Now that inflation is back, it's not going away anytime soon. The Federal Reserve expects it to fall below 3% next year and eventually go back to 2%. But there are reasons to think that’s far too optimistic. We are living in a new world. Even after things get back to normal that could mean inflation averages 4% or even 5% for the foreseeable future.

The Fed can almost be forgiven for its optimism. The idea that inflation was no longer a concern had become conventional wisdom before the pandemic. Many articles were written explaining why. Pension funds pulled back on their promises to increase benefits with inflation, and hardly anyone noticed.

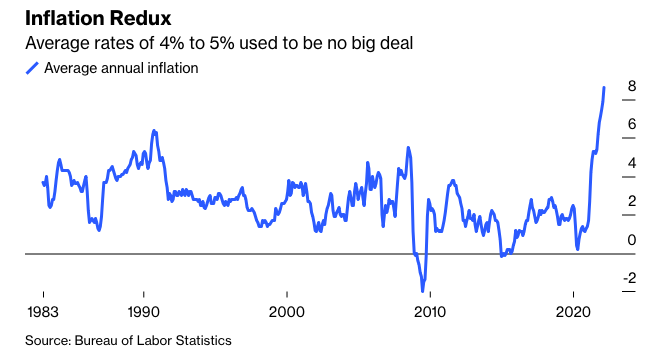

But now inflation is up to 8.5% and, between lockdowns in China and the war in Ukraine, it could go even higher this year. At some point, we hope, the world will fully open and some of the pressure will lessen. But these times could leave lasting scars on the economy and we may have seen the last of 2% inflation for a while. Americans used to live in a world where 4% or 5% inflation was the norm, and that could be where it settles in the future.

There are many reasons why inflation became so low and stable in the last 30 years. One popular explanation is after years of missteps, the Fed finally figured out what worked. During the last serious bout of price increases in the 1970s, Fed Chair Paul Volker raised interest rates high enough to cause a recession. This created confidence that the Fed would do what it takes to keep inflation in check and that credibility helped keep inflation low, because today’s economy is largely driven by expectations about what future inflation will be.

There were other economic forces that kept prices from rising. Global trade grew, we bought more goods from countries with lower labor costs, and companies learned to keep tighter inventories, taking full advantage of the global supply chain and making production leaner and more efficient. The internet also empowered consumers to do more comparison shopping, which kept prices lower.

Inflation returned after the pandemic because the ripple effects of Covid disrupted global supply chains and created shortages of goods. People got extra money from the government as they hunkered down at home, and they spent it on goods instead of services just as supply contracted. Government policy poured fuel on the fire by sending even more checks, while the Fed continued to keep rates at zero and kept buying long-dated assets, all of which was designed to increase demand even further to avoid a recession and bring unemployment down.

In short, prices went up because there was less supply and a lot more demand. And even after the government put the brakes on writing checks, the effects will linger for many months. People saved some of that money and are still spending it. Monetary policy still is expansionary and its impacts will also be felt for many months.

These are some of the reasons to believe that even after the dust settles on the pandemic, and hopefully on the war in Ukraine, we might still be in a higher-inflation world. So far, the Fed has not indicated it deserves or will maintain its credibility for keeping inflation in check. It was slow to acknowledge price increases were a serious and persistent problem, and it still only plans to increase rates slowly to a level that may be below inflation. Many economists don’t think it will be enough.

So far, most indicators of inflation expectations, bond yields and surveys, are still fairly low. But the longer inflation sticks around the harder it is to get rid of. Inflation was not on anyone’s radar for a long time. Now it is. That means it may get baked into wage increases, companies will get used to raising their prices and inflation can become entrenched even as supply and demand pressures ease.

Meanwhile, some deflationary forces may soon reverse. Economist Charles Goodhart expects an aging population, especially in China, will spell the end to cheap labor that produced low-priced goods. Efficiency could suffer long term from the supply-chain disruptions if firms maintain bigger inventories as a cushion against future shortages. The White House is pushing more domestic production and encouraging less trade, which will make goods more expensive. Democrats and Republicans both favor these policies; odds are they will continue no matter who is in office.

On the bright side, higher inflation needn’t be bad for the economy. Uncertainty creates the biggest problems. If people don’t know whether inflation will be 2% or 5% year-to-year, this can pose many costs. Firms don’t know how much they can increase prices without it affecting the demand for their goods and services, and workers don’t know how much of a raise they need to maintain their purchasing power. Saving, spending and investment decisions all become much harder. All this uncertainty can cause people to pull back on economic activity, which harms the economy.

Stability can become more important than the actual level of inflation. If it’s higher but remains in a tight range, it won't cause too much damage to the economy. When the average inflation rate was 4% or 5% for many years, the economy still grew. Before the latest events, several economists even argued the Fed should target a 4% inflation rate because it would provide more room to conduct monetary policy.

Ultimately, the Fed may not have much control over where inflation settles. It’s largely driven by the macroeconomic forces in our economy that the Fed has limited influence over. But if the Fed pursues responsible, consistent and transparent policies it can promote price stability. That means we could be living in a stable, 4% inflation world, and that may be the best we can hope for.

Allison Schrager is a Bloomberg Opinion columnist. She is a senior fellow at the Manhattan Institute and author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.