The Tax Cut and Jobs Act signed into law in December made an important modification to a widely used college savings vehicle—529 college savings plans can now be used for qualified K-12 educational expenses. Advisors will undoubtedly be questioned by their clients about this new opportunity, and should be prepared to provide some perspective as to how it could impact or improve upon both new and existing educational funding strategies.

To date, 529 plans (savings vehicles which enable tax free growth) have been strictly for qualified, college-related expenses. Now, as a result of the new law, state-sponsored 529 plans can be used for “tuition in connection with enrollment or attendance at an elementary or secondary public, private, or religious elementary or secondary school.” There is, however, a $10,000 a year per student limitation for K-12 expenses as opposed to qualified college expenses that have no annual distribution limit.

Since the number one benefit of 529 plans is tax-exempt growth, the longer the compounding time, the greater the potential benefit. So, households that have been diligently stashing away money every month for anticipated college expenses should think carefully before tapping those funds early.

Just because you’re allowed to do it does not necessarily mean it’s the right thing to do. It may make good sense to use 529 dollars to satisfy a portion of K-12 expenses, but only under certain circumstances. Depending on a client’s particular situation, it may even be beneficial to contribute additional funds to a 529 in the expectation of using the funds for pre-college expenses.

Here Are Five Considerations:

1. Focus On College First

First and foremost, before you advise your clients to consider using their children’s existing 529 money for K-12, be sure that they have already achieved their higher education savings targets first. Since college is one of the most significant expenses households will face (typically ranging from $80,000-$300,000 in today’s dollars for a child’s four-year higher education), even high-income households will be hard pressed to plug those costs into their annual budgets without some advanced planning. This is especially true for those with multiple children attending college at the same time.

Since 529s can be switched to other family member beneficiaries or used for graduate school, determining the educational funding status should be done on a family aggregated basis. So, unless you are confident that your client has overfunded the total expected family college costs, then they should hold off on tapping those funds early for K-12 and enjoy the power of compounding.

2. Is There More Funding Capacity?

If you are comfortable your client has already over-funded their family’s aggregated college savings goals, using a 529 fund for K-12 is a reasonable thing to do. However, if your client is still working towards achieving a goal, upping 529 contributions for expected K-12 expenses could also be of benefit as long as there is capacity to do so.

Capacity comes into play in two ways: (i) how much remaining room is there to fund a current 529 plan before hitting the plan’s aggregate limit, and (ii) is there unused annual gift exclusion capacity?

529 plans restrict contributions once a specified aggregated account value is reached. Generally, these limits range from $300,000 to $500,000. Also, limits are aggregated across the same beneficiary under the same 529 plan, but not across different state 529 programs. So, in other words, you could theoretically have $400,000 in Nevada’s 529 plan, and another $400,000 in Virginia’s plan for the same child. Of course, that’s a lot of expensive schooling, but it illustrates the point. Most people don’t run into this issue, but they might if they contemplate funding $100,000 or so of K-12 expenses.

Parents should also be aware of how contributions to a 529 impact their annual gift tax exclusion. A parent can make an annual $15,000 ($30,000 for married couples) gift to a child not subject to a gift tax return filing. In fact, 529 plans allow parents to pull forward 5 years’ worth of gifts. So, you could make a lump sum $150,000 contribution to a 529 plan as long as you haven’t already or are planning to make other gifts to that child under the annual exclusion over the next five years.

3. Do You Have Available Funds?

If a client is sitting on a lot of liquid funds and intends to send a child to private school, moving additional funds into a 529 plan is a practical thing to do. The tax savings, even if invested conservatively in a 529 plan, can add up over time, potentially making it worthwhile to add extra funds to the 529 for K-12.

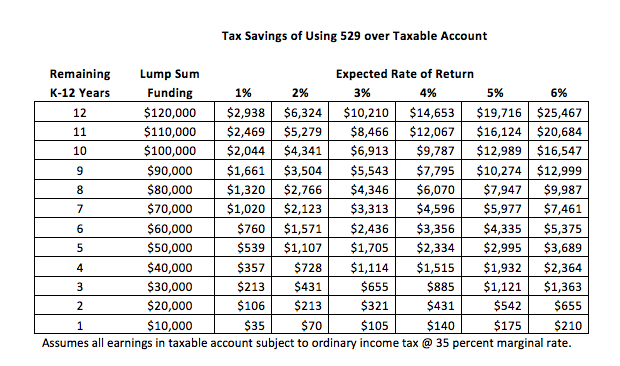

The chart below illustrates the potential savings for a household in the 35 percent tax bracket. Again, since you can only use $10,000 a year for K-12, the tax savings are relatively meager at low rates of return that are only invested for relatively short periods of time. For example, if you have an 8th grader that is going to be attending a private high school, you could save $357 by depositing $40,000 in a 529 account (earning 1 percent tax free in a money market option vs. a taxable account) and paying $10,000 a year out over the next four years.

4. Account Management

Given the relatively short time horizon, those putting new funds into a 529 earmarked for K-12 spending should be mindful of how to invest those funds. The more aggressive the account is invested, the less time to make up for potential losses. Conservative investments still have a tax benefit, but the compounded benefit is less meaningful.

If you have your 529 plan set up in the autopilot “aged-based” investment option (which gets more conservative the closer to college) it may misalign how to invest your college and/or K-12 funds. This means you might have to manually select multiple investments for your 529 to segment off the college funds from the K-12 funds. Another option is to set up a separate 529 for K-12 expenses. You can combine the account later on if K-12 funds remain as long as the owner and beneficiary are the same.

5. Converting Your ESA Into A 529 Account

Those wanting to streamline their educational savings funding may consider combining their existing ESA with a 529 account since the new law makes 529 plans competitive with Coverdell Education Savings Accounts (ESAs). The allure of ESAs is that they always allowed withdrawals for K-12 expenses. However, ESAs are more limited than 529s in that ESA owners could only put in $2,000 per year per beneficiary. Furthermore, those households with income over $220,000 per year are completely phased out for making contributions. Lastly, ESA contributions must be made before the beneficiary reaches 18 and used by age 30.

To summarize, there are several factors to consider when determining whether or not you should advise a client to start utilizing an existing 529 or a new 529 plan to fund K-12 expenses. Like all good financial planning, it depends on a client’s particular circumstances and should be viewed as part of an overall educational spending plan geared towards meeting your client’s desired goals and objectives.

Steven M. Sheldon, CFA, CFP, is a principal with SMS Capital Management LLC in Houston, Texas.