Investing trends come and go—today’s financial fad may be tomorrow’s goofy gimmick—but environmental, social and corporate governance (ESG) investing continues to gain in adherents around the world, a new study says.

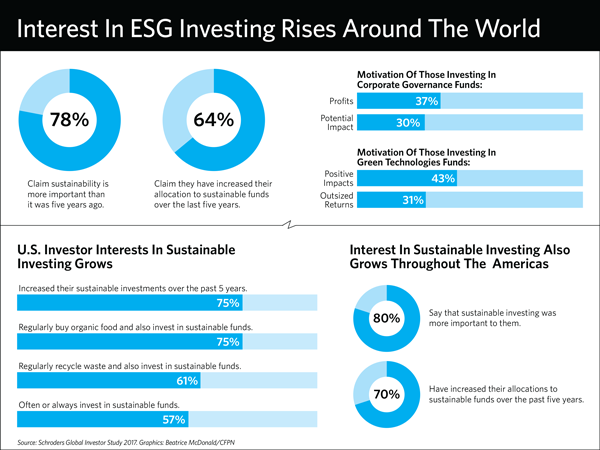

In the Schroders Global Investor Study 2017, 78 percent of more than 22,000 investors claimed that sustainability is more important than it was five years ago. Sixty-four percent claim that they have increased their allocation to sustainable funds over the last five years.

On a regional basis, nowhere was the increase in sustainable investing more notable than in the Americas, where 80 percent of respondents said that sustainable investing was more important to them, and 70 percent had increased their allocations to sustainable funds over the past five years.

The report correlates rising interest in sustainable behaviors to increases in sustainable investing. Majorities of investors globally already display these behaviors when they recycle or reduce household waste, shop locally, avoid controversial businesses and frequent businesses with a socially responsible track record, according to the Schroders study.

Schroders said that sustainable investing was the most commonly selected choice from a list of investment topics that investors said they would like to learn more about, ahead of topics like asset classes and the effects of compounding.

The respondents were slightly more likely to say they embraced sustainable investing for its potential positive impacts (38 percent) than for profit (32 percent).

Schroders found that investors bought different types of ESG funds depending on their motivations. For example, investors buying funds focusing on corporate governance were more likely to be motivated by profit (37 percent) than by potential impact (30 percent). Investors buying funds focused on green technologies tended to be more interested in positive impacts (43 percent), than outsized returns (31 percent). Similarly, investors tend to be motivated by potential impact when buying funds focused on human rights, diversity, poverty and social welfare, or funds that avoid fossil fuels, according to the study.

Investors buying funds focused on medical science and biotechnology were as likely to be motivated by profitability as they were by positive social impact.

Investors buying funds focused on medical science and biotechnology were as likely to be motivated by profitability as they were by positive social impact.

When Schroders ranked new investor interest in sustainability country by country based on survey responses, U.S. investors had the third-highest interest in sustainable investing, behind Indonesia and India.

Schroders sponsored surveys of 22,100 investors in 30 countries in July.