Ali Motamed, manager of the Invenomic Fund, doesn’t fear market downturns. In fact, he seems to relish them.

“The reaction of many long-only investors to a market slide is to hold their foreheads in their hands and wait for the carnage to be over,” says Motamed. “For us, it’s an attractive and fun time.”

This cheeriness in the face of adversity is rooted in the 41-year-old manager’s conviction that down markets should be mined rather than feared. “We believe that we can make money on our investments without taking on big market risks, and that we can take advantage of security mispricing on both the long and short side,” he says.

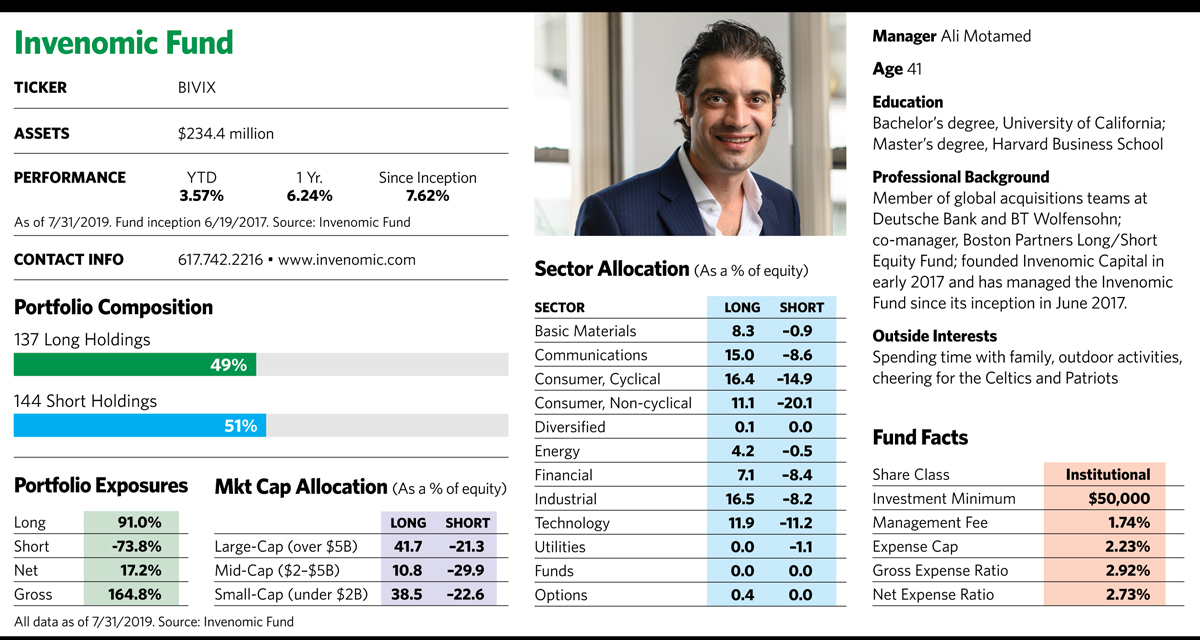

Unlike most mutual funds, the Invenomic Fund employs an active short-selling strategy for individual securities in its portfolio. In its two-year history, its net long allocation (the percentage of long positions minus the percentage of short positions) has ranged from around 17% to almost 38%, depending on where Motamed sees the best prospects for grief or prosperity. He makes decisions about allocations to both sides of the portfolio by looking stock by stock, rather than by making projections about where the market is headed. The goal is to use short selling to make money for investors, as well as to hedge away some market risk.

The strategy has worked well for the fund thus far. Since its inception in June 2017, its risk-reward profile and especially its risk-adjusted returns have eclipsed those of most Morningstar peers in the long/short category according to David Snowball, co-founder of the website Mutual Fund Observer. “Their approach is distinct, their strategy is disciplined and their manager is well-tested,” Snowball recently wrote. “On the whole, investors anxious about both preserving capital and generating positive returns in turbulent markets should consider putting the fund high on their due diligence list.”

Before founding Invenomic Capital in early 2017, Motamed co-managed the Boston Partners Long/Short Equity fund and was Portfolio Manager of the Year in Morningstar’s alternatives category in 2014. He will be a featured speaker at this year’s Inside Alternatives & Asset Allocation conference in Philadelphia on October 29, along with Charles Clough of Clough Capital.

Shorting Opportunities

The danger with long-short funds, of course, is that in long-term bull markets with little volatility—the same conditions that have prevailed for most of the past decade—long-only portfolios capture much better returns. But Motamed believes a number of elements are in place that could make short selling a winning strategy now.

“This has been the longest bull market in history, and valuations suggest this is not a good time to be long-only,” he says. “Investors need to stop looking in the rearview mirror and avoid being wedded to long-only strategies.”

