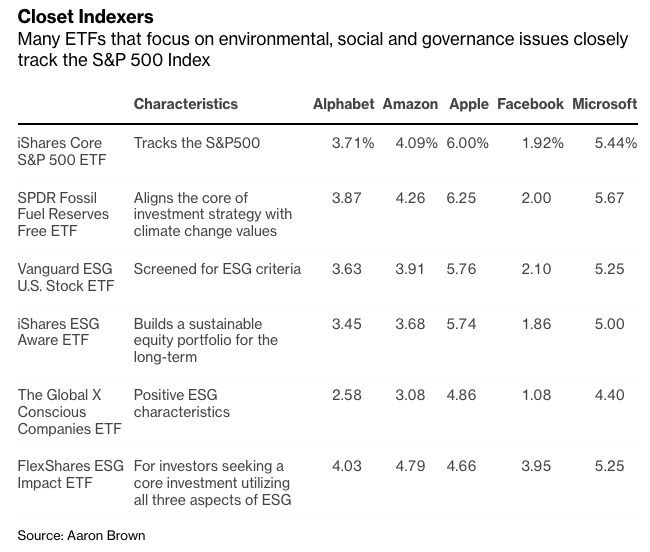

Want to align the core of your investment strategy with climate-change values? Or build a sustainable equity portfolio for the long term by focusing on environmental, social and governance goals? A variety of ESG exchange-traded funds have made these and other promises. But as the table below shows, they mostly hold the same large capitalization technology stocks as the S&P 500 Index, represented in the top row by a popular ETF with a miniscule 0.03% expense ratio, in similar weights. (The idea for this column was suggested to me by a former student, ETF executive Phil Bak.)

Not only are the portfolios similar, but performance is nearly identical. The Vanguard ESG fund has a 0.9974 correlation to the S&P 500 fund since inception in September 2018, which is higher than most index funds have to their benchmarks. A correlation of 1 would mean the two funds run perfectly in sync.

Instead of putting $10,000 in the Vanguard fund, you could put $9,948 in the S&P 500 fund, and $52 in a long/short fund that bought a bit more of some stocks and shorted small amounts of others so the combination of the two funds had precisely the same holdings as the Vanguard ESG fund. The ESG fund charges $12 per year in expenses, while the index fund charges $3. The extra $9 in fees is really paying for the $52 “active share” fund, an annual expense ratio of over 17%!

The other ESG funds charge similar outrageous fees for tiny adjustments to the S&P 500. FlexShares charges 0.32%, which works out to 16% on the active portion of its portfolio. Conscious Companies charges 0.43%, but has a lower S&P 500 correlation, so is a relative bargain at only 11% for its active portion. SPDR charges 0.20%, or 18% on the active portion. ESG Aware is the second cheapest on raw fees at 0.15%, but its sky-high correlation of performance with the S&P 500 means you’re paying more than 20% on the active share.

There are three main reasons to consider ESG funds. The first is that you think these are the best long-term investments because they are based on sustainable, socially beneficial business models and overseen by diverse, wise and empowered directors. But moving 0.25% of your portfolio weight in or out of Apple Inc. isn’t going to do much to your long-term investment risks. If your fund has more than 0.99 correlation with the S&P 500, it won’t save you when oil companies, polluters, sellers of toxic products and companies with entrenched boards fail. And paying fees of 10% to 20% per year for the active share portion of your ESG fund would overwhelm any likely value anyway.

Another issue is that these funds are all managed by the same people—and the same types of people—who manage other investments. Whatever opinions these people have about long-term sustainability are incorporated in standard funds. BlackRock Inc. thinks it’s more virtuous than the average S&P 500 company, so in its own ESG fund the company accounts for a 0.53 percent weighting, compared with a weighting of 0.33 percent as a member of the S&P 500. The money manager is one of the largest percentage overweights in the fund. But it’s not the financial industry in general that’s virtuous; Blackrock underweights competitors Charles Schwab Corp., Berkshire Hathaway Inc., Goldman Sachs Group Inc., Bank of America Corp. and JPMorgan Chase & Co. Wells Fargo & Co. has a zero weighting. Are BlackRock’s analysts and managers the people you want to trust to reflect your ESG opinions?

The second reason to buy ESG funds is the opposite of the first. You want to reduce the cost of capital of good companies, and force up the cost of capital of bad ones. This means worse performance for you, but hopefully a better world for everyone. But the tiny weight adjustments in these ESG ETFs won’t matter to companies.

The third reason is an expression of virtue and a signal to corporate managers. Even if it makes no financial difference, some investors prefer not to profit from things they disapprove of, and want corporate managers to know they care about the environment, society and governance, not just profits. But it’s hard to see how 6.25% versus 6.00% versus 5.75% weight in Apple Inc. has much virtue or sends much of a signal. I’ll bet any virtue or signal of buying these funds is less than the effect of donating the extra $9 to $74 per year in fees on a $10,000 investment to a good charity.

Not all ESG ETFs and mutual funds are closet indexers, but true ESG funds generally come with higher fees and definitely come with more tracking error risk. Index funds give you cheap average performance. It’s hard to save the world by being cheap and average.

Aaron Brown is a former managing director and head of financial market research at AQR Capital Management. He is the author of The Poker Face of Wall Street. He may have a stake in the areas he writes about.