This year has proven to be an acceleration of a macro trend that started in 2021: it’s less about whether you are in crypto and more about which sub-sector your money is in. That means great returns can be earned by observing which sector investor sentiments are shifting towards and finding a way to “index” into the broader idea. This is no different than traditional finance markets, and is a suitable approach for those who are not all-in and following every single development in the market.

As such, the thesis presented below provides a macro view that will help analysts determine where to spend their time in the next six months. So without further ado, Secure Digital Markets (SDM) expects these four sectors to thrive in 2022:

1. Layer 1s

2. Stablecoins

3. Metaverse

4. P2E

Each of these has already generated enough of the initial interest for the thesis to be partially validated. However, market capitalizations and adoption figures show there is still plenty of room for growth.

Layer 1s

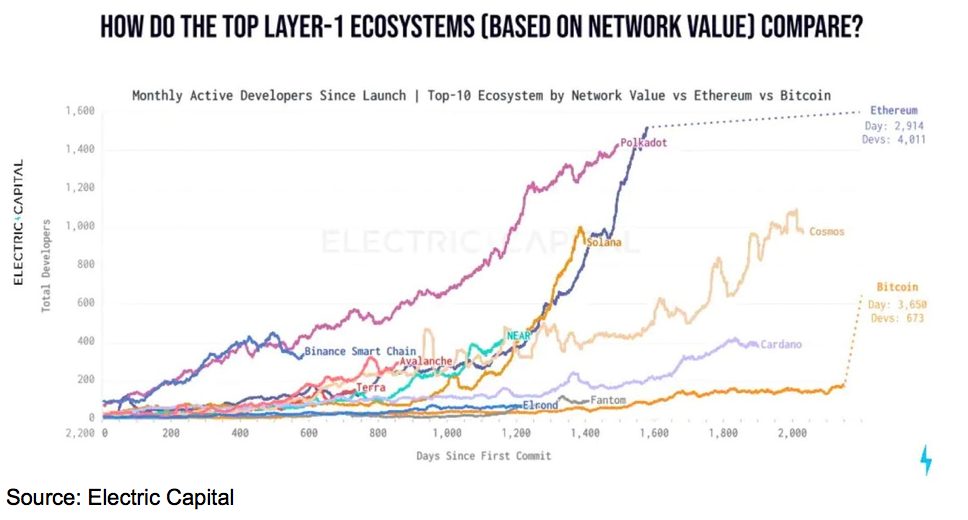

The emergence of a multi-chain ecosystem has become a foregone conclusion at this point. Everyone knows it’s going to happen—it’s just a matter of which chains will dominate which use cases. In the coming months, it will be critical to look at what use cases need to be filled, where the developers are and where the growth in wallet addresses is.

Four unexpected winners of 2021 were SOL, AVAX, LUNA and MATIC. In a lot of ways, this “theme” is equally about not being ETH as it is about the strengths of the alternative chain in question. Users are looking for ETH alternatives right now.

Many users are looking for a place where they can perform DeFi transactions without paying over $100 per transaction on the ETH chain. This is what initially pushed more money to AVAX and SOL. MATIC fits into a similar narrative and has onboarded more money than any other Layer 2 solution for ETH. It also functions in many ways like a leveraged position in ETH.

On the LUNA front, they’ve done well by having a built-in stablecoin. These types of utilities make a protocol much more attractive and show a maturity that brings potential converts from other ecosystems.

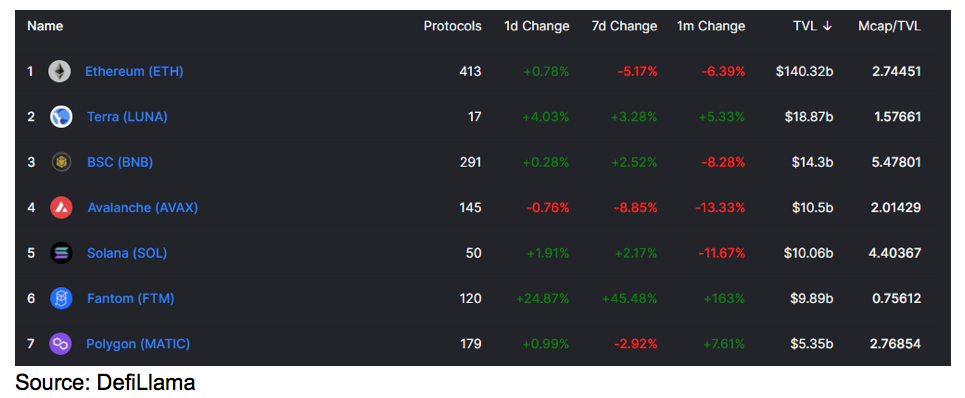

Some interesting alternatives SDM is tracking are Fantom, Atom, Near and Harmony. Each of these is battling to pick up total value locked (TVL) and developer movement. The way SDM analyzes these is by looking at daily active users, fees, and TVL. In the end, we’re looking for the battle-tested networks.

Strong communities will help in the short- to mid-term, but looking for the dApps being built on each of these chains and figuring out where the actual users are going is the real indicator of long-term success.

