The cost of permanent or cash value life insurance has long been an anathema with many financial advisors, who believe that permanent life is too expensive, and the cheaper term life is the way to go. This belief is captured in the popular saying: “buy term and invest the savings.” Another objection is that most people do not need any life insurance in later years as they would have accumulated enough assets to cover their financial needs, particularly because they have already fulfilled such obligations as paying off their mortgage and their children’s college. Accordingly, many advisors would not recommend permanent life insurance to their clients.

I do not think that this is a helpful approach to dealing with life insurance as I believe that clients need to understand the fundamental principles and the utility of term versus permanent life.

I believe that people need both kinds of insurance, oftentimes simultaneously.

My view is that term life is protection against premature death, while permanent life is protection against mature death when people in advanced age may encounter unexpected financial calamities, such as the loss of life savings due to market conditions, or exorbitant medical bills caused by health conditions that were never anticipated.

Given the recent incidents of wild fire on the west coast, and hurricane and flooding on the east coast, we must also be cognizant that our life savings may be vulnerable to natural disasters that may not be fully covered by other types of insurance. In such events, a permanent life policy with sufficient cash value would provide an invaluable reserve to help manage any number of financial disasters that we have no control over.

The Cost Of Term Life

It is true that term life is very cheap. It is best for young people when they need maximum protection for their family at low cost due to their limited resources. Term life is cheap because it is only temporary protection for 10, 20 or 30 years, and few people actually claim the death benefit. It has been estimated that only 1 percent - 3 percent of term life policies result in a claim. Essentially, one would pay premium on a policy for years until it expires without getting any benefit in return.

Conversely, a permanent life policy covers a lifetime, which can mean 100 or more in years. It is more expensive because it offers seven times (70 years) more in coverage than a 10-year term life, and more than two times in coverage than a 30-year term policy, assuming that the policy begins at age 30. The problem is that a term life policy for 70 years does not exist.

What exists is that if clients in good health want an additional 30-year term life policy at age 60, it would not be available at any cost. They may get a 20-year policy for $6,057 per year for a $1 million death benefit for a man, and $3,639 for a woman, or a 25-year policy for $9,980 for a man and $6,384 for a woman.

Here is a real life illustration. A recent client of mine, who is now 74, had a triple heart bypass in his 50s, and has been in good health since. At 64, he took out a 20-year term policy for $100,000 that costs $3,233 per year. However, the premium schedule for the policy indicates that by age 79, his premium will increase to $42,920 a year, and by age 84, which is the end of the 20-year term, the premium will skyrocket to $61,955 per year.

So, if a client is interested in lifetime protection, term life can be cost prohibitive and will not even be available in later life, particularly if he has had uninsurable health issues.

The Cost Of Permanent Life

In contrast, a level premium for the life of a policy can apply to various types of permanent life by design, and many current permanent life products permit flexible paid-up so that premium payment can stop at specified time prior to policy maturity.

For example, I’m reviewing an IUL policy for a 32-year-old male client. He plans to start a family within 3 years, and his insurance plan includes a $1 million 30-year term life and a $1 million IUL policy. The current annual premium for a 32-year-old male in good health is approximately $890 for a 30-year term. The IUL policy would cost $8,774 per year in premium for 30 years at an assumed return of 6 percent.

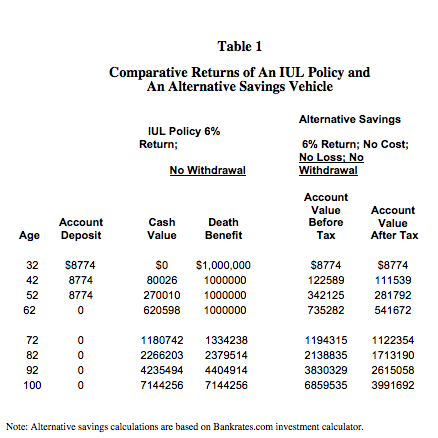

By age 62, the term policy will expire. The IUL policy will have $620,598 cash value in the policy and $1 million in death benefit. By age 70, the cash value will grow to $1,037,251 and the death benefit will increase to $1,203,211. By age 100, the cash value will grow to $7,144,256, and the death benefit will be the same as the policy would have matured at age 95. The internal rate of return over the life of the policy is 5 percent-6 perecent,tax free. These numbers are based on the scenario that there will be no withdrawal and the cash value has already accounted for all the fees and costs of the policy. Table 1 shows the benefits of the policy from age 32 to 100.

