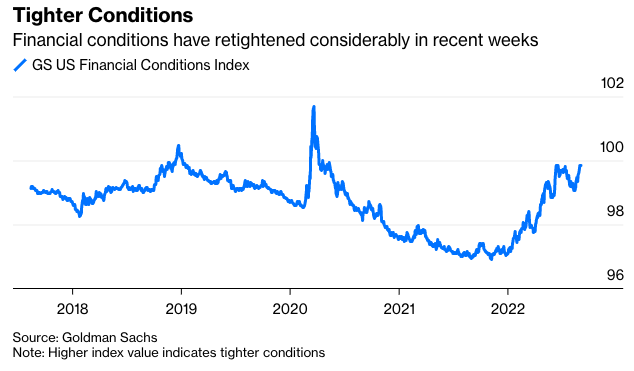

Financial conditions have tightened in the past three weeks, with stocks dropping, corporate credit yield spreads widening and mortgage rates rising back to almost 14-year highs. If the data continues to show inflation is moderating, it could be enough to help convince Federal Reserve Chair Jerome Powell and his central bank colleagues to only institute a modest interest-rate increase when they meet in two weeks—with one big caveat.

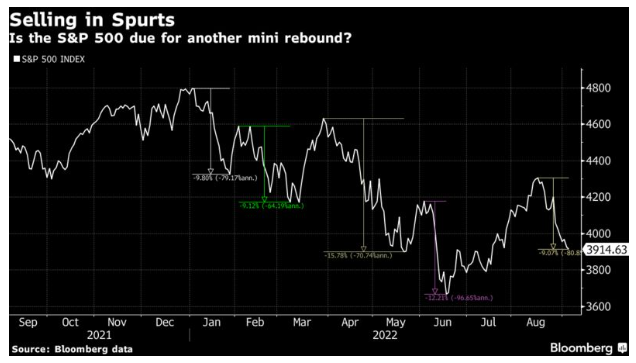

In order for that to happen, investors would need to suppress their obsession with “buying the dip.” The S&P 500 Index is now 14 trading days and 9.2% into its fifth mini-drawdown of the year. The first four lasted from 10 to 36 trading days and zapped 9% to 16% off the benchmark’s value from peak to trough. So, this slump is already within the range at which a brief reversal is possible, if not necessarily imminent. Will traders poke the hornet’s nest before the Fed’s September 20-21 policy meeting?

Measures of financial conditions track more than just equities, but stocks have been the most visible source of defiance as the Fed has tried to curb demand to tame the highest rates of inflation in four decades. Monetary policy works in part through financial markets, as the combination of higher borrowing costs and lower asset prices make consumers and businesses less inclined to spend. Although the Fed doesn’t explicitly target financial conditions, members of the rate-setting Federal Open Market Committee keep a close eye on them: “I certainly was not excited to see the stock market rallying after our last Federal Open Market Committee meeting” in late July, Federal Reserve Bank of Minneapolis President Neel Kashkari told Bloomberg’s Odd Lots podcast last week.

Conditions have been heading in the Fed’s desired direction lately, helped along by a nudge from Powell. At his Aug. 26 speech in Jackson Hole, Wyoming, he made a point to push back against most of the bullish narratives that had been sustaining risk assets, arguing that even in the face of a slowing economy, the central bank had no intention to cut rates anytime soon. Federal funds futures now imply that the central bank will push the upper bound of the target rate to 4% by February from 2.50% currently, and even if it starts to reverse course, may only cut rates by a paltry 25 basis points in 2023. As for this month, the debate is centered on whether the Fed will raise rates by 50 basis points or 75 basis points. Futures imply a three-quarters likelihood the central bank will choose the latter.

Whether the Fed has tightened monetary policy enough depends on how you conceptualize financial conditions. Goldman Sachs Group Inc.’s GS U.S. Financial Conditions Index has headed back toward the tightest levels of the year, helped by the increase in 10-year Treasury yields. On the other hand, Bloomberg’s United States Financial Conditions Index has tightened but remains much looser than early July. The Goldman Sachs index gives considerable weight to 10-year yields, while the Bloomberg index emphasizes credit spreads and ascribes more importance to stock-related components. Either way, the Fed has to like the trajectory.

It’s mostly technical drivers that could attract equity investors and potentially make Powell’s decision easy. In other words, stocks have gone down enough that there are bound to be some short-sellers who don’t want to leave their profits at risk and fast-money traders who see bargains. That doesn’t necessarily become a problem for the Fed unless the whole thing snowballs, as it did in July and August, and real money starts to see the rally as something more durable. What are the factors to watch? Here is a sampling:

• The 14-day relative strength index—a user-friendly momentum indicator that signals when assets and indexes may be “overbought” or “oversold”—is nearing the key level of 30 that indicates the latter.

• The S&P 500 has a “key support” level at around 3,900, as my Bloomberg Intelligence Chief Equity Strategist Gina Martin Adams and Senior Associate Analyst Gillian Wolff pointed out Friday. (This means that trading patterns suggest that some investors thought these levels were a good buy earlier in the year, so maybe they’ll feel that way again.)