The traditional approach to investment portfolios involves diversifying them with low-correlation investments to help maximize their return for a given level of risk (or alternatively, to minimize risk for a given level of return).

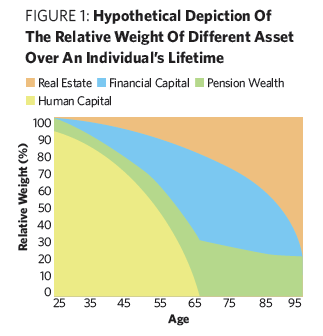

Yet from the holistic financial planning perspective, a household balance sheet is more than just the portfolio of liquid financial assets. Real estate holdings are also important, whether it’s a person’s primary residence or some other direct property holding. Also important for prospective retirees are the implied asset values of future Social Security and the lump sum equivalent of pension payments.

But for people still working, financial capital is typically not even the biggest asset. It’s often trumped by the individual’s “human capital.”

Financial And Human Capital Correlation

Human capital is simply a worker’s ability to work and generate income in the future. And for those who have many working years before them, it can be an enormous asset.

As David Blanchett and Philip Straehl of Morningstar point out in their recent paper, “No Portfolio Is An Island,” financial capital is actually a minority share of the household’s total balance sheet, which is dominated in the early years by the human capital factor (measured as the present value of our future earnings).

In fact, it may be two, five or even 10 times the value of its financial counterpart. Actually, the only moment at which financial capital briefly represents the majority of total household assets is right at the transition into retirement.

Accordingly, it’s crucial to not just view the portfolio by itself but to diversify around the human part of the equation, given the sheer size of the human capital asset. In practice, this implies that workers in conservative “bond-like” jobs might require more equity-heavy portfolios, while those in more aggressive “stock-like” jobs should invest even more conservatively.

Diversifying around job sectors matters, too. Those who work in the tech industry might want to own less of that sector in their portfolios. And that means financial advisors, who are greatly exposed to the economic and stock market cycle by virtue of their jobs, might actually want to own less in stocks (or at least far less in financials!)

It’s also notable that over time, human capital, like its financial form, is not stable—people can get raises or get fired. Their industries may benefit from more or less wage growth. The manufacturing sector, for instance, gives raises in times of growth but cuts salaries or lays off staff during recessions. Some companies go out of business altogether, and their (former) workers become unemployed.

Since these economic dynamics affect the value of financial as well as human capital, Blanchett and Straehl analyzed the correlations between investments in the major asset classes and the human capital value for various industries (based on 12 industries in Kenneth French’s data library).

The correlations between the two can be quite significant, but also quite varied from one industry to the next. For instance, high-yield bonds have a 0.65 correlation to the real estate industry, but no statistically significant relationship to manufacturing. The manufacturing industry, meanwhile, shows the strongest relationship to long-term government bonds, which for their part have no relationship to the lodging industry. The lodging industry actually has the strongest correlation of any industry to all the equity asset classes (large cap, small cap, growth, value and international).