It seems hard to believe, but it was only 16 days ago that the U.S. stock market was at record highs. It has since fallen more than 25%, marking the fastest time between a new high and a bear market in history. The old record was set in 1929, when it took 42 days over the course of September and October of that year to drop into a bear market. It is never good when the market is breaking a record set in 1929!

Ironically, it’s a lack of panic over the expanding coronavirus pandemic that is driving the selloff. The declines are being compounded by government officials who still refer to Covid-19 as “just the flu.” More specifically, this is President Donald Trump’s problem, for he thinks this way and believes there has been a giant over-reaction. That attitude came across in his Oval Office address Wednesday night.

The problem is that the too many, including the government, have prioritized the economy and stock market over life. Hitting quarterly numbers are more important than slowing the rate of infections. The market collapse is a signal that this is the wrong approach and, if not reversed now, will end badly. In other words, to stop the rout in markets, start protecting the health-care system and making sure it doesn’t get overwhelmed even though it likely means a painful economic stop in the developed world. Markets are pricing in this inevitability.

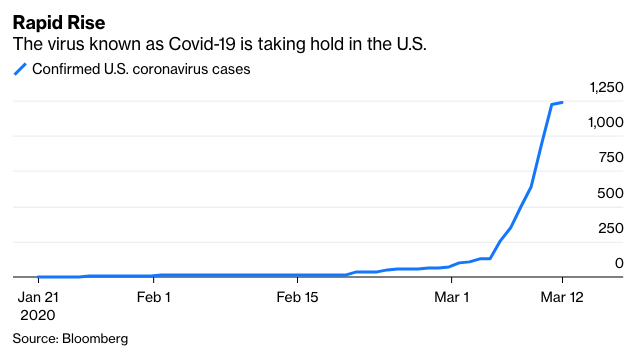

That starts with making sure there are enough hospital beds to accommodate the sick. The U.S. only has about 2.8 such beds per 1,000 people, according to Dr. Liz Specht, the associate director of science & technology at the Good Food Institute. About 65% of those beds are occupied at any given time. She goes on to explain that if the virus is allowed to continue to double every six days in the U.S., as it has other countries, the U.S. will run out of available hospital beds to treat the truly sick, which amounts to about 10% to 15% of all infections, in May.

So, the market is saying that it is imperative that the government institutes protective measures to slow the spread enough that the health-care system can handle what is sure to be an increased caseload. This means canceling mass gatherings such as sporting events, social distancing, travel and public transportation restrictions, as well as widespread business and school closures. Quarantines may also be necessary.

One of the more underappreciated developments concerning China’s efforts to slow the growth in virus infections there to zero is that the harsh measures implemented caused tremendous economic, psychological and emotional damage on the country. Even now, there is concern the virus has only been suppressed, and not eliminated, which is leading to reluctance to fully restart the economy. And even when that happens, China may be left with enough long-term damage that will make returning to a pre-virus economy tough to recapture.

Economists are now debating about whether the shape of the looming U.S. economic recession and recovery will look more like a “V,” “W,” “U,” or “L.” The betting now is on a “V,” which implies a short recession and rapid recovery. But if anger and a new call for the de-globalization of supply chains takes hold, that hoped for “V” could quickly become an “L.” This is what the equity markets seem to be signaling with its rapid plunge.

If hospitals become overrun and physicians are forced to decide who to save and who to let die, the outcry will be a “culture of greed” that prioritized the economy and stock market over life. This will make investing a painful endeavor for years to come. If, however, everyone that needs a hospital bed gets one, then the lasting damage will be mitigated, and the market has a much better chance to recover to the old highs.

Although markets are clearly pricing both a decline corporate earnings and a contraction in gross domestic product, their real worry is long-term damage from a poorly constructed response that continues to place economics over life.

This article was provided by Bloomberg News.