Ultimately, all the developments on ETH can now occur on these other blockchains. The ensuing races and battles over dominance on these chains will create lots of profitable trading opportunities.

Stablecoins

The stablecoin narrative is confusing at first, because instinct classifies them as “a dollar is a dollar.” However, with the introduction (and explosion) of algorithmic stablecoins and the ongoing “Curve Wars,” the number of opportunities for the “replacement of money” and the surrounding competition to deliver massive returns is increasing.

The “Curve Wars” are ongoing battles by different stablecoin protocols to increase yields on their particular stablecoin pool. They do this by purchasing CRV and using the governance rights to direct yield. Then, Convex is functioning as a DAO that owns a lot of CRV and can route yields to different tokens, which makes DAOs the next step in the Curve Wars.

There are also stablecoin-token pairs like UST-LUNA, FRAX-FXS, MIM-SPELL where the growth of the TVL for the stablecoin results in greater value of the associated stablecoin. Of course, there is associated risk here, but the idea is that the less protocols have to pay users to join the protocol, the greater a multiple of treasury the tokens are worth.

Metaverse

Ever since Facebook’s rebrand to Meta, the world has been awash with metaverse-related media coverage. In the ensuing weeks, native tokens to some implementations were pumping over 400%. It’s SDM’s contention that this is a small sample of the FOMO that will guide every brand and company into the metaverse this year.

The idea that companies can access eyeballs at scale in the metaverse is drawing everyone in, which we expect to continue. There will be many speculators moving in, but more importantly, builders are already starting to figure out how to offer 3D design services. This will act as an accelerant and draw in more users and value to the entire ecosystem.

Investing in the right metaverse land or token will be important, but there will also be profitable opportunities in finding utilities that are metaverse implementation-agnostic.

P2E

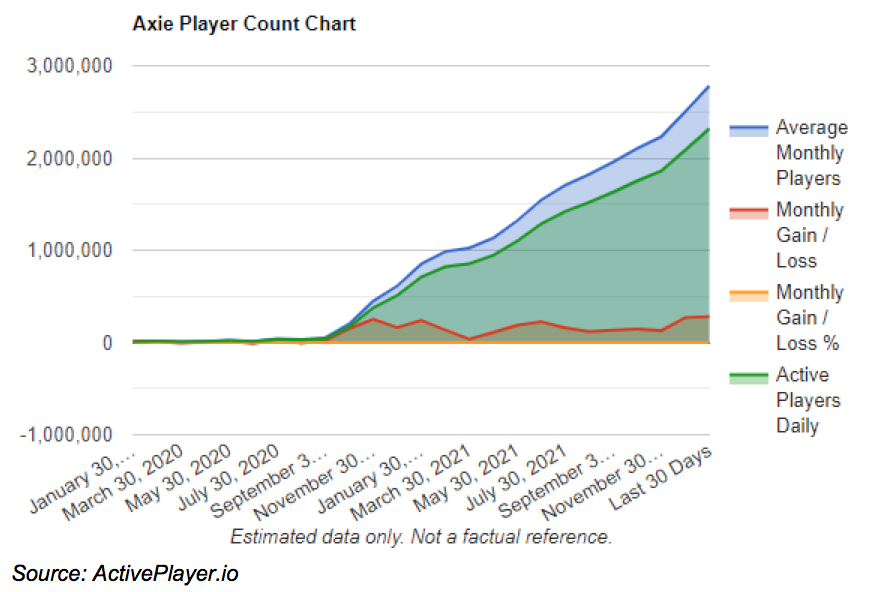

Axie Infinity was the first major player here prior to its recent hack, creating insane wealth that was passing from those with time to those with money.

DeFi Kingdoms has done something no one expected to see. It has yield farming like mechanics, but with a game overlay. The design is exquisite and has all the elements of “ponzinomics” we saw in algorithmic stablecoins, but with real gameplay behind it.

Layer 1 protocols are competing for developer activity on their chains, and Harmony (ONE) has knocked it out of the park with the success of DeFi Kingdoms.

There will almost definitely be competitors that pop up with a similar level of addictiveness and strong community. These play-to-earn games are going to accelerate in adoption, due to their positioning at the intersection of NFTs, Metaverse, and DeFi.

Any game where holding the token benefits users will have a natural utility that draws in more users to metaverse-like applications. Most importantly, if you can make these games fun, you have a real chance at attracting a long-term userbse that isn’t just there for the short-term gains.

Conclusion

As a final note, please remember that in April 2021 everyone "knew" that DeFi Summer was coming and invested accordingly. They were wrong and the meme has not yet played out. Be cautious and know that unexpected developments will always occur in a space like this, and the best thing you can do is be diversified enough to benefit from multiple narratives playing out.

NFT season was a surprise, yet many investors adjusted their priorities and thrived. Being able to adapt to a shifting metagame and see where the less advanced speculators will end up is the key skill here in the months ahead.

David Shafrir is the co-founder and CEO of Secure Digital Markets, a leading digital asset brokerage that provides access to cryptocurrency and emerging digital asset markets. Shafrir is a serial entrepreneur with a proven track record of bringing disruptive technology to market and generating strong returns for investors. He specializes in seeking new growth opportunities that align with the company’s mission while forging and maintaining client relationships.