With the economy gaining momentum and the caffeine from corporate tax cuts kicking in, companies in the S&P 500 realized earnings growth of over 20% last year. It was their best showing on that front since 2010.

Now, a much more sobering picture is taking shape. For the first quarter of 2019, analysts project a decline in earnings of 2.2% from the same period last year, according to FactSet’s February earnings report. Consensus estimates call for earnings to tick up 1% in the second quarter, 2.4% in the third quarter and 9.1% in the fourth quarter.

The slowdown is happening for a variety of reasons, including the diminishing tailwind of corporate tax cuts. The Fed could raise rates this year, posing a threat to housing and other rate-sensitive sectors of the economy. With the new balance of power in Congress and frequent changes of key personnel in the Trump administration, political gridlock could take a toll on the economy. Uncertainty about Chinese tariff negotiations or an all-out trade war could thwart corporate productivity in the U.S., while a strong U.S. dollar has already eaten into the profits of some U.S. multinationals with substantial overseas sales. Meanwhile, optimism has faded as investors ratchet down expectations following a near decade of expansion in the economy and stock market.

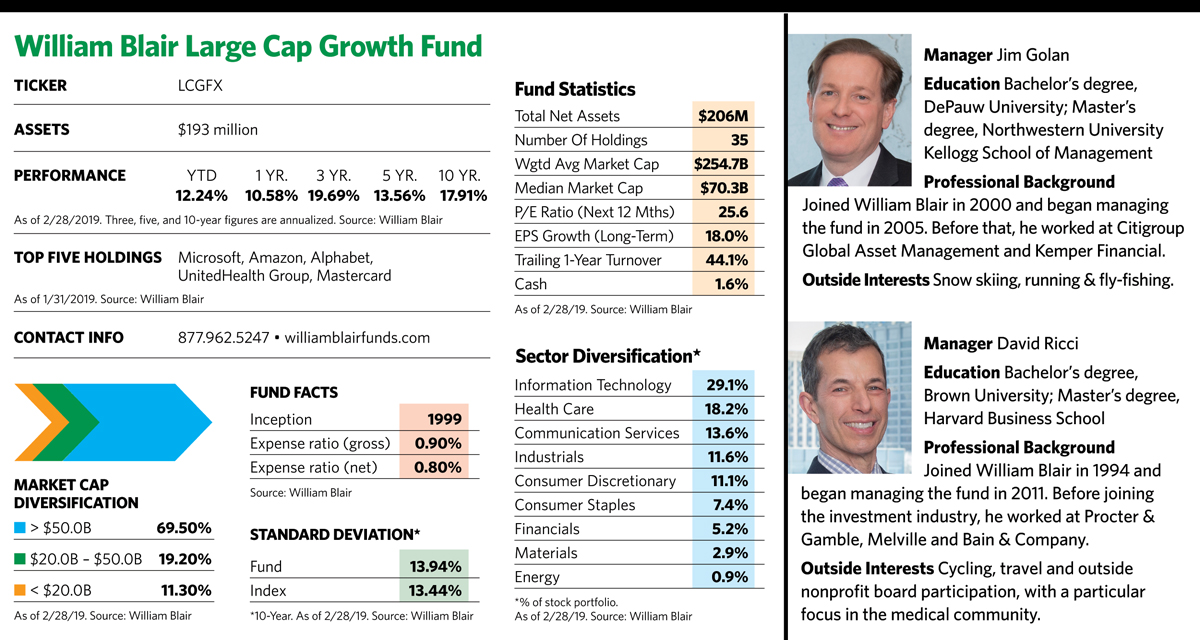

David Ricci and James Golan, who manage the $193 million William Blair Large Cap Growth Fund, aren’t wringing their hands about slower earnings growth, or how investors may or may not react to headline news. Though they pay attention to macroeconomic and stock market events, they say they’re more concerned with the business of picking stocks.

“A lot of what we’re hearing is short-term noise,” says Ricci. “Our focus remains on investing in long-term winners. The stuff we’re hearing about now washes away over three to five years.” They view market volatility as an opportunity to pick up solid growth companies that the market has misjudged or overlooked, rather than a cause for concern.

It’s also possible that the market can offer good surprises. Golan says that after last year’s brutal fourth quarter, investor concerns about the trade war with China and the Fed’s rate increases seem to be abating, at least for now. If rates increase at a slower-than-expected pace, or trade talks with China prove fruitful, there could be some upside for the stock market. “Growth stocks typically do better than value stocks in a slowing economic environment,” he adds.

