This year’s record-setting market swings may cause even the most rational of investors to feel like they’ve lost their balance, leaving them vulnerable to counterproductive decisions. How can advisors help clients gain a solid footing and stay focused on long-term goals? Findings from recent research into investor sentiment show where clients may be the most vulnerable. Armed with insights from behavioral economics, we can help clients remain resilient during extreme market stress and economic uncertainty. Communication is key, trust is critical.

Headlines Shouldn’t Drive Portfolio Decisions

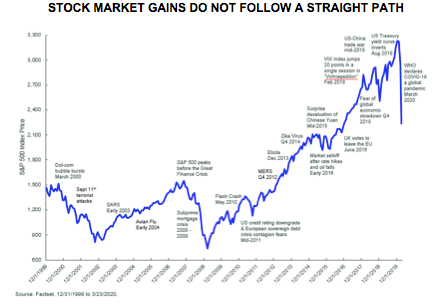

History shows that investment returns do not follow a straight path, but investors who focus on the downturns may lose sight of the upturns. Behavioral economics suggests that investors tend to experience twice the amount of psychological pain from losses compared with the psychological pleasure from gains.

Maintaining an asset allocation that is in line with a client’s willingness and ability to bear risk is a cornerstone of financial advice. However, reinforcing the fundamentals of portfolio diversification and regular rebalancing sometimes isn’t enough to settle their nerves during periods of extreme market turbulence.

Volatility can test even the most steadfast of investors’ confidence in their portfolios. This year’s market swings have led some investors to make decisions that directly conflict with their reasons for investing; others are left with a general sense of unease or feeling disengaged. Even when markets are operating smoothly and the economy is robust, downside risk can stoke anxiety. This is evident from research State Street Global Advisors conducted in late 2019 that revealed:

• Only 36% of investors believed they were prepared if the markets were to take a downturn and the value of their investments declined.

• Investors’ top five concerns included the rising costs of healthcare, potential investment losses, protecting current level of wealth, rate of return in the stock market and rising inflation.

• Only 29% of investors reported that they use their financial advisor as encouragement to help stay on track during market volatility.

Has investor sentiment changed significantly in the four months since this research was conducted? New research from State Street Global Advisors indicates some decline in optimism, in the four months between December 2019 and March 2020. The average investor seems to be balancing some personal optimism with general market pessimism:

• The percentage of investors optimistic about their financial future over the next 12 months declined from 88% in December 2019 to 71% in March 2020

• The percentage of investors optimistic about the country’s economic outlook in the next 12 months has fallen from 47% to 32%; an

• The percentage comfortable with the highs and lows of financial markets has dropped from 49% to 36% during this period of time.

We can help investors navigate these tumultuous times by providing emotional guardrails. Disregarding the emotional component of decision-making only undermines the advisor’s ability to help investors endure difficult times. Instead, taking the time to understand and empathize with investors’ emotions will enable more productive conversations and reinforce healthier decision-making.

To help clients become more effective and knowledgeable investors in all market cycles, advisors should:

• Discuss the concepts of risk aversion and loss aversion with them to demonstrate how these can bias decisions.

• Review risk budgeting concepts like opportunity cost and risk-adjusted return, to support more intentional decision-making.

• Frame decisions in a relative context and connect that to the financial life—the intersection between things that matter and the things we can control—to reinforce a thoughtful buy/sell/hold discipline.

• Discuss current events within a broader historical timeframe to illustrate how past market declines can help us look at current events more rationally.

Further, to balance the emotion quotient (EQ) and the intelligence quotient (IQ) in investment decision-making to help clients achieve suitable risk levels and meet long-term goals:

• Demonstrate empathy, listen actively and show patience during the decision-making process. Ask open-ended questions. Discuss what’s important to them before bringing up what you think is most relevant.

• Look for opportunities to tailor the investment solution to personal circumstances and align emotional constructs (such as family, security and independence) as a force for action.

• Review the downside protection plan when emotions are running high—talk about what to do, or what not do, if there is a sustained downturn.

Irrational Behavior Is Commonplace, Even Among The Smartest Investors

Emotion occupies a powerful position in investment decisions. It drives human behavior. However, all of the rational financial discussions in the world won’t propel an investor to their goals if they are not aware of where their emotions may come into play.

Periods of volatility are a good time to meet with clients to review their overall financial situation. This is an opportunity to review whether they are on track and to discuss optimization if needed. Decisions framed within the client’s overall financial plan may help to keep them feeling engaged and more confident. Even if markets continue their ups and downs and milestone events are canceled, clients can become more resilient, adapting to volatility today and beyond.

Brie Williams is head of practice management at State Street Global Advisors.