a significant cost savings. But what is the “real” cost and how do you explain that to clients?

Laying Out The “Real” Cost Of Choice

Comparing the “real cost” of financing education when selecting a school is similar to the concepts used in retirement planning. At MainLine, one pressing point communicated to clients is that regardless of a client’s asset base, there are no special loans or scholarships for retirement. When it comes to saving for retirement, advisors need to do everything they can to help clients grow wealth for a time when they will not be working. Because of the impact of accumulated wealth, a comfortable retirement should be the primary goal for clients. It’s easy to say to a client that the goal is to save as much as you can as consistently as possible, but an emphasis on saving early introduces one of the most important concepts in retirement planning—the miracle of compounding. By providing a visual representation of current saving in projected future dollars, this enables clients to understand how much of their retirement might be financed by compounding interest. This same concept can be used to help clients understand the real cost of choosing a college.

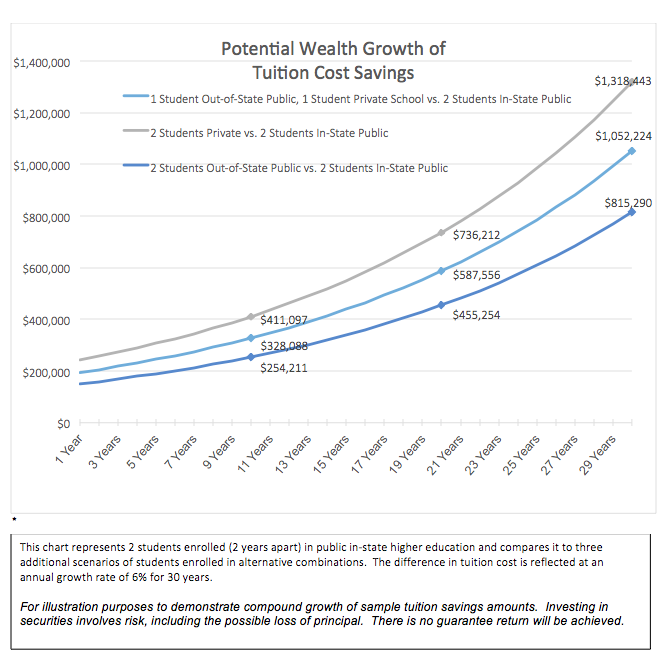

Using the example above, the typical client will look at the “gross cost” difference of $229,254 and may or may not be troubled by that variance. However, as advisors, we live in the world of compound growth. The actual cost to the family isn’t ascertained by simple subtraction, but is actually determined by the loss of future wealth. What would happen if we evaluated the cost differential in terms of potential retirement savings? If we took the $229,254 and retained that money in the family’s balance sheet and grew it at an investment rate of 6 percent per year for the next 30 years, the future value would be $1,318,443. At MainLine, we think that number is significant enough that even high-net-worth clients will care.

An Advisor’s Role—Stewarding Clients To Make Informed Financial Decisions

Advisors are charged with empowering clients to make more informed financial decisions. Many clients look at issues, like college planning, in a simplistic way and never fully appreciate the future implications of their choices. It is an advisor’s job to lay out the possible impact of these financial decisions and offer alternative strategies for consideration. If a client sees the real cost or potential future value of an expensive private university and still elects to send their child there, as many will, at least it will be an informed choice. Perhaps understanding the real cost of selecting a college will encourage clients to use more of their income to contribute to college funding or even place some responsibility on their children to contribute to their education. Whatever the outcome, by illuminating the actual cost of paying for various college options and taking the emotion out of the decision-making process, advisors will be able to fulfill their role as stewards to clients as they move toward making financial decisions that align with long-term investment goals.

Gary Droz is the managing director of MainLine Private Wealth LLC, a Wynnewood, Pa.-based investment advisory firm that provides unbiased advice and sophisticated investment solutions to high-net-worth and ultra-high-net-worth investors across the United States.