From Amazon To Zoetis

Ricci and Golan run a portfolio of 30 to 40 growth stocks drawn mainly from the fund’s benchmark, the Russell 1000 Growth Index. Their investment time horizon is three to five years, although it can sometimes be longer or shorter than that.

The fund’s sector allocations and average market capitalization are not radically different from those of its bogey. But the fund is far from being a benchmark hugger, as many large-cap funds tend to be. The portfolio’s forecast one-year earnings growth rate is substantially higher, and its fortunes are driven by far fewer stocks. The top 10 holdings account for nearly half of the fund’s assets.

Those stocks, and the rest of the portfolio, are a mix of some of the usual suspects in growth stock portfolios as well as a good number of lesser-known ones that fly under some radar screens. “We go beyond the Amazons of the world to large-cap names a lot of people haven’t heard of,” says Ricci. “Our alpha comes from stock selection, not sector bets.” That difference has helped put the fund in the top 8% of its Morningstar large-cap growth category over the last three calendar years, the top 5% over five years and the top 25% over the last 10 years.

Better-known names in the fund include Microsoft, the fund’s largest holding. At the end of December, it accounted for 8.36% of the fund’s assets, well above the 6.3% weighting in the benchmark. Other familiar names, such as Amazon, Abbott Laboratories and McDonald’s, also have an above-benchmark weighting in the fund.

Microsoft was added to the portfolio in 2014, and despite its size remains an innovative force in the industry. Golan is particularly optimistic about prospects for the company’s Azure platform, which offers a growing roster of cloud-based services. “Many companies are deciding to outsource their data center needs to Microsoft’s cloud service, so this is an enormous area for growth. A lot of small and midsized businesses have trouble keeping up with the growing threat of hacking. With Azure, they can hand over handling security requirements to Microsoft.” Over the long term, he believes, this new line of business will help Microsoft achieve consistent, low-double-digit earnings growth.

Another familiar name in the portfolio, Intuit, is the business and financial software company known for its TurboTax and QuickBooks products used by consumers as well as small and midsize businesses and accountants. The introduction of TurboTax Live last year offers software users consultation with a tax specialist for an additional fee. Golan believes the stock is undervalued and that analysts are focusing too much on slow growth in tax filings rather than earnings potential from a new revenue stream.

“Intuit is a high-quality company that is driving revenue and earnings through innovation and the ability to lock in customers to a service for many years. It understands the consumer better than the competition. We believe the company has the potential to deliver strong double-digit earnings growth over the next five years.”

In addition to such well-known names, the portfolio is peppered with less-well-known companies that have bigger footprints here than they do in the benchmark. One of them, Zoetis, an animal health-care company, is the leader in animal health therapeutics and vaccines for both livestock and companion animals. The company’s recent earnings growth has been driven largely by strength in its pet segment. “This is an overlooked name with a diverse, high-quality product mix in an industry that is not impacted by insurance issues or government regulation,” says Ricci. “The company is benefiting from a rising global population that is eating more animal proteins and owning more pets.”

Monster Energy, another company whose presence in the fund is far greater than it is in the benchmark, competes with Red Bull in the energy beverage category. The stock underperformed the market in 2018 for a number of reasons, including investors’ concerns about the company’s tighter profit margins and rising aluminum and freight costs.

Golan says Monster Energy’s global distribution agreement with Coca-Cola is a big plus. Even though the latter company has retained the right to introduce its own energy drink, he thinks there is plenty of room for both products to thrive as the segment expands in developing markets such as China and India. He’s optimistic that, once panic about the trade agreements subsides, aluminum costs could come down as well.

The William Blair managers may leave out certain industries or emphasize others within a sector. For example, the consumer discretionary sleeve of the portfolio has no traditional retailers because of the fund’s concerns about competition from online retailers. Zoetis is another untraditional play, because even though it’s a major component of the health-care sector, it specializes in the care of animals rather than people. Because the fund is so concentrated, just one stock that the managers consider the most promising may represent a particular industry.

That is the case with defense industry giant Raytheon. The company has reported strong business results and better-than-expected revenue forecasts for 2019, but is struggling along with other defense industry stocks because of worries about possible U.S. defense budget cuts and concerns about the possible impact of new projects on profits. The William Blair managers added to the stock’s position in the fourth quarter of 2018 and continue to believe Raytheon, which has less cyclical and more diversified revenue streams than its peers, is well positioned for sustainable growth. “Raytheon goes up and down with other defense stocks and follows perceptions about the defense industry,” Ricci says. “The group’s short-term fortunes often ride on the latest Trump tweet about defense spending.”