With the stock market on an upward trajectory for most of the last decade, hedge fund managers and others who include short selling in their investment toolbox have had a tough time persuading investors to hope for the best but prepare for the worst.

The coronavirus pandemic, which sparked a swift and brutal stock market descent from late-February through March 23, breathed new life into that argument. The Standard & Poor’s 500 lost nearly 20% of its value in the first quarter, even after a late March rebound shaved a peak-to-trough loss of 34%. By contrast, the RiverPark Long/Short Opportunity Fund (RLSIX), which includes short selling in its investment toolbox, was up 9.48% in the first three months of the year.

Mitch Rubin, who has managed the fund since its inception in 2009, says that investors lulled into a false sense of security by a prolonged bull market are waking up to the periodic “black swan” events that make the hedging strategies his fund employs a lifeboat in a sea of losses.

“It’s often been said that if there is just a 2% chance of something happening, then there is a 100% chance of it happening over the next 50 years,” he says. “The best way for an investor to be truly prepared for these predictably unpredictable events is to have part of a portfolio invested in a long/short strategy before the next drawdown begins.”

RiverPark Long/Short had trouble spreading that message when it started life as a traditional hedge fund partnership in 2009. As relatively new players in the space, the team had to compete against much larger, better-known hedge funds with more established reputations. Hoping to have better luck among a more familiar territory of financial advisors and individuals, Rubin and RiverPark CEO Morty Schaja, both alumni from the Baron Funds, converted the portfolio to a mutual fund format in 2012.

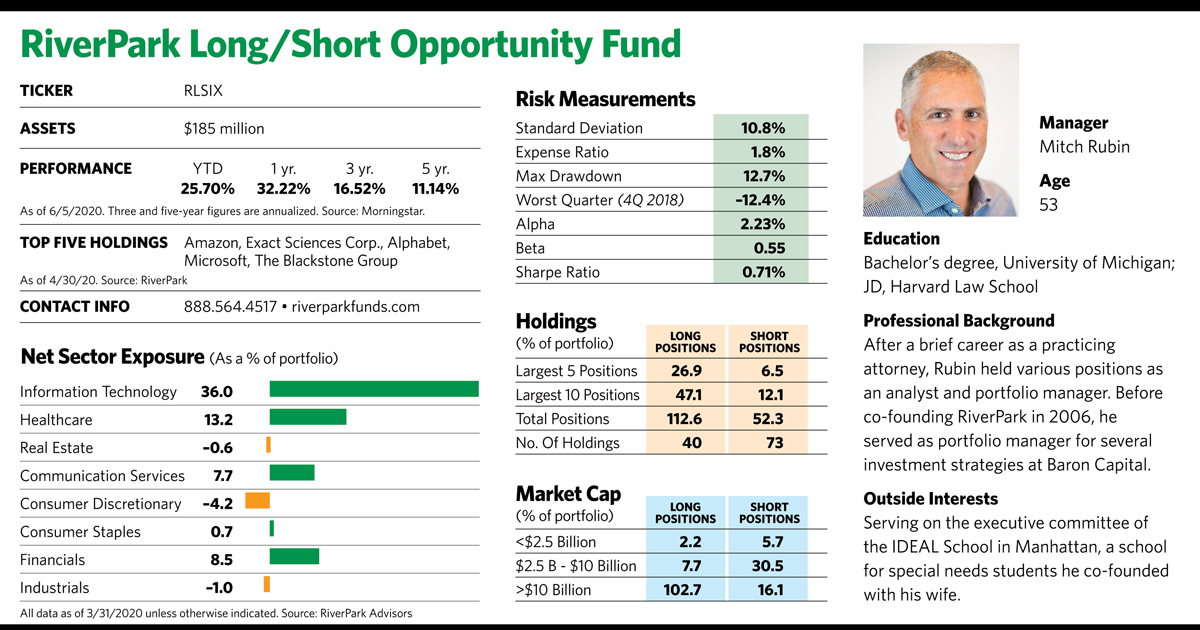

In the ensuing years, a roaring bull market drew few investors to this hedge fund product or other ones. But in 2020, a swift pandemic crash and the RiverPark fund’s strong performance turned the tide. By mid-May, it had $185 million in its coffers, more than twice as much as it held just four months earlier.

“We always thought the fund wouldn’t shine until we had a significant drawdown, and that turned out to be the case,” says Rubin, who believes the strategy will remain valuable to investors as market turbulence continues. He also sees a growing performance gap between the market’s winners and losers, which argues for active management on both the long and short sides. “The pandemic has highlighted that trend by accelerating both the creation and destruction of profit-making opportunities,” he says.

