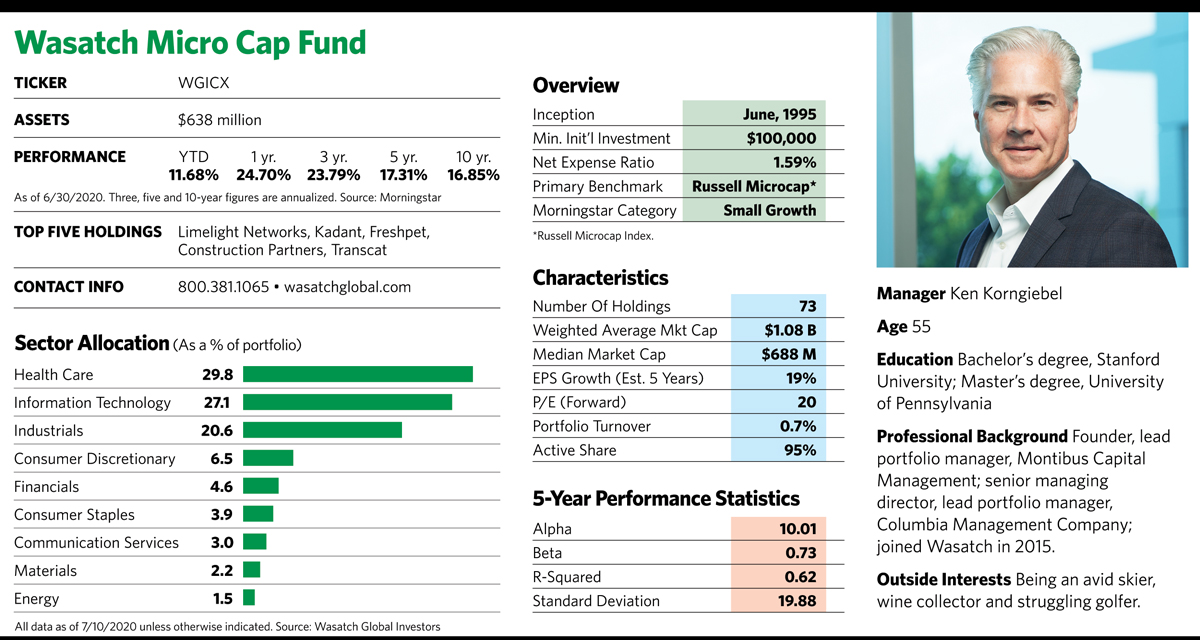

Even in the world of small-cap stocks, the companies in the Wasatch Micro Cap Fund (WGICX) are on the diminutive side. The 50 to 80 holdings in the portfolio have a median market capitalization of $689 million, and chances are you’ve never heard of most of them.

But what these companies lack in size they more than make up for in quality and staying power, says fund manager Ken Korngiebel, who has mined the small and micro-cap universe for nearly 25 years. Unlike many companies in the micro-cap space whose financial profiles are less than impressive, those in the fund’s portfolio typically have healthy low-debt balance sheets and the potential to grow sales and earnings at rates significantly better than those of companies in the benchmark index. For the most part they’re profitable industry leaders mostly able to self-fund their growth without much debt or high fixed costs.

“Those kinds of companies may be positioned to withstand periodic Covid-related challenges and emerge from the pandemic even stronger with increased market share,” says the 55-year-old manager. “And because most of them are focused on domestic economies, they should have fewer challenges if global supply chains and worldwide demand are disrupted by Covid-19 for an extended period.”

The Case For Active Management

It’s no secret that actively managed large-cap funds have a tough time beating the performance of lower-cost indexed ETFs or mutual funds. In that space, finding undiscovered gems and overcoming the hurdle of high management fees is a steep climb.

But Korngiebel says the same does not necessarily hold true among small and micro-cap stocks, an area where active managers have a better shot at uncovering less obvious investment opportunities. And the companies that populate these indexes often have vastly different financial profiles. “Micro-cap indexes certainly contain many unprofitable companies that are likely to remain micro-caps,” he says. “That is one reason why indexing typically doesn’t work in this space.”

Wasatch, a small company stock specialist, screens for companies with growing revenue and other superior financial attributes. With the exception of a handful of biotech names, which traditionally plow money into research and development but generate little or no revenue, the companies in the portfolio are profitable.

Nearly a quarter century of mining this segment of the market has provided Korngiebel with a network of valuable industry contacts that include private equity investors, venture capitalists and corporate executives who have a track record of success at previous companies. He’s even had a former investigative journalist on retainer to conduct due diligence and interview the former employees of the stock issuing companies to get a better picture of what the insides of the companies look like.

The fund’s independent streak is evident in its 95% active share (the measure of how much it differs from its benchmark). Both the average and median market capitalizations of the companies in the fund are much larger than those in the bogey, while the portfolio’s higher price-earnings ratio reveals its focus on more rapidly growing companies. The fund has emphasized the growth style, which has trumped value in recent years, and that has also helped push its performance past that of the benchmark. The goal, says Korngiebel, is to double investors’ money every five years.

