Highlights

• The world is already emerging from the deepest and possibly shortest recession in modern history. But investing is likely to become more—not less—challenging.

• Massive monetary policy stimulus has helped restore order and confidence. At the same time, lower yields mean investors have to take on more risk to generate income.

• We are seeing seismic shifts across financial markets and within key sectors and industries, creating more challenges and more opportunities.

The Bounce Has Begun; How High Can We Go?

Back in March, we were as stunned as anyone to be marching into an economic recession and an unprecedented global health crisis. We’re nearly as surprised to find, only three months later, that the global economy is once again expanding and financial asset prices are staging one of their strongest quarters in history. While health experts are quick to caution that the coronavirus remains a serious threat, high-frequency data—and our own eyes—tell us that commerce is returning as virus fears abate (wisely or not) and businesses reopen.

And so, it seems, passes the 2020 recession, the deepest and the shortest downturn the world has experienced since World War II. The National Board of Economic Research has pegged February as the end of the longest uninterrupted period of growth in U.S. history, but it also acknowledged that a new expansion may have begun as early as May. Asia, especially China, has been expanding for a few months now given its earlier and generally more successful experience with the virus. And Europe, which has experienced the worst of the fatalities per capita, is being supported economically by its strong social safety net and aggressive economic stimulus. In the wake of this severe global downturn, we find a recovery of highly uncertain trajectory.

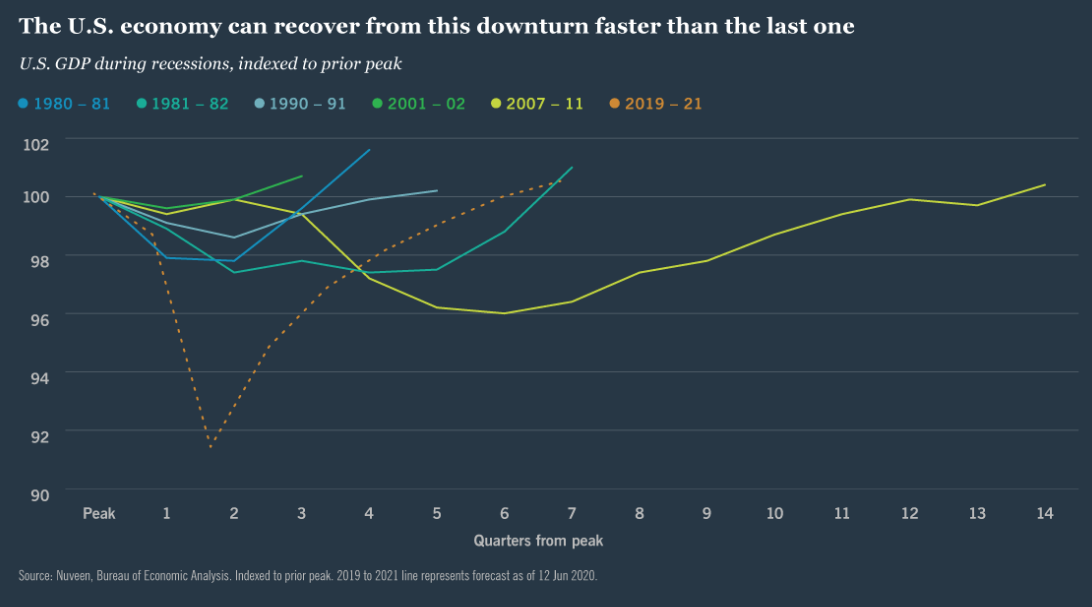

As the figure shows, we expect U.S. economic activity to return to its Q4 2019 peak in the second half of 2021, clocking this recovery at twice the speed of the one that began in mid-2009. While that forecast might appear optimistic, we also see unemployment remaining between 8% and 10% through much of 2021. That’s because restrictions on how certain businesses may operate in the phased reopening could cause job creation to lag even as the economy grows.

As we wrote in March, the speed and trajectory of this recovery will be largely determined by economic policy. Global fiscal policy has been effective so far at replacing lost income and helping businesses of all sizes stay afloat. With reopening underway, policymakers will need to do more to a) ensure financial conditions don’t tighten; and b) cushion the demand shock by assisting distressed industries and unemployed workers.

Proceed With Caution After A Fabulous Recovery Rally

It would have been nice to know with certainty in our last quarterly outlook how close we already were to “the bottom” in global financial markets, particularly equities. Stocks have staged arguably the most impressive and unexpected rally on record since their bottom in late March. The first stage of that rally was marked by subsiding panic about basic market functionality, thanks to a hefty dose of liquidity from the Federal Reserve and its global peers. The second stage was dominated by a relatively small number of high-growth companies, mainly in the U.S., that became more attractive for their abilities to generate profits during the economic shutdown. The latest stage since mid-May has been driven by evidence that the coronavirus is being contained and the global economy is getting back to work. Its leaders include non-U.S. markets and more cyclical companies with lower valuations.

