What is ESG investing? There are as many definitions of ESG right now as there are investment vehicles claiming to provide “ESG” exposures. But at its heart, the concept is simple: Environmental, social and governance principles argue for a cleaner environment, a more inclusive society and sounder corporate governance.

These principles are increasingly shaping the business strategies and government policies around the globe, as well as the growing debate about how much “corporate responsibility” corporations should shoulder. The principles are also having a significant impact on investor awareness and consciousness, which in turn spurs a growing need for advisors to be well-versed in the ESG debate and the ways ESG investing can be incorporated into a portfolio.

Principles Pushing Regulatory Changes Globally

Perhaps it’s helpful to look at what people are doing locally. Let’s look at climate change, for example. How are people’s concerns about climate change leading to regulatory changes? And how will that, in turn, affect impact investing in the auto and fossil fuel/commodity industries?

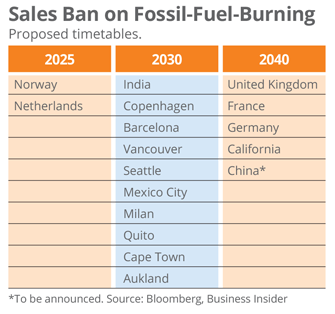

Many national and city governments have begun to propose timetables to ban the sales of fossil-fuel-burning cars in their territories (see the table). Norway and the Netherlands lead the pack, with plans to ban the sale of such cars starting in 2025. China, the top car market for both electric vehicles (EV) and conventional vehicles, is working on its own timetable, but when it completes one, it could be a game changer in the EV industry.

These governments are serious about forcing or motivating manufacturers and consumers to meet these deadlines. China and the U.S. are leading the growth of electric vehicles (see top chart on the right). The production of these will dramatically increase to meet new consumer demand and replace the soon-to-be-obsolete fossil fuel vehicles. Therefore, the challenge to the auto industry is to manage a timely transition to electric vehicles or to face business survival risk.

It is not just auto manufacturers seeing major changes forced upon their business models. The fossil fuel industry is also facing significant upheaval. While we have not reached it yet, a peak in global demand for coal and crude oil is on the horizon. Many of the largest names in fossil fuel extraction and refining have already been diversifying their exposures with efforts in wind, solar, geothermal and other “greener” energy categories. With the technology breakthroughs and regulatory changes, we are seeing the start of a significant, government-backed push away from fossil fuels toward alternative energies, which are viewed as being less damaging for the environment globally.

Implications For Mainstream Investors

What does this mean for ESG-conscious investors and advisors? Most investors have substantial exposures to the auto industry and commodities since, after all, the big automakers and mega-cap oil companies are hard to avoid in broad-based equity strategies.

That means investors will need to differentiate those auto companies and energy firms that are quick to embrace ESG principles and separate them from those that aren’t. Many investors treat commodities, which include fossil fuels, as a separate asset class to diversify and boost performance. But that strategy will require a serious re-examination as these changes unfold in the use of energy sources.

ESG Principles Push For Gender Diversity In Workplace

ESG principles are also being put to use in the form of gender diversity. Women are under-represented in leadership roles in many industries. Progress has been made, but it’s painfully slow.

In asset management, for example, female portfolio managers are outnumbered 10 to one. And yet, ESG studies at numerous firms such as State Street Global Advisors, MSCI and Credit Suisse have concluded that gender diversity in the workplace has an important positive impact on the bottom line, as it helps companies avoid group thinking and leads to more thoughtful decisions.

ESG reporting has encouraged companies to be more transparent about the gender gap in their workforces, pay scales and management structures. CEOs and their management teams at every level need to be held accountable for making conscious and measurable improvements in closing the gender gap in management and in pay, adjusted or unadjusted, so they can reap all the benefits of having a balanced workplace.

Implications For Financial Advisors And Client Investments

ESG discussions have reached a point in which those advisors who have already “bought in” are nodding in agreement, while those who remain unconvinced argue that “ESG sounds nice, but my clients will judge me based on results.”

To that I respond, “They should, and in a few years, if you haven’t been following the ESG debate and incorporating key ESG exposures into their portfolios, your clients will judge your results quite harshly.”

Companies viewed as “bad actors,” whether it’s for the damage they may cause to the environment, policies that discriminate against their female employees or products viewed as harmful to society, are going to see their company performance suffer in the long run. Large asset managers that oversee trillions of dollars in indexed vehicles are increasingly viewing their holdings through an ESG lens. State Street brought us the “Fearless Girl” statue in Lower Manhattan, while BlackRock brought us CEO Larry Fink’s very public declaration that good governance and sustainability are being closely watched. Companies looking to build long-term sustainable shareholder value need to build long-term sustainable business models.

For advisors, there are a growing number of ESG products in the ETF wrapper. Index companies such as MSCI have conducted comprehensive research and currently have more than 70 ETFs that follow their ESG indices, including products with track records of more than a decade. Many leading asset managers are also leaders in the ESG ETF space, including BlackRock, State Street, Nuveen, Global X and Oppenheimer. These ETFs typically remove harmful investments and champion those making positive impact on the environment and society.

The table (see bottom chart on page 34) lists some of the key ESG principles allowing companies to be included in typical environmental, social and governance ETFs.

The current ESG ETF landscape is far from perfect. Some argue that energy companies seem to slip through ESG screens. But ESG investing is a journey. We may not reach perfection immediately, but we can help our clients get started today.

Despite those who would dismiss it as a niche investment strategy meant to make people feel good, ESG will be the growth story of the next decade. The day will soon arrive when such investments are mainstream. Now is the time to learn what it means and how it will impact our work for years to come.

Dr. Linda Zhang is CEO and founder of Purview Investments, an independent asset management firm and RIA based in New York City. The firm holds many ESG-principled ETFs in its recently launched Purview Impact Solutions, a global multi-asset product.