Key Points

• Many investors pay too little attention to investment returns on an after-tax basis.

• Active tax management strategies can boost post-tax returns by 1 percent annualized.

• Passive indexes are less tax-efficient than many investors realize, but active tax-loss harvesting can enhance returns of an index-tracking portfolio, and adding a multi-factor investment strategy can further add to returns.

With the April 17 income tax deadline looming, I thought this would be an opportune time to write about our thinking on taxes and investing, along with some tax-managed investment strategies that we deploy at Gerstein Fisher. The fact that markets abruptly turned volatile from early February 2018 and entered correction (-10 percent) territory does not change the fact that many investors will be stunned to learn just how much of their bumper gains from the 2017 bull market they will need to surrender to the coffers of Uncle Sam and state tax authorities. It doesn’t have to be this way: In our experience, a successful “tax alpha” (additional return generated through active tax management) strategy can boost after-tax returns of an equity portfolio by one percentage point.

Taxes Are A Drag

To the extent that they do pay attention to taxes, many investors (and their advisors) use portfolio turnover as a proxy for tax efficiency. To us, this is a simplistic view, which blurs “bad” turnover (e.g., selling positions that trigger short-term capital gains taxes) and “good” turnover (e.g., realizing capital losses or deferring gains to the much lower long-term rate). An investor (or portfolio manager) who doesn’t focus on the tax effects of trading activity is, to our mind, passive with respect to tax management.

Before discussing the two quantitative strategies we use to enhance after-tax returns, I want to provide an example of an index fund and taxes. Many investors perceive index funds as an inherently tax-efficient solution, but in fact these passively managed portfolios are far from immune to the negative impact of taxes on investors’ bottom-line (i.e., after-tax) results, particularly when taking the relentless math of long-term compounding into account. After all, tax liabilities are generated in an index fund through dividend income, periodic index reconstitutions, and corporate events

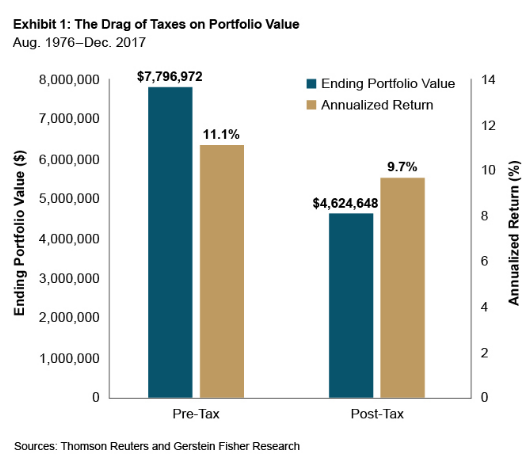

Exhibit 1 shows the effect, over 41 years, of the tax drag on a taxable investor vs. a tax-free investor holding an S&P 500 Index fund. Both invest $100,000, but the taxed investor ends up with $3.2 million less money, in effect coughing up more than 40 percent of investment gains to taxes. (Based on estimated tax rates and after-tax costs/benefits of: 40 percent for ordinary dividends, 40 percent for short-term realized capital gains, 25 percent for qualified dividends, and 20 percent for long-term capital gains. Note that these rates approximate the effective marginal tax rates for a typical investor in a Gerstein Fisher tax-managed equity strategy.) This scenario is simplified, but it demonstrates how taxes, when unmanaged, can substantially corrode a portfolio’s value over an extended time frame.

Tax-Managed Indexing

Our first quantitative layer is a tax-managed indexing strategy. By decomposing what otherwise might be held as an index-tracking mutual fund or ETF into a portfolio of individual equity holdings, we can control tax liabilities and turnover with greater precision (than with a passive index fund), customizing transactions to an individual investor’s tax situation. Here, we use tax-loss harvesting—the process of selling securities in an investor’s portfolio at a loss and simultaneously replacing the sold securities with new holdings with similar risk-and-return characteristics to the ones sold. Example: an investor holds a portfolio of 150 securities which aims to replicate an index of 1,000 securities. If 10 of those 150 stocks have unrealized losses, an active tax loss-harvester could sell those 10 securities and simultaneously buy 10 others with similar risk exposures.

Here are a few examples of the ways in which active tax-loss harvesting can add value to an investment portfolio:

• Capital-gains tax reduction: Realized losses can be deployed to offset gains in the same portfolio to avoid paying capital gains taxes, or used to offset other capital gains outside the portfolio (such as on the sale of an investment property).

• Taking advantage of inevitable losses: Volatile markets such as this year’s create abundant opportunities for tax-loss harvesting; even in the bull market of 2017, more than a quarter of stocks in the S&P 500 Index suffered losses.

• Ordinary income tax reduction: If an investor has no realized capital gains in a tax year, the IRS permits taxpayers to offset up to $3,000 of ordinary income per year with net capital losses and to carry forward unused losses.

With the second quantitative layer, we add systematic style tilts to the portfolio. Instead of holding individual securities in proportion to their market capitalizations (the approach in most passive index funds), we adjust their weights to “tilt” the portfolio toward security characteristics, or “factors” (such as momentum, value, and profitability), that academic and our own research has shown to reward long-term investors in the form of enhanced returns over the market. In a tax-managed portfolio, for example, we would tend to tilt away from tax-inefficient securities such as high dividend-yielding shares (and REITS, with their non-qualified dividends in particular) and towards the more-efficient value factor (for more detail on dividend-yield vs. value investing, see our paper, “Dividend Investing: A Value Tilt in Disguise?”

Conclusion

As I’ve demonstrated above, taxes can be an insidious drag on a portfolio’s long-term investment returns. In many cases, the difference between a pre- and post-tax investment return is even greater than the costs associated with the investment’s management fees. I realize that tax managed-investing can be rather complicated and even intimidating, but it is also an extremely important discipline. To learn more, I encourage you to read an extensive research paper on the subject that we recently produced: “Managing One of the Greatest Costs Investors Face: Taxes”.

Gregg S. Fisher, CFA, is the founder, head of research and portfolio strategy at Gerstein Fisher and the portfolio manager for the Gerstein Fisher Funds.