Income-oriented funds can take various forms, and sometimes in unconventional ways. Take the JPMorgan Equity Premium Income Fund, for example, essentially a U.S. large-cap equity product that began the year with stakes in non-dividend paying stocks such as Alphabet Inc., O’Reilly Automotive Inc. and Amazon.com. And among some of the fund’s other 90 or so equity holdings are those that pay tiny dividends, such as the 0.16% yield recently offered by Thermo Fisher Scientific Inc. The fund’s income yield from its equity holdings adds up to roughly 2% at best, a relatively unimpressive number.

Yet the fund recently sported a chunky 30-day SEC yield of 7.87%, which means the income is coming from elsewhere. And the fund got its extra yield from premiums generated by selling options on equity-linked notes (ELNs)—a debt instrument tied to a stock, a basket of stocks or an index. These notes are issued by counterparties such as banks, broker-dealers or their affiliates.

Options premiums provide recurring cash flow to the fund that distributes income to investors monthly, and the fund’s portfolio managers posit that investing in ELNs containing written call options can potentially reduce the fund’s volatility. On the flip side, the call options written on ELNs reduce the fund’s ability to fully profit from the gains in the value of its equity portfolio.

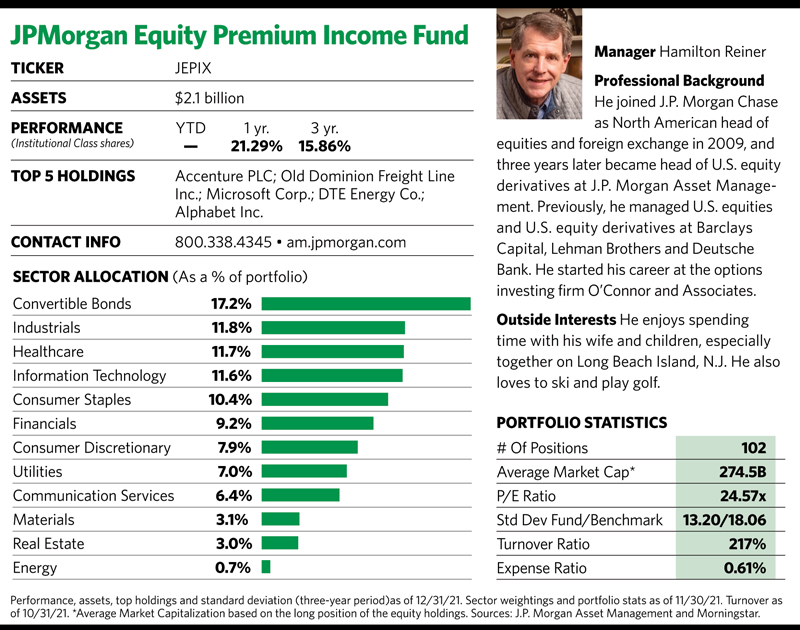

That’s reflected in the performance of the JPMorgan Equity Premium Income Fund, which began trading in August 2018. According to Morningstar, the fund’s average three-year return of 15.9% (through December 31) trailed the 25.9% return on the Morningstar U.S. Market Total Return Index during that period. J.P. Morgan Asset Management uses the S&P 500 as the fund’s bogey for the equity portion of the portfolio; either way, the fund has seriously underperformed its benchmark.

But that misses the point, because this product’s raison d’être is to provide investors with substantial income while keeping them invested in equities. ELNs, which recently represented 10 of the portfolio’s roughly 100 holdings, are central to that strategy.

“In today’s environment, where interest rates are at negative real yields, how can we help people own an asset class they think has more appreciation and do it in a way where they won’t get shaken out? That’s the basis of our hedged equity strategy,” says Hamilton Reiner, managing director at J.P. Morgan Asset Management and co-portfolio manager of the fund.

Reiner, who leads the company’s U.S. equity derivatives business, is the architect of the fund’s strategy and manages the options part of the portfolio. His partner, Raffaele Zingone, handles the equities.

As Reiner explains it, when he joined J.P. Morgan Asset Management 10 years ago he began working on a hedged equity strategy aimed at combining stocks and options to enable investors to hold more equities but do it in a more cautious or defensive manner.

