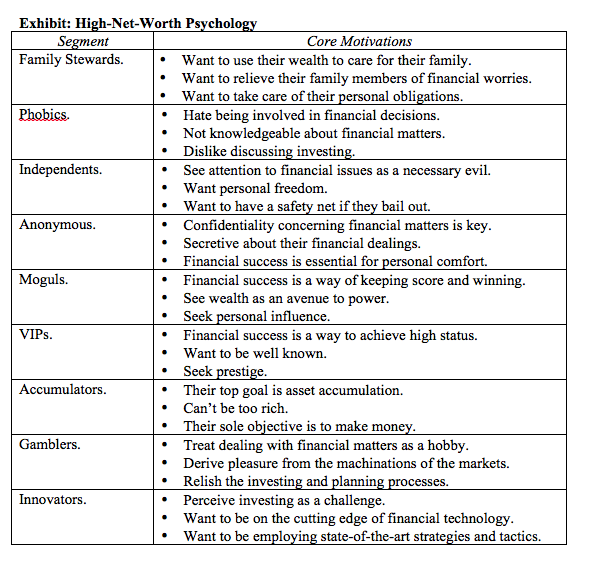

High-net-worth psychology can enable professionals to better connect with the wealthy. The following chart provides an overview of the nine high-net-worth personalities and some of their key attributes.

Let’s review the nine high-net-worth personalities.

Family Stewards are the most prevalent of the high-net-worth personalities. They’re motivated by the need to protect their families over the long term. This makes them suitable candidates for a wide range of professional services.

Phobics are people who—although they’re wealthy—dislike thinking about money. They also believe they are not especially capable of effectively managing the professionals they turn to for assistance.

Independents include people whose primary objective in accumulating wealth is to achieve financial independence and the accompanying security. Some want to retire from their financial obligations to play golf or go sailing; others will continue to be involved but value the security of knowing they could leave at any time.

The Anonymous are typified by their deep-seated—and sometimes irrational—need for privacy and confidentiality in all of their financial as well as selected personal dealings. In their interior belief system, they fear that the disclosure of information will enable someone or some office to gain control over them and their affairs.

Moguls are motivated to accumulate more and more wealth in order to achieve personal power (and, by extension, influence if not control). In short, they want to leverage the power conferred by wealth.

VIPs are motivated to accumulate assets and utilize their wealth, in part to achieve greater status and prestige. This personality type prizes the opinion of select others above all else.

Accumulators seek to accumulate wealth out of an overriding concern for personal financial well-being. Their focus is on the continual accumulation and protection of assets as a bulwark against an uncertain future.

Gamblers believe their skills and competence will protect them from all significant threats. They view financial affairs as a personal challenge, but one they are very capable of handling.

Innovators believe their analytical capabilities will sustain them and protect them from external threats. Because of their lifelong reliance on their analytic capabilities, they are highly self-reliant and do not delegate any portion of tasks having to do with analysis.

High-net-worth psychology has proven exceedingly effective in enabling professionals to communicate the value of their expertise to the wealthy. While the underlying nature of the service often remains the same, your ability to connect the benefits of your expertise to the core motivations of the wealthy very often motivates them to take action.

High-Net-Worth Psychology: Segmenting the Affluent

March 7, 2014

« Previous Article

| Next Article »

Login in order to post a comment