Note that this policy is presented as one of many types of permanent life to illustrate the cost and benefits of permanent life. There are many types of permanent life with different cost and corresponding benefits. IUL policies are considered to be relatively more expensive than other types, but the benefits with regard to cash value are also potentially higher.

A Lower Cost Alternative

Pursuant to the adage “buy term and invest the savings,” is there a cheaper way to invest the same amount of money? What would be the result of a savings or investment alternative to this IUL policy in the example?

Comparing apple to apple, Table 1 shows the potential returns of an alternative savings vehicle that invests the same amount of the IUL premium at the same 6 percent rate of return for 30 years with no cost, no loss and no withdrawal. As most savings accounts are subject to tax, the data show the returns for both the before and after tax scenarios, assuming a combined 28 percent tax rate (22 percent federal and 6 percent state).

For an alternative savings or investment instrument that would provide a consistent or average return of 6 percent over 70 years for a contribution of $8,774 per year for 30 years with no cost, no loss and no withdrawal, the calculations show that in 30 years, there will be $735,282 in the account before tax, and $541,672 after tax. The after tax result is consistently less than the return on the IUL policy in the example, and the cash value in the permanent policy begins to overtake the alternative account’s before tax value in the early 70s. Regardless of how well the alternative savings may do, it would not surpass the death benefit that the permanent policy offers.

There is always the argument that a higher rate of return can be achieved by investing in the stock market. The question then is: “At what risk?” The death benefit in permanent life policies is guaranteed if it is managed the way it is designed to work.

The Utility Of Permanent Life

In addition to the cost and the potential return, the utility of permanent life is also well known.

If the cash value in a policy has accumulated sufficient funds, usually in 11 to 15 years, it can be used for many purposes, which are in effect living benefits, and which include:

• Emergency fund due to its liquidity.

• Income replacement in the event of unemployment or disability.

• College funding and financial aid, as the cash value in a life policy is not included as a family asset that reduces financial aid potential, unlike the value in 529 plans which would be considered a family asset.

• Business funding, as exemplified by such business legends as Walt Disney, Roy Kroc, and J.C. Penney who cashed in their permanent policy to fund their business.

• Supplemental tax free retirement income.

• Long-term care expenses, particularly in the absence of long-term care insurance.

• Debt repayment, such as a mortgage if the insured still has a mortgage in retirement years, as well as medical bills not covered by any health insurance.

• Additional business uses such as succession planning, buy-sell agreement, key person insurance, and executive retirement benefits.

• Asset diversification due to its tax advantages.

• Estate and legacy planning.

• These are some of the benefits that permanent life has to offer, and which are not available from term life or other savings vehicles.

Conclusion

It is axiomatic that every financial instrument serves specific purpose, and no instrument can do everything. While term life is designed to provide life insurance at low cost, it does not offer the benefits of savings potential, liquidity, lifetime protection and many living benefits that permanent life does.

There are certainly downsides to permanent life. The main issue is that it requires a long-term commitment to realize the best result of a policy. Clients may lose money if they should want to cancel a policy in early years. The product may be too costly for many people no matter the benefits, although custom-designed policies can accommodate any premium level that is affordable to the client. Given the requisite long-term commitment, it is critical that advisors deal only with carriers with the best credit ratings to guard against defaults, though the industry has built-in safeguards through state insurance programs to protect the consumers, among other measures. Then there is a potential tax issue if a policy is not being managed properly, even though permanent life enjoys tax-free benefits not available to most other investment vehicles.

One common objection against permanent life is the high sales commissions. The problem with such objection is that it allows some of the bad practices to override the merits of the instrument, since overcharging in fees and commissions is certainly not unique to permanent life. Many mutual funds are still charging front and back loads of 5 percent or more, in addition to annual portfolio charges of 1-2 percent, while many other investment vehicles have fees that may exceed 20 percent.

Instead of rejecting permanent life, advisors should do their due diligence and help clients understand the respective cost and benefit of both term and permanent life. And instead of taking issues with high fees, advisors should search for good products with lower costs and fees. Clients are entitled to be informed of the relative merits of these financial instruments before making any decision on getting the right protection for themselves and their families. Advisors should not make the decision for them by recommending only the cheapest option, not to mention that it may not even be what the clients want, if they have had the opportunity to evaluate for themselves the benefits relative to the cost of a financial instrument like permanent life.

Eva L. Levine, J.D., CFP, RIA, is the principal of Plenaris Advisory, based in San Jose, Calif. The firm offers comprehensive financial planning in the San Francisco Bay Area.