Doctors often have both the economic resources and personal and business needs to meaningfully benefit from the help of talented financial advisors. It’s likely that, as many found themselves at the epicenter of the pandemic, these professionals are asking hard questions about their priorities in life. And yet many of them aren’t getting the answers they need.

That’s clear from a survey we recently performed of 198 high-income physicians—all of whom were either specialists or self-employed. They regularly earned between $580,000 and $1.1 million annually, and none of them had seen their incomes drop below $500,000 in the previous three years. Besides their annual earnings, each doctor in the survey had amassed investment portfolios of $1.4 million to $5.1 million (outside their retirement plans).

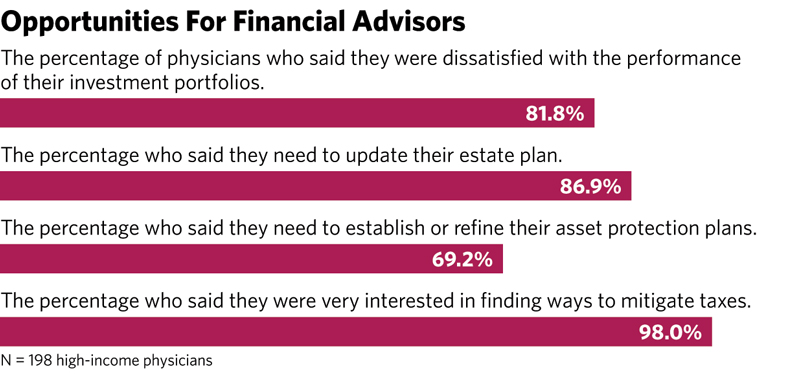

The survey found that physicians are seeking better investment performance and are concerned financial advisors aren’t addressing their needs as well as they could (See chart).

The survey found that physicians are seeking better investment performance and are concerned financial advisors aren’t addressing their needs as well as they could (See chart).

About four out of five of the doctors in our survey said their portfolios were not performing as well as they expected. While their assets might have increased in value over the past five years, it was less growth than they expected.

Another problem is more long term in nature: Even though all the physicians said they had estate plans, only 15% said the plans were current—which means 85% of them aren’t and need updating.

The doctors in the survey also revealed that they needed to refine their asset-protection plans. All of them had malpractice insurance, but they still faced unfounded and frivolous lawsuits—including some that had no direct connection to their practices. About 70% of the physicians in the survey said they were interested in asset-protection planning but had not done anything about it within the last three years.

Meanwhile, physicians, like almost everyone else, prefer to pay as little in taxes as they have to legally, specifically income taxes. There are a number of financial strategies and products that can be used for this purpose, but many doctors are unaware of them.

The Power Of Stress Testing

It’s the job of financial advisors to have a deep knowledge of their clients—to know their hopes and dreams, wishes and concerns. A robust discovery process is the key to developing this understanding.

That requires stress-testing: a process in which advisors find previously overlooked ways to add value and get better results. In this process, advisors evaluate whether there are better financial solutions than the ones the physicians are currently using. There are three steps the advisor needs to take: One is to understand what the doctor’s self-interest is. The next is to evaluate what’s been done already. And the last is to specify a course of action.

Connecting With Physicians

Many financial advisors have problems, however, connecting with physicians. Very often it’s difficult for doctors to find the time to meet (91.4% of those in our survey said they had little or no time, in fact). Because they are busy, they have a tendency to frequently put off those things that aren’t pressing, which is usually the case with abstract concepts like estate and asset-protection planning.

In fact, they don’t tend to act until some major life event suddenly triggers their interest—it could be an inheritance, the birth of a child, a death in the family or some other event that suddenly requires them to think about the long term. They might try to make decisions about trusts and investments on their own, but they would do better to reach out to professionals such as their accountants and lawyers. And it’s key for financial advisors to know who those professionals are if they want to work with the physicians.

That’s when it helps advisors to be good at discovery—finding out what the clients really need and ways clients could be served that they weren’t thinking about. Advisors who are good at discovery can find themselves fairly quickly introduced to doctors who they can help, and it’s common to get referrals in the very first meeting with other trusted counsel.

Advisors can also get referrals from other physicians. That approach doesn’t work as often as introductions from attorneys and accountants, but it’s still very effective under the right circumstances. For example, when you’re good at discovery and can show one doctor how to save $500,000 or more annually in income taxes, he or she will likely introduce you to other doctors.

Again, because physicians are time-deprived, they often turn to substandard financial solutions and suffer from missed opportunities. For those advisors technically proficient enough and good at knowing what a prospect’s long-term goals and desires are, there are many ways to add value, and in that fashion the advisors can build their own practices as well.

Russ Alan Prince is president of R.A. Prince & Associates. Brett Van Bortel is director of consulting services for Invesco Consulting.