Despite rising equity market volatility in June, stocks are not likely to retest their March bottoms because a return to that level of panic remains unlikely. However, risk assets have undoubtedly priced in an optimistic scenario for the next 18 months: no serious second virus wave, a strong recovery in corporate profits and near-zero interest rates across the developed world. Only the last of the three assumptions seems solid to us.

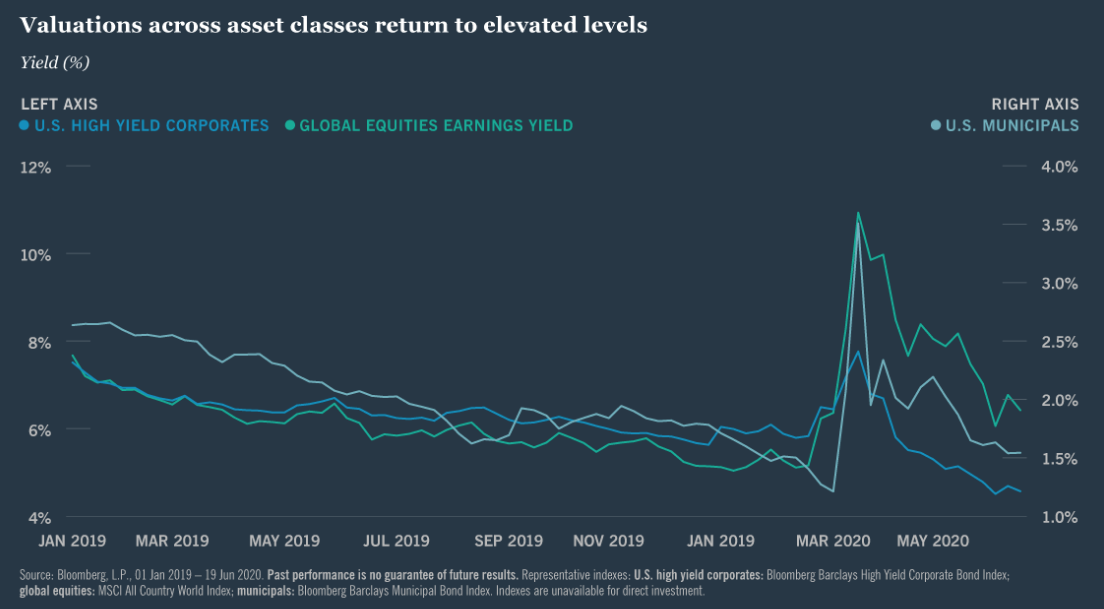

Even so, valuation has become a concern, as the figure shows, as it was heading into this year. Interest rates have plunged and credit spreads have narrowed, even on lower-rated securities with elevated risks of default. And global equity markets are at their most expensive levels relative to expected earnings since the bursting of the technology bubble in the early 2000s. Even if stimulative economic policy helps markets continue to post impressive returns in the coming quarters, the long-term prospects for holders of diversified portfolios of publicly traded assets looks precarious.

What Comes Next?

While the outlook for the balance of 2020 is clouded by uncertainty, the GIC devoted time at its last meeting to discussing how the longer-term outlook might influence—or already be influencing—our investment processes. Many industries face existential risk as fears of the virus affect consumer behavior and business investment. Assets tied to travel and leisure continue to trade at distressed levels. We think leisure travel will rebound before business travel, as families look to take vacations while companies continue to cut travel-related costs and reduce risks.

