Sales of new single-family houses were down 13.2 percent in September from a year earlier, the Census Bureau reported Wednesday. That’s a lot — the biggest year-over-year percentage decline since April 2011, when the housing bust was still busting.

It is also within the margin of error. The Census Bureau doesn’t go out and count every home sold. It takes a sample, and it estimates that there is a 90 percent likelihood that actual home sales nationwide in September were somewhere between 26.8 percent lower than a year before and 0.4 percent higher. The midpoint of that range is 13.2 percent.

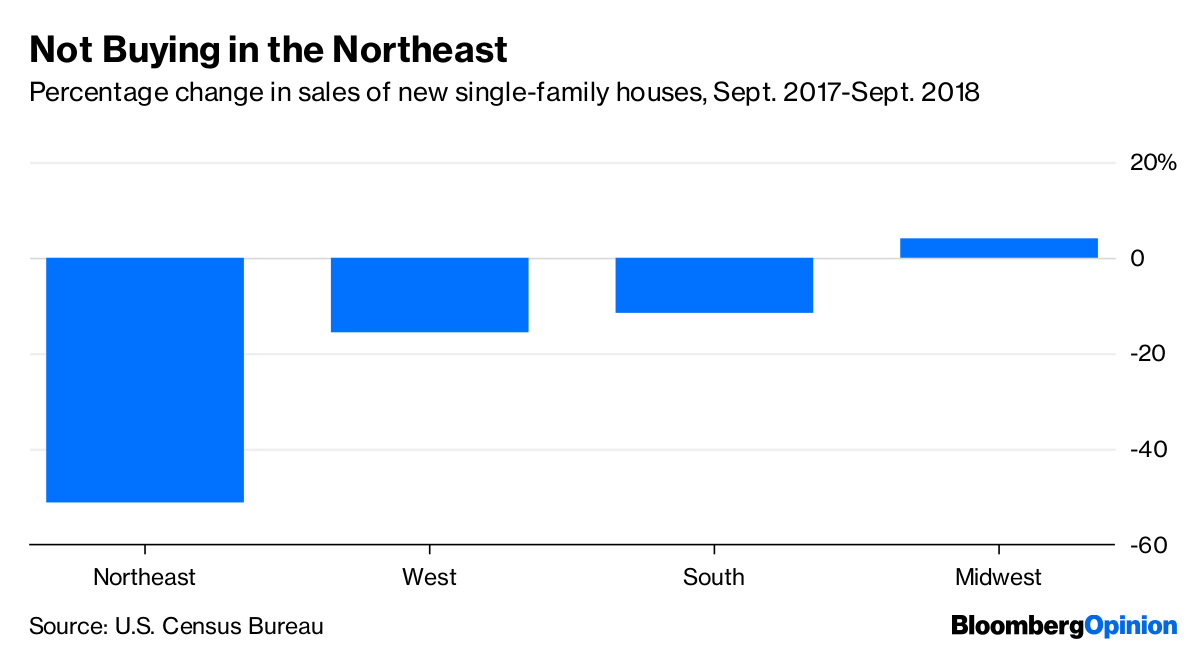

There was one region of the country, though, where home sales were definitely down by a lot. That would be the Northeast, where new home sales fell year over year at a rate somewhere between 31.2 percent and 71.4 percent (midpoint: 51.3 percent):

Why might this have happened? Nationwide, rising interest rates would seem to be the obvious culprit for any decline in home sales. The average 30-year fixed mortgage rate was 4.85 percent as of Oct. 18, up from 3.88 percent a year before and higher than it’s been since 2011, according to Freddie Mac. “High mortgage rates are preventing consumers from making quick decisions on home purchases,” National Association of Realtors chief economist Lawrence Yun said in reporting a 4.1 percent year-over-year drop in existing home sales last week.

But there’s this other thing that’s weighing on the Northeastern housing market: the provision in the Tax Cuts and Jobs Act passed by Congress and signed into law by President Donald Trump in December that restricts deductions for state and local taxes (aka SALT) to $10,000 a year. Some homeowners in states with (1) high housing prices and (2) high property tax rates will see much bigger tax bills as a result. Those homeowners happen to be concentrated in the Northeast. According to the Tax Foundation, the states with the biggest per-capita property tax bills are, in descending order, New Jersey, New Hampshire, Connecticut, New York and Vermont.

The SALT effect seems to be showing up in prices as well, with the New York area (which includes suburban counties in Connecticut, New Jersey and Pennsylvania) the worst performer this year to date among the 20 metro areas tracked by S&P CoreLogic Case-Shiller Home Price Indices.

Existing home sales have declined even more rapidly in the West than in the Northeast. But that seems to be more about high prices than the loss of the tax deduction. The West has by far the most expensive houses in the country, but California ranks 21st in per-capita property taxes, and the other populous Western states rank even lower. Lots of affluent Californians will still be hit hard by the reduction in the state and local tax deduction, but it will be mostly because of no longer being able to deduct all of their state income taxes, so the impact on the housing market will be less direct.

To be sure, the Northeastern decline isn’t what’s driving the national decline in new home sales — if in fact there is a national decline in new home sales. It’s just not a big enough market.

So blame the Federal Reserve and the stronger economy (and maybe the rising federal deficit) for any national housing slump. In the Northeast, though, you can thank the authors of the Tax Cuts and Jobs Act.