The fund’s performance also bears little resemblance to the benchmark Russell Microcap Index. As of May 31, the Wasatch fund’s institutional class shares were up 23.71% over one year, while the index declined 4.78%. Fund shares rose an annualized 23.66% over three years, 16.30% over five years and 15.57% over 10 years. Over the same time frames, the index rose at an anemic annualized rate of 0.52%, 2.06% and 8.31%. Over the last five years, the fund has captured 98% of the index’s upside returns, and only 77% of its downside.

And the fund has been resilient during the recent down market: In the first quarter of 2020, it fell 24.8%, while the index dropped 31.99%. The Wasatch portfolio benefited during this period from several things: It did not have significant positions in the heavily affected travel and tourism industry. It also held less than the benchmark in financials, which fell even more than the overall market, and the stocks the portfolio held here dropped less than the sector as a whole. The fund’s substantial presence in health care and information technology, two areas that did do well relative to other sectors of the market during the downturn, also supported its returns.

Growth Mix

Wasatch Micro Cap invests in a mix of companies with different growth patterns that fall into one of three categories. The first group, high growth, consists of companies with minimum annual earnings growth of 20%. An innovative or unique product or service gives these holdings the best shot at becoming mid-cap, or even large-cap names. A few companies in the portfolio, such as pet food purveyor Freshpet and Medallia, a technology firm that provides customer experience management tools, have graduated from the micro-cap space since Korngiebel first bought them. He continues to own them because their growth prospects remain strong.

The second group, the core growth segment, includes high-quality bedrocks with stable and growing earnings. These companies often experience mid- to high-single-digit annual growth rates. Although most of their growth is internal, they may acquire other firms as well.

The last contingent, fallen angels, consists of companies that have suffered a temporary setback but sell at compelling prices. During the market pullback, the fund added to positions in several stocks in this category, names whose prices had fallen particularly hard because of the Covid-19 crisis. “In market panics, extreme risk aversion can cause investors to unfairly punish the stocks of companies whose long-term businesses remain strong, but whose near-term prospects are much less certain,” he says.

Boot Barn, which sells Western and work-related apparel, is a fallen angel that sank with other stocks tied to the retail and restaurant industries as customers recently stayed home. In addition to pandemic trouble, the retailer also faced concerns about faltering oil prices in Texas, where it has a substantial presence.

“This is a multi-channel retailer with a substantial online presence that remains the 800-pound gorilla in its category,” Korngiebel says. “Its retail stores are also a plus because, unlike some kinds of clothing, most people like to try on boots before they buy them.”

The fund also added to pandemic-battered positions in Tex-Mex chain Chuy’s and Chefs’ Warehouse, which distributes specialty food products to high-end restaurants. Korngiebel says Chuy’s has beefed up its delivery capabilities and done a good job of keeping costs down. Although Chefs’ Warehouse “was priced like it is going out of business,” Korngiebel believes the company is well-positioned to once again capitalize on the growing foodie scene.

Not surprisingly, this year’s stronger performers include companies that saw an immediate benefit from the pandemic. These include Inovio Pharmaceuticals, a biotechnology company that is developing a coronavirus vaccine. Inovio plans to have one million doses of the potential vaccine ready for additional clinical trials or emergency use by the end of the year. Another holding, Limelight Networks, boasts an innovative content delivery network that enables businesses to deliver digital content across internet, mobile and social channels. Demand surged with the spread of Covid-19 as billions of people sheltered in place.

Looking For A Recovery Play

Because small companies are typically more sensitive to the level of economic activity than larger ones, they frequently get hurt to a greater extent during a market selloff. That happened during the global financial crisis between 2007 and 2008, and again earlier this year. Even after the recent market rout, large caps maintained a big lead. Between December 31, 2014, and April 30, 2020, the large-cap S&P 500 returned a cumulative 57.71% while the small-cap Russell 2000 returned 17.18%.

Korngiebel observes that large-cap returns over the last few years have been driven largely by a relatively few mega-cap names that have benefited from phenomenal success in technology and communications. While these companies face the risk of declining growth rates as they continue to mature, he says, the companies in his portfolio have an ample runway for growth and are priced competitively. “Based on price-to-earnings ratios, our analysis shows that today’s profitable small caps are undervalued relative to profitable large caps by one of the widest margins in over 20 years,” he observes.

He isn’t keen on predicting when small company stocks will produce better long-term returns than large caps, a pattern that prevailed until recent years. But he points out that over almost all one-year periods following recessions since the World War II era, small-cap stock performance surpassed large-cap names by a wide margin.

Once the country climbs out of the pandemic slowdown and a recovery begins, historical precedent points to a speedier, sharper recovery for smaller company stocks. “If the economy does well, micro-caps and small caps should also do well,” he says.