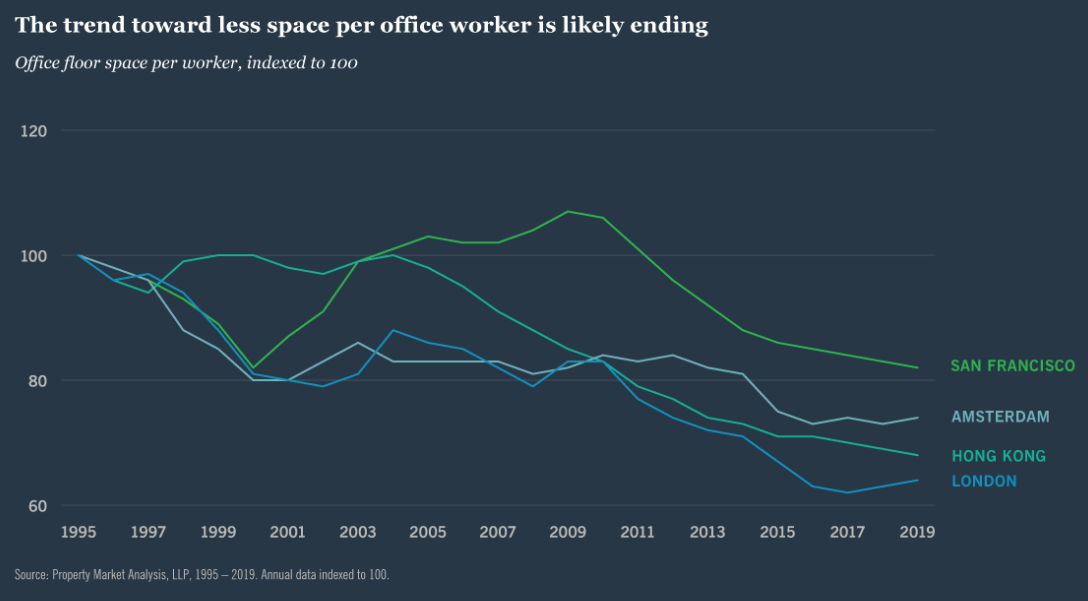

Speaking of companies, what will become of all the office space leased to global firms, especially in densely populated cities, that were disproportionately affected by the coronavirus? While we don’t think 2020 will be the beginning of the “end of the office” by any means, we see the potential for significant changes in how offices are designed. As the figure shows, more employees have been pushed into less office space over the past 25 years. That trend may be primed to reverse as social distancing and employee safety take on greater importance. The average worker may commute less often to work, but once there will need more room to operate and a design built for greater flexibility, learning and collaboration.

Health care is another industry likely to reinvent itself on the fly given its experience during this crisis. As the coronavirus became the primary focus for patients and providers alike, spending on other health care services fell precipitously. The industry will likely make greater use of telemedicine and ambulatory surgical centers. More countries may also incentivize domestic pharmaceutical production to exert greater control over drug manufacturing and avoid supply chain bottlenecks.

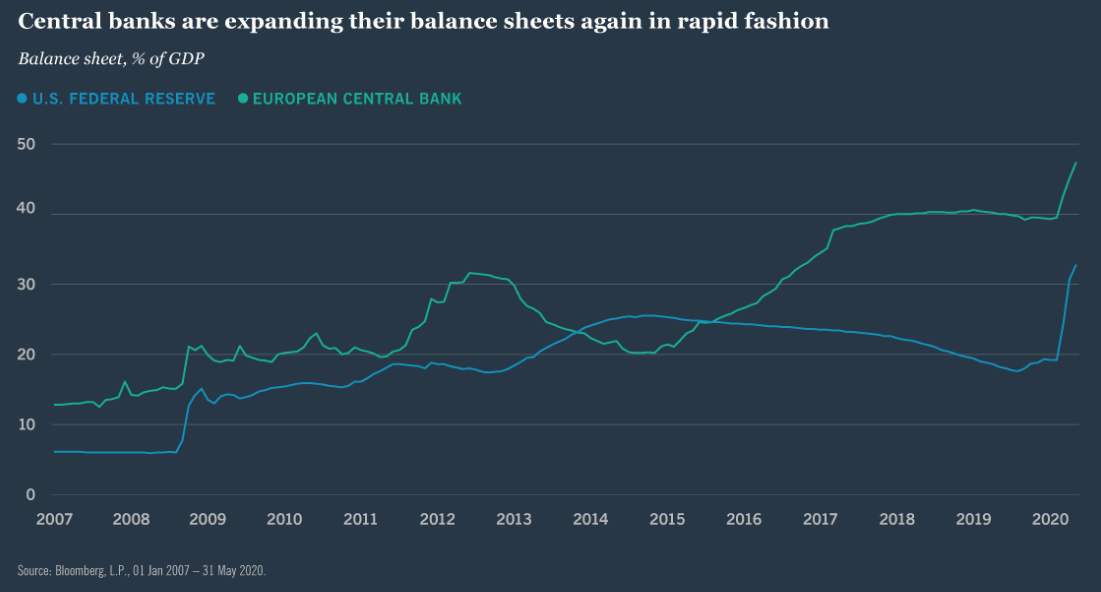

We also see this recovery leading to even lower interest rates around the world. Central banks have all but sworn an oath not to raise interest rates until well after the economy has healed, and the bond market seems to have gotten the message.

During the previous recovery, long-term interest rates initially rose quickly in anticipation of higher short-term rates. But this time rates in the most of the developed world remain at historical lows close to zero out to 10 years or more. Central bank balance sheets have ballooned as policymakers commit to quantitative easing policies as a means to reinforce their verbal commitments as the figure shows.

Where does that leave investors looking for income? That question dominated the discussion at our June GIC meeting and serves as the foundation for our major investment theme for the balance of the year.