Investors interested in the strategy pay a 1.8% expense ratio for institutional class shares, which have a $50,000 investment minimum. While that’s high for a mutual fund, it’s much lower than the management and performance fees associated with a hedge fund. RiverPark Long/Short is also more transparent, with long and short positions posted quarterly at the website. And unlike traditional hedge funds, which only allow quarterly purchases and redemptions, RiverPark’s fund provides daily liquidity.

Playing Both Sides

“We have a dual mandate with this fund,” says Rubin. “The first is to produce equity-like returns by capturing a good portion of the market’s upside through investing in stocks. The second is to protect capital in down markets.”

Even in a generally upward market that’s lasted over a decade the fund has managed to achieve the first of those goals. Over the last 10 years, the institutional class shares have delivered an 8.64% annualized return, while the S&P 500 has returned 10.53%. In 2019, when the S&P 500 rose 30%, the fund was up 19.9%.

As its strong first-quarter performance shows, the fund’s strength emerges best in down markets. Well before the pandemic, Rubin had short positions in fading consumer brands, grocery and general merchandise retailers and fully valued industrials—things that he thought were on a long-term downward path. But once the pandemic hit in February, he closed out of many of these short positions to move to more direct pandemic plays—companies directly in the crosshairs of the pandemic, including those in the travel, leisure and consumer discretionary categories. He also shorted businesses that were highly levered and vulnerable to short-term setback. Finally, the fund expanded its use of index products and equity options to manage exposure and protect capital.

Normally the fund has gross exposure (long positions plus short positions) of 150%, consisting of 100% long and 50% short. This makes its normal net exposure to the stock market (long positions minus short positions) 50%. These ranges often vary, however, depending on market conditions and the manager’s outlook.

At the beginning of the drawdown, the fund quickly reduced its net exposure from nearly 60% to 20%. It did so by maintaining most long positions, but increasing the short side of the book.

Toward the trough of the selloff, the fund shifted focus from protecting capital to buying as its manager took advantage of extraordinarily low valuations. At the same time it covered many of its profitable short positions, such as Halliburton, Expedia Group, and MGM Resorts International. “Over the first three months of the year, the shorts covered the losses from the long side, and then some,” he observes.

Despite an untraditional approach, the fund also has a more conservative side. The typical holding period for a stock is three to five years, and the fund’s goal is to double the security’s price over that period. Rubin also likes companies with lots of excess cash, with the ability to at least double their earnings organically over the holding period and with leadership roles in growing industries.

The fund’s short side tends to be more tactical, with more frequent trading. Positions are typically covered in anywhere from five months to two or three years from when they’re established. With change happening so quickly in the first quarter of 2020, however, that happened within the span of a few weeks for some transactions.

Building On Creative Destruction

Rubin says the concept of “creative destruction”—the manner in which the market creates and destroys business opportunities—is a major driver of his team’s investment decisions. “On the long side, that belief drives us to look for companies and industries that benefit from innovation and creating the business opportunities of tomorrow. On the short side, we are looking for companies where change is destroying a competitive advantage as well as their ability to earn profits.”

During the market mayhem earlier this year, Rubin added to several of the fund’s existing holdings, including Amazon, Mastercard, Twitter, Twilio, Disney, Exact Sciences, Illumina and Intuitive Surgical. He also established several new high growth positions to the long side of the portfolio, including medical device company DexCom, Uber, Snap Inc., Pinterest, Lockheed Martin, RingCentral, Bill.com, Apollo Global Management and KKR.

With the exception of aerospace defense contractor Lockheed Martin and asset managers Apollo and KKR, these new holdings are relatively new businesses. That fact doesn’t dissuade Rubin, who believes they have enormous market opportunities, highly profitable business models and substantial cash reserves. They are also leading the way in their respective areas of expertise. Bill.com, for example, is a leader in automation and back office software for small and midsize businesses, and it recently reported 50% year-over-year revenue growth. Yet despite its leadership position, it has penetrated only 1% of its potential market. Uber is the global leader in ride sharing and is expanding its footprint in food delivery. Shopify provides software tools that enable retail merchants of all sizes to display and sell their products across numerous sales channels.

“As a result of these changes to the portfolio, we believe that the long book is positioned well to weather any further downturns while also generating substantial returns as the virus dissipates,” Rubin says.

He has transitioned some of the short side from pandemic casualty plays to what he calls “core shorts” in industries he believes will continue to be under enormous pressure even after the pandemic subsides. These include traditional advertising agencies, media firms that are ill-prepared for the digital age, leveraged telecommunications firms, and companies in the travel and entertainment industries whose financial positions will make it difficult for them to move past the crisis.

Despite the good times for the fund brought on by bad news, Rubin is relatively optimistic about the future. “Six months or a year from now the stock market is likely to be higher, if not much higher, than it is now. The economy will come roaring out of this because the coronavirus is not a structural problem with the economy or any one industry. But we still think people need to manage the downside. We could still see a retest of the lows.”