In the week ahead, as has been the case for most of the year, markets will likely take their cues from medical rather than economic data. The key question is whether America will see a second wave in the Covid-19 pandemic. The answer to that question has, of course, profound human and social consequences. However, it also has implications for the economy, for fiscal and monetary policy, and, ultimately, for investment strategy.

Sadly, evidence is mounting that a second wave is indeed upon us, even before the first one has ebbed. Recent weeks have seen a surge in cases with confirmed infections rising by 70% from just over 21,000 per day in the week ended June 6th to just over 36,000 per day in the week ended June 27th. Some have argued that this merely reflects more testing. However, the data clearly don’t support this idea, since the number of tests conducted nationwide rose by only 21% over the same period.

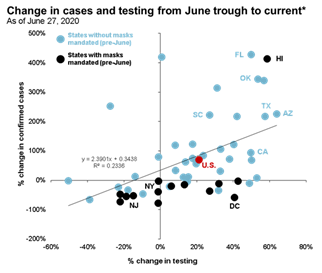

Moreover, as is shown in the chart below, individual state data show enormous disparities in the growth in infections in recent weeks, which appear far larger than any disparities in the growth in testing. In addition, greater local testing is very likely being driven by more people seeking tests as infections rise and so is the result of, rather than the cause of, more infections being confirmed. It should be noted that local regulations do appear to be having an impact on the pandemic, with most states that mandate the wearing of masks seeing an actual decline in new cases over the same period.

Source: The COVID Tracking Project, J.P. Morgan Asset Management. *June trough in cases was on June 9, when 7-day moving average of cases was at its lowest since peaking in April. Percent change in testing = percent change in total testing in week of 6/20-6/27 relative to total testing in week of 5/30-6/6. Percent change in confirmed cases = percent change in total confirmed cases in week of 6/20-6/27 relative to total confirmed cases in week of 5/30-6/6. States with masks mandated pre-June: CT, D.C., DE, HI, IL, KY, MA, MD, ME, NJ, NM, NY, PA, RI. Data are as of June 27, 2020.

It should be emphasized that the news is not all bad. The mortality rate from Covid-19 appears to be falling. In part this is because a greater share of those recently infected are young and mortality rates among the young are lower. However, it also likely reflects the more widespread use of better protocols and drugs in treating the illness, improvements that will hopefully continue in the months ahead. This being said, however, the latest surge in cases will likely boost fatalities in the weeks ahead.

While this is sobering news from a medical perspective, it is unlikely to alter public behavior enough to cause new cases to resume a strong and steady downward trend nationwide. Sadly, the simple but effective steps of social distancing and mask-wearing have become political issues, with millions of Americans refusing to adopt these basic precautions either as an assertion of their individual freedoms or because they believe the news media is overhyping the pandemic.

Regardless of motivation, the behavior of these individuals will make it very difficult to achieve the kind of success in controlling the virus seen in parts of East Asia and more recently in Europe. In addition, there is an understandable urgency to the desire to reopen workplaces and schools, given the economic and personal toll of social isolation. However, even with great attention paid to health protocols, it will be hard to achieve this partial reopening without increasing the risk of infection. Sadly, then, it seems likely that the U.S. will sustain a very heavy level of contagion and fatalities all the way until the widespread distribution of a vaccine, hopefully early in 2021.

From an economic perspective, this rolling-wave pandemic likely eliminates hopes for a full V-shaped recovery in advance of a vaccine. The basic problem is that there are many businesses that cannot reopen in a way that is profitable or sustainable, while still assuring consumers and workers that they are not putting their health in jeopardy. These businesses include a multitude of firms in the travel, accommodation, food services, personal services, entertainment, sports and retail industries.

This problem will likely be in full display in the June jobs report, due out on Thursday. While we believe the economy may have added roughly 2 million jobs in June, this would still leave payroll employment down 17.5 million or 11.5% since February, with more than half the job losses coming in the leisure and hospitality, transportation and retail sectors.

In addition to the difficulty in rehiring these workers, a rolling-wave pandemic and economic uncertainty will likely keep home and auto sales suppressed, as should be evidenced by June auto sales, due out on Wednesday. Economic weakness could be further exacerbated by more layoffs in the energy sector, due to low global oil prices, and declines in state and local government employment, reflecting the inevitable impacts of lower revenues and inadequate federal support.

On the subject of jobs, it should also be noted that classification errors appear to be artificially suppressing the measured unemployment rate. The impact of these errors should fade even as employment slowly rises, leaving the unemployment rate in double digits well into 2021.

This would, in turn, likely force Congress and the Administration to pass further Coronavirus relief bills both this summer and at the end of the year, potentially adding at least a further $2 trillion to the federal deficit. In addition, a slower economic recovery, accompanied by continued low inflation, would like encourage the Federal Reserve to continue quantitative easing until later in 2021 and quite possibly postpone a first rate hike until 2022.

We now expect real GDP to fall by roughly 35% annualized in the second quarter followed by a 20% bounce in the third. Thereafter, while positive policy actions, combined with a rebound in global growth, should prove sufficient to avoid a further outright decline in real GDP, a rolling- wave pandemic should impede further GDP gains, with real economic activity only surpassing its fourth quarter 2019 level by the fourth quarter of 2021. In this environment, corporate earnings would also fall short of analyst predictions, with S&P500 operating earnings per share only hitting a new high in 2022.

So, what does all of this mean for investors?

First, in the short run, some caution is warranted. While U.S. equities still look attractive relative to Treasuries for the long run, there is a significant risk of disappointment in either the medical data or the economic numbers. This suggests the need to hedge equity exposure using either high-quality, long-duration bonds or, better still, more explicit hedging techniques.

Second, the Fed has bought almost 60% of the extraordinary $3.2 trillion increase in federal debt in the last six months and its announcements pertaining to lending facilities have reduced credit spreads on corporate and municipal bonds to levels which hardly seem appropriate in a deep recession. This leaves bond investors both starved of income today and exposed to losses in the long run, assuming that the economy eventually improves enough to warrant a tighter monetary stance. This, in turn, suggests that investors looking for income should search more broadly and, in particular, consider dividend income from equities in sectors that appear less vulnerable to a long pandemic.

Finally, it is important to acknowledge that many countries in Europe and particularly in East Asia have been more successful than the U.S. in taming the virus and should consequently experience shallower recessions and quicker rebounds. This should boost overseas profits relative to those in the U.S. and could also precipitate a dollar decline, given the possibility of more monetary tightening overseas. This, along with the significant valuation advantage outside the U.S., argues for an overweight to international stocks in general, and emerging markets in particular.

There is no point in downplaying the negative impacts of the virus on our emotional and financial wellbeing. In the short run, we will adapt to Covid-19. In the long run we will prevail over it. However, in the meantime, it remains important to see the pandemic for what it is, and position assets not just for the hope of an early cure but the more likely path of a long struggle with a rolling-wave pandemic.

David Kelly is chief global strategist at JPMorgan Funds.