What To Do About ‘Even Lower For Even Longer’

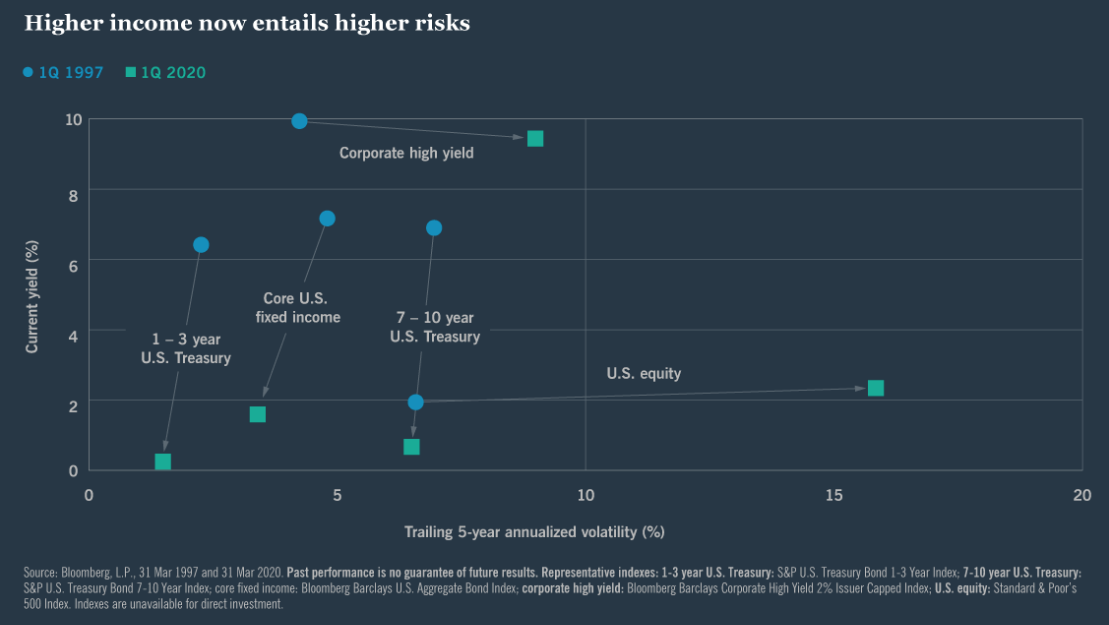

To state the obvious: It’s a lot harder to generate income than it used to be as shown in the figure. The long-term effects of the global financial crisis and aging global demographics created a heightened demand for “risk-free” income and—ballooning fiscal deficits notwithstanding—too few securities to supply it. And the coronavirus crisis has pushed rates down even further. Before 2008, a foundation could almost meet its distribution requirement using U.S. Treasuries alone, and a retired couple could sustain a reasonably comfortable lifestyle with a nest egg subject to relatively little market risk. Today that is no longer the case, requiring us as managers to consider not only how to meet and beat a benchmark, but also how to remain responsive to the persistent and growing demand for income.

In 2020, any solution for targeting higher income comes with increased portfolio risk. Diversifying the sources of those risks is key to an income strategy. Fixed income is the place to start, where investors are paid for credit, interest rate and liquidity risk. With yield curves flat in most of the world, it doesn’t really pay to focus on duration risk. But credit spreads remain well off their early-2020 lows, and even high-quality corporate and municipal bonds still trade at significant discounts due to lower levels of liquidity. Given the currently high corporate debt burden, however, managing risks in a bond portfolio requires careful research, especially in high yield. Investors can also consider allocating to emerging markets debt, which tends to provide more income than U.S. high yield corporate debt for a given level of quality.

With rates so low, however, investors must look beyond a fixed income-only solution. Even at the index level, global stocks provide a dividend yield to rival, if not exceed, high-quality bonds. We favor a more targeted approach to a dedicated equity income strategy, including dividend growers and publicly traded real assets like REITs and infrastructure. These dividend payers are also less correlated than the bond market to day-to-day moves in interest rates.

Perhaps the most fertile ground for income-seeking investors is in alternative asset classes. Direct ownership of real assets—real estate, farmland, timber—provides income diversification not only by source, but also by time horizon. These assets are often backed by long-term leases to tenants, making their income streams less volatile and the overall investment experience smoother.

Private credit has many properties in common with high yield corporate bonds and leveraged loans, but is typically only available through less liquid limited partnership investments. Backed by skilled management and investment selection, it’s another source of income that can perform in an economic recovery.

Looking Ahead

In sum, growth is improving, but the investment horizon remains cloudy. The coronavirus and ensuing economic and market upheaval have rattled investors, challenged income generation and called into question the long-term health of key global sectors and industries. Navigating markets from here looks to be extra tricky. In the coming sections, we’ll share some of our best investment ideas from individual GIC members. We’ll wrap up with selective ideas for portfolio construction for the second half of the year.

Bill Martin is CIO of Global Fixed Income at Nuveen. Saira Malik is CIO of Global Equities at Nuveen.