He notes that during mostly bullish times investors tend to forget that downturns can be long and brutal. It took over eight years for stocks to recover losses from the bursting of the dot-com bubble in 2000. In fact, there have been at least two periods lasting 15 years or longer in the last century where the stock market did not deliver positive returns.

While he is not predicting a similar scenario now, Motamed believes the opportunities for short sellers are expanding. “As we look at valuations, growth rates, interest rates, political unrest and central bank influence, we believe that the dramatic swings of the last three years will become more common moving forward,” he observes.

Amid the rise in passive investing, many stocks included in popular indexes rise to the top even though their financial characteristics aren’t all that impressive. Eventually, those stocks fall when the market tumbles and investors become less enamored of them. Those are the kinds of securities Motamed likes to short. On the other hand, some companies that aren’t a prominent part of an index fall off the radar screen despite having much stronger financial profiles. Those may become candidates for the long side of his portfolio.

Passive investing has also created some predictable market distortions that could hurt passive investors but work to the advantage of short sellers. For example, Motamed has observed that when a company moves from one popular small-cap index into a mid-cap index, its stock will go down an average of 12%, largely because passive asset allocators tend to devote a smaller piece of the pie to mid-caps than they do to small caps.

Another less-recognized advantage of a long/short fund is its ability to buy stocks when the market is down. When that happens, the fund generates cash through its short positions and can use it to establish long positions at lower prices. By contrast, long-only funds may need to sell stocks at unfavorable prices to meet redemptions and thus they have more limited room for buying in down markets.

Hedge Fund Alternative

The Invenomic Fund is one of a growing number of alternative mutual funds in a category that covers a broad range of offerings using strategies beyond long-only investing. They typically have higher expense ratios than long-only mutual funds for a variety of reasons. Many of them are smaller, leaving fewer investors to shoulder costs. They may also employ strategies that are expensive to execute, and trade securities more frequently than a typical fund.

In the Invenomic fund, the expense ratio is 2.73% for institutional class shares, which have a $50,000 investment minimum.

While that may be high for the mutual fund world, long/short funds are much more liquid and less expensive than the traditional hedge funds they mimic. Hedge funds usually charge a performance fee of 20%; also, they allow only quarterly redemptions and have high investment minimums of $1 million or more. They are furthermore less transparent, and less regulated, than mutual funds.

Yet both hedge funds and alternative mutual funds are designed to produce different returns than traditional asset classes do, particularly during difficult times in the stock market. They also aim to reduce overall portfolio risk and mitigate the effects of severe drawdowns in the equity market. Motamed thinks an 80/20 split between long-only equity funds and the Invenomic Fund would be a good strategy to achieve those goals, generate strong returns and add an element of capital preservation to portfolios.

“New Growth”

Motamed believes that “old growth” companies in industries such as mobile devices and software are becoming tired and vulnerable to a downturn. Many of them have already penetrated vast markets, so their growth prospects are limited. And after a 10-year market that has favored growth stocks, the shift to value will intensify. “We’re in the late stage of a massive growth rally, but for many of these companies the growth story has already played out,” he says.

The fund’s large short position in Apple last year illustrates that point. Despite the tech giant’s huge market cap and deep analyst coverage, the company faces a mature marketplace for smartphones, numerous competitors and revenue growth driven largely by price increases rather than volume growth. By the end of the year, the stock had fallen substantially after a disappointing earnings report.

On the other hand, Motamed believes prospects for “new growth” companies, such as those involved in artificial intelligence and self-driving vehicles, have much better prospects for the future. At times, investors may simply be overlooking strong stocks with attractive valuations. That was the case with HCA Healthcare, the largest hospital group in the country, which was added to the fund in 2017. Even though the company had a great balance sheet, strong free cash flow, high profit margins and other favorable characteristics, it wasn’t on a lot of buy lists. The fund exited the long position in the company at the beginning of 2019 after it had appreciated substantially.

“We are not interested in buying stocks of companies in broken situations that are looking for change,” he says. “We want great, proven companies selling at great valuations.”

Typically, the fund has around 250 to 300 positions on both the long and short side. To winnow down their 4,000-stock universe, Motamed and his team of analysts use quantitative screens. For the long side of the portfolio, they like to see companies with reasonable valuations, strong cash flow and solid balance sheets. For the short side, they look for companies with weak cash flow and evidence of overpricing and inflated earnings. “There is a lot of misplaced enthusiasm and greater fool buying in the market,” he says. “About one-third of stocks in the Russell 2000 universe don’t even make money.” He says the holding period for stocks can vary anywhere from a few months to a few years.

Motamed, who doesn’t talk to corporate management because the pictures they paint are often rosier than their numbers suggest, says the process is grounded in research and very data-driven. “At one point a few months before the fund launch, our computers froze when we were using the Bloomberg database because we’d hit the data limit,” he recalls with a combination of amusement and pride.