Market risks come in three flavors: recession risk, economic shock risk, and risks within the market itself. So, what do these risks look like for April? Let’s take a closer look at the numbers.

Recession Risk

Recessions are strongly associated with market drawdowns. Indeed, 8 of 10 bear markets have occurred during recessions. As I discussed in this month's Economic Risk Factor Update, right now the conditions that historically have signaled a potential recession are not in place. Although growth may well have peaked, the economy is still growing—with healthy job growth and high levels of consumer and business confidence. As such, economic factors remain at a green light.

Economic Shock Risk

There are two major systemic factors—the price of oil and the price of money (better known as interest rates)—that drive the economy and the financial markets, and they have a proven ability to derail them. Both have been causal factors in previous bear markets and warrant close attention.

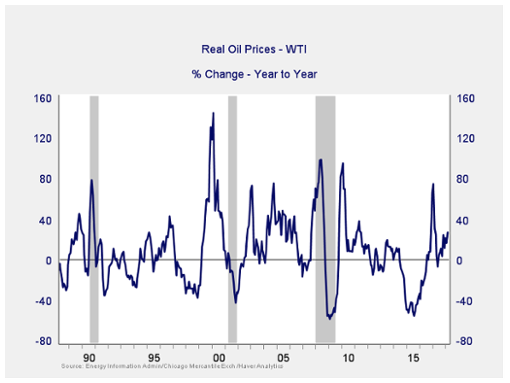

The price of oil. Typically, oil prices cause disruption when they spike. This is a warning sign of both a recession and a bear market.

As we saw with the price spike in 2017, a quick spike—it did not appear to reach a problem level and was short lived—is not necessarily an indicator of trouble. The subsequent decline also took this indicator well out of the trouble zone. Although prices have started to rise again, that rise is still modest and may be topping out, suggesting that the risks from this indicator are not yet material. Overall, while rising, risks from this indicator are not immediate, so it remains at a green light.

Signal: Green light

The price of money. I cover interest rates in the economic update, but they warrant a look here as well.