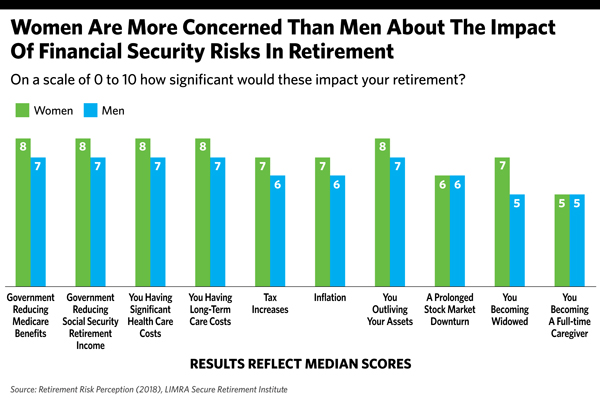

The study found that both male and female pre-retirees are worried about risks such as reductions in Social Security and Medicare benefits, and the increasing costs of long-term care and health-care in general. While both groups worry about how these factors will effect their retirement security, women scored these risks at an 8, while men scored the same risks at a 7, on a scale of 1 to 10.

Women believe the impact of running out of money would be greater for them, scoring it a 7, compared with men, who scored the impact at 6.

Women felt they were more likely to face certain risks that could effect financial well being in retirement, including increased taxes or a reduction in Social Security benefits, than men. The study also showed woman felt they were more likely to incur long-term-care costs then men. Female pre-retirees are more worried about the financial risk they may face in retirement than men, according to new LIMRA Secure Retirement InstituteRisk Perceptions study.

Female pre-retirees are more worried about the financial risk they may face in retirement than men, according to new LIMRA Secure Retirement InstituteRisk Perceptions study.

Men and women believe they are equally as likely to run out of money in retirement and scored this possibility at a 5 on average, according to the study.

Both men and women ranked the likelihood they would become a full-time caregiver to a family member as a 4 out of 10. Research shows women are more likely to become caregivers than men, according to LIMRA.

Women Worrying More About Retirement Than Men, LIMRA Says

February 12, 2018

« Previous Article

| Next Article »

Login in order to post a comment