Ken Mertz doesn’t fit the profile of a “Technoking.”

Mertz is the president and chief investment officer of Emerald Advisers, a $4.7 billion asset manager based in Leola, Pennsylvania, a community of about 7,500 situated 66 miles west of Philadelphia. The company prides itself on its “proprietary 10-step research process” and “fundamental approach to choosing securities.” Mertz is a CFA charterholder who was the chief investment officer of the Pennsylvania State Employees’ Retirement System for seven years before joining Emerald. He’s held a variety of board positions. His resume all points to a traditional, longtime investor at a modest-sized firm.

Then there’s his $256 million Emerald Banking and Finance Fund.

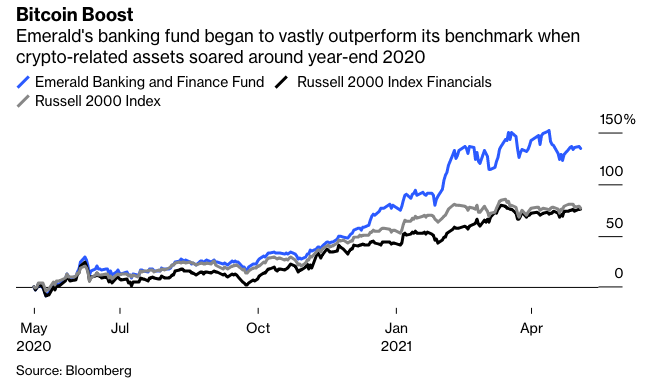

It’s the second-largest public holder of Grayscale Ethereum Trust, which tracks the cryptocurrency that has soared to record highs this week. It’s one of the biggest mutual-fund owners of Grayscale Bitcoin Trust. As of March 31, it has 192,020 shares of the Purpose Bitcoin exchange-traded fund (ticker: BTCC) and 48,520 shares of the Canadian Bitcoin ETF (ticker: EBIT). As you might expect, this has paid off big: The fund has surged 133% over the past year, easily beating every other U.S. domiciled open-end mutual fund focused on financial stocks, according to data compiled by Bloomberg. It’s almost double the return of the Vanguard Financials Index Fund, which itself is up a remarkable 74% in the past 12 months.

Riding the crypto wave more than just about any other mutual fund has come at a cost, however. Morningstar Inc. published a scathing report that downgraded the fund’s cheapest share class to neutral from bronze, stating in bold letters on the first page that “big changes diminish this strategy’s appeal.” The first sentence of the analysis says in no uncertain terms that “Emerald Banking & Finance has moved outside its circle of competence.”

Here’s Morningstar analyst Eric Schultz on why the fund’s investment process is now deemed below average:

Co-managers Kenneth Mertz and Steven Russell historically focused on U.S. banks with market caps between $50 million and $2.5 billion, using Emerald’s 10-step process to find the best names. These steps include extensive interviews with management, board members, customers, vendors, and competitors. The team also assesses competitive positioning and growth prospects, then builds valuation models estimating future cash flows and earnings to arrive at a target price and evaluate downside risk.

The recent shift into cryptocurrencies calls the discipline of the approach into question. The managers often diversified their core regional bank holdings with an eclectic mix of other businesses such as REITs, financial technology, insurance, and even gold miners. But these bets were at the margins and prudently sized. Cryptocurrencies have no cash flows or management teams to assess, so with nearly 5% of portfolio assets directly betting on their price, the move seems more speculative rather than a diversifying extension of the existing process.

It’s true: you can’t sit down and interview a Bitcoin. You can’t size up Ethereum’s management team. It’s hard not to see Emerald’s decision to load up on cryptocurrency ETFs as something akin to a YOLO bet you’d find on Reddit. The difference is it comes in a mutual fund that Mertz has managed for 23 years, not in the Robinhood account of a 23-year-old.