The beauty of high-net-worth psychology is that it simply and effectively categorizes affluent clients and prospects into nine distinct prototypes, allowing a financial advisor to understand the marketplace and whom they want to work with.

One of the most commonly asked questions by financial advisors is, “Should I try to work with all of these profiles, or focus on a couple?” Clearly, nobody can be all things to all people. Instead, there is a much more efficacious way of leveraging high-net-worth psychology. The answer is to focus on whom you naturally work with best. In fact, you probably are already working predominantly with two or three of the profiles. The key is to learn which high-net-worth personalities you have a natural rapport with, and focus on these to maximize your success and minimize your workload.

By using the high-net-worth psychology framework, you can get a very clear idea of the kinds of wealthy clients you work best with. It helps you quickly understand the wealthy clients with whom you can develop especially strong levels of rapport. These are the affluent that share your values, interests and goals. Because of your more natural affinity with these affluent clients, they should probably become your service and referral core. Consequently, they are the ones you want to service to the hilt, so that they can and will be increasingly likely to refer you to wealthy people just like themselves—usually the same high-net-worth personalities.

For the great majority of financial advisors, a core of two or three high-net-worth personalities should become the focus of all their high-touch service efforts. It’s certainly acceptable to have affluent clients that aren’t one of these high-net-worth personalities; however, you must recognize that they aren’t likely to be nearly as good a source of referrals among your high-net-worth personalities of focus. That being the case, they will probably be of less long-term value and not a perfect fit to the high-touch service models you develop for your core wealthy clients.

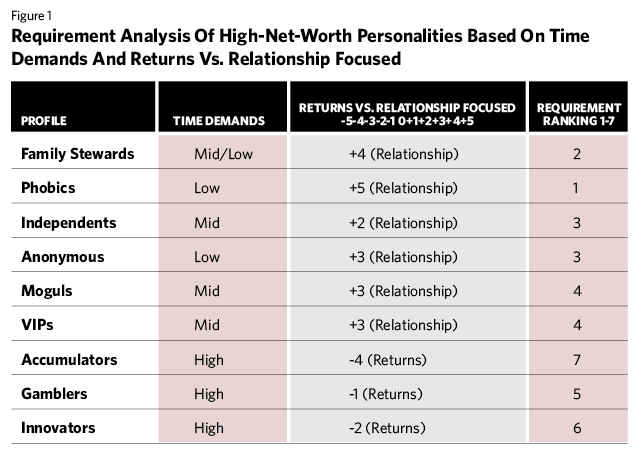

Requirement Rankings Of The Nine High-Net-Worth Personalities

What’s clear is that not all of the high-net-worth personalities are equal in their desirability to your financial advisory practice. For example, some high-net-worth personalities are much more relationship-focused, rather than returns-focused. This means they are more likely to place a premium on the value of the service you provide, rather than be calling you up to complain that their account was not equal to a given performance benchmark.

Additionally, some high-net-worth personalities are simply more work than others. That is, they require more time and effort if you are to ensure they are highly satisfied. We take it as a given that all of the high-net-worth personalities should be managed with a high-touch service system centered on their financial motivator. But even with that, some wealthy clients will be making a high level of inbound contacts because of their high-net-worth personality, and this will of course consume a fair amount of your time.

For these reasons, we have found it useful to analyze the high-net-worth personalities according to their overall requirements, essentially balancing the time demands they make on the financial advisor beyond what goes into the high-touch service system, as well as their proclivity toward being return- or relationship-focused. Below is a table reviewing these two criteria for each of the nine high-net-worth personalities, wherein we look at their time demands and focus on returns or the relationship, culminating in a desirability ranking. Generally speaking, the higher the high-net-worth personality requirement ranking, the better in terms of the long-term value to your financial advisory practice.

What proves to be most important remains your natural affinity to certain types of affluent clients. So even if you naturally connect with a high-net-worth personality with a high requirement ranking, that type of affluent client is probably best for your practice.

The table reports three different measurements. The first is the time demands the client makes, which is given a ranking of low, mid or high. The second is a measurement of a client’s tendency to be returns- or relationship-focused. Any negative score is skewed toward a focus on returns. Any positive score is skewed toward a focus on the relationship. The higher the numerical score in either case, the more strongly clients lean in that direction. Finally, the desirability of the profile—the final ranking—takes into account the other two measurements.

A question we commonly receive is, “Do individual variances come into play?” The answer is of course “yes.” You may find a family steward who is more sensitive to performance than the bulk of your family stewards, and this affluent client’s requirement ranking would be adjusted accordingly. However, we have found the high-net-worth personalities to be an overall reliable indicator of these requirement rankings.

Based on this assessment, the least challenging affluent clients are phobics. They are intensely relationship-oriented. They lack, by “definition,” any interest in financial matters. At the same time, they require relatively minimal attention. Of course, capable financial advisors will do the best job possible for phobics. It’s just that they are the easiest of the high-net-worth personalities to work with, and volatility in the markets, for instance, will not cause them to panic or even question your capabilities.

On the other end of the spectrum are accumulators. Their focus is intensely on investment performance. The interpersonal nature of the relationship is comparatively minor. If a financial advisor is not delivering superior returns pretty consistently, he or she is likely to be replaced fairly quickly irrespective of the quality of the interpersonal relationship. At the same time, accumulators can be highly demanding of your time, energy and resources.

Conclusions

Where and when possible, you should focus on cultivating affluent clients with high-net-worth personalities that you have a natural affinity with. Doing so will enable you to develop and deliver the optimal levels of service with the lowest level of personal and professional friction.

At the same time, it’s worthwhile to understand the requirement rankings of each of the high-net-worth personalities. This provides you with some perspective about what it is likely to take to effectively work with each of them.

Russ Alan Prince is president of R.A. Prince & Associates.

Brett Van Bortel is director of consulting services for Invesco Consulting.