“If you have a hedge in place, you can help clients and investors get and stay invested,” he says, adding that the premiums from written call options address the need for investment income.

“It’s an outcome-oriented strategy where income is the outcome,” Reiner says.

Monthly Income

Some investors view options as arcane, complicated and, thus, risky. But Reiner notes that options strategies have been around a long time and have been used by farmers, oil companies and others to achieve certain financial goals. He likens his fund’s options overlay strategy to farmers who use options to lock in a certain price on their crops, whether or not prices rise above that in the future.

The fund’s strategy, Reiner explains, results in investors’ forgoing some of the market’s upside in return for having an incremental amount of income today. He adds that the strategy avoids using leverage, which can result in substantial performance gains, but at significantly increased risk.

But the options-based income provided by the JPMorgan Equity Premium Income Fund can vary depending on market volatility. “We look to sell an option with a 30% chance of finishing in the money,” Reiner says. “That means when market volatility goes up, we’ll sell an option that’s farther out of the money, giving our investors an above-average level of income with more potential upside than we’d get from selling an option in normal volatility experiences.

“It also goes the other way because when market volatility is low we’ll give you a little less upside and less income than the long-term average,” he continues.

The fund recently reported a high turnover rate of 217%, which Reiner says results from how he manages the one-month options he uses for this strategy. “Most people set it and forget it with a one-month option,” he explains. “Our turnover is based on our strategy to ladder and stagger our options every week on a fraction of our portfolio, so over time there’s potentially more upside to be had at any given point.”

Reiner notes that he employs ELNs in his hedged equity strategy because they’re a packaged security letting the fund distribute income in a way that won’t create return of capital.

“Option income is not considered income as per the rules and regulations,” he says. “Rather, it’s considered potential capital gains. As such, many strategies that do call overlays have return of capital when they distribute their options premium. Using an equity-linked note converts the options premium to being a coupon. That coupon is bona fide income.

“Every month we distribute 100% of our dividend and 100% of our options income as a coupon, net of fees,” he adds.

It’s important to note that exchange-linked notes are exposed to the credit risk of the financial institutions that issue them. Reiner says that’s something his firm monitors when sourcing these notes. “From a credit quality perspective, there are lots of different aspects within J.P. Morgan that monitor counterparty risks,” he says. “We’re transacting with some of the largest and best-rated financial institutions in the world.”

Ice Cream Man

On the equity side, Reiner says his fund puts an emphasis on playing defense. “We attempt to fill our equity portfolio with steady Eddie earners with less price volatility and less earnings variability over time,” he notes. “We have Google as a top-five holding, and it doesn’t pay a dividend. How many income-oriented strategies would own a non-dividend paying stock? We’re looking for stocks we find most attractive, whether or not they pay a dividend.”

J.P. Morgan Asset Management is one of a growing number of traditional asset managers offering actively managed exchange-traded funds that mimic some of their existing mutual fund strategies. In many cases, they’re structured as semi-transparent ETFs that don’t have the same daily portfolio disclosure requirements of traditional ETFs. Instead, in most cases they have quarterly portfolio disclosures akin to traditional mutual funds.

The hedged equity strategy behind the JPMorgan Equity Premium Income Fund is also the foundation for the JPMorgan Equity Premium Income ETF (JEPI), which launched in May 2020 and had $5.8 billion in assets at year-end 2021, or $3.7 million more than the older mutual fund. Both products disclose their portfolios daily.

“I manage both portfolios, so if I make a trade in one I make it in both. I manage them to be near identical,” Reiner says. “I make the ice cream, so whether you like it in a cup or a cone doesn’t matter because I want you to partner with me and my ice cream. There are some advisors who run their portfolios using mutual funds, and others who use ETFs or a mix. It’s all a matter of their personal preference. We launched the ETF so people can have that flexibility.

“From my perspective I run a single strategy,” he continues. “I think this is the wave of the future where investors say ‘I like this strategy,’ and the next thing they ask is, ‘How do I present this inside my clients’ portfolios?’”