Municipal-bond investors are dumping holdings at an unprecedented rate as the worst slump in decades for US state and city debt rattles this traditionally staid asset class.

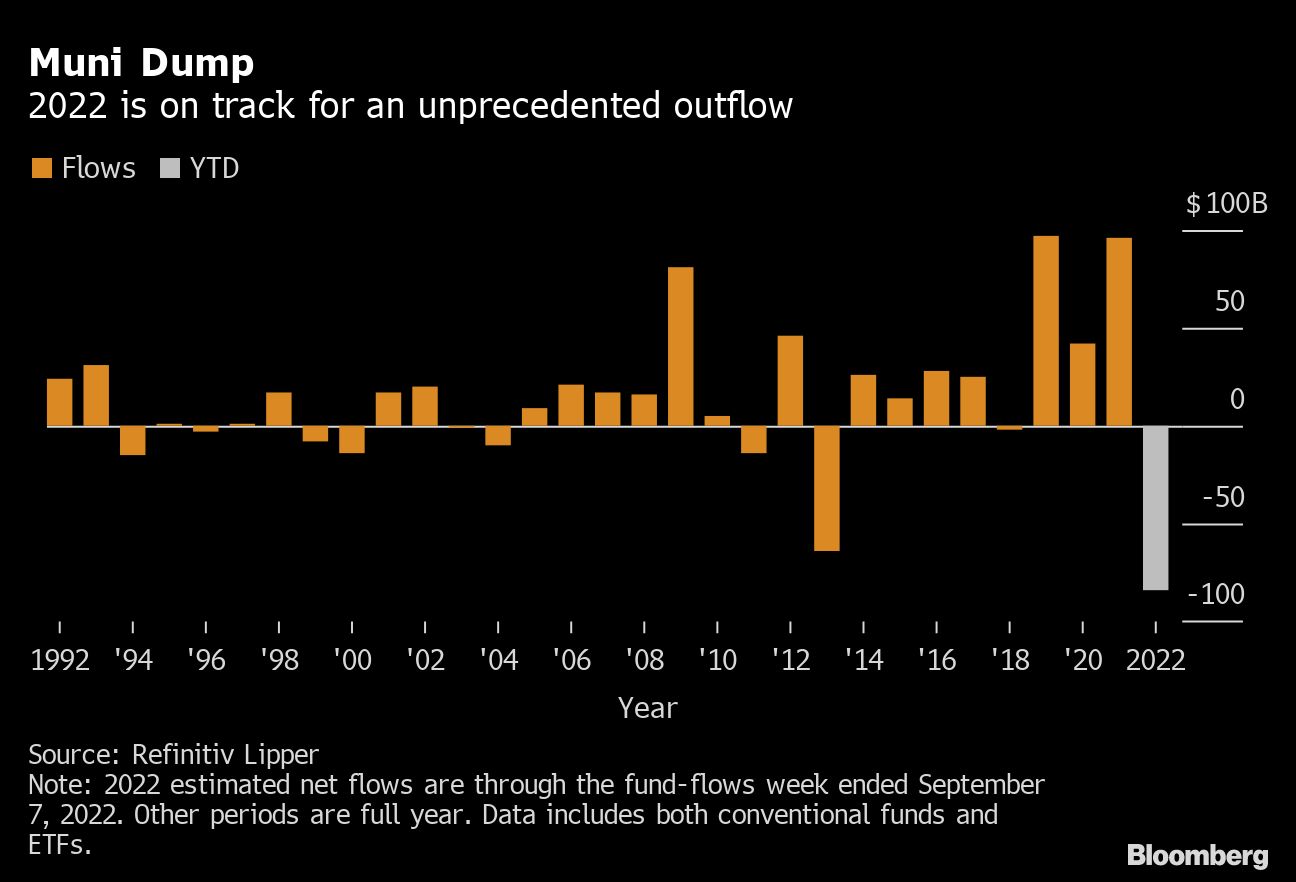

The tally of outflows this year from muni-focused bond funds and exchange-traded funds has reached $84 billion, on track for the largest annual net redemption since at least 1992, according to Refinitiv Lipper US Fund Flows data.

Such a cash exodus is a hallmark of poor performance periods for the muni market, which is dominated by individual investors who tend to get spooked by negative returns. And with the Federal Reserve signaling further aggressive interest rate increases to combat soaring inflation, there may be no end in sight to this year’s turbulence, which has pummeled the whole fixed-income universe.

“Going into the fourth quarter, I still see volatility on the horizon,” said Kathleen McNamara, senior municipal strategist at UBS Wealth Management. “The markets are still concerned about whether the Fed is going to make a policy mistake.”

Munis are on track for their worst year since 1981, with a loss of 9.5% in 2022, according to Bloomberg index data. They’re still beating the broader US bond market, which is down almost 12%.

Investors pulled about $1.1 billion from muni-bond mutual funds during the week ended Wednesday, the fifth straight period of withdrawals, Refinitiv Lipper data show.

The cash flood is affecting most corners of the market -- the muni holdings of banks, insurance companies, mutual funds, closed-end funds and households have all declined this year, according to Fed data through June.

The tumbling demand and rising interest rates have had broad repercussions, including roiling the borrowing plans of the nation’s municipalities. Issuance of long-term municipal debt is down 12% relative to last year’s clip, data compiled by Bloomberg show. To be sure, Citigroup Inc. expects higher volume of tax-exempt bond sales in the coming months.

McNamara at UBS points out a silver lining to the turbulence: With many investors unloading, it could present a buying opportunity for others. Benchmark yields are testing their highest levels of the past five years, after soaring from record lows seen in 2020.

“It’s a good thing if you’ve been sitting on the sidelines and you’ve been waiting,” she said.

Rate-hike anxiety was also prevalent in 2013, which holds the current record for largest full-year outflows at $64 billion, said Mikhail Foux, a municipal strategist at Barclays Plc. In his view, the outlook for the rest of the year is still hazy with the rate trajectory in flux.

The Fed is expected to deliver another jumbo rate increase next week and investors will also be looking for clues to the central bank’s path in the months ahead.

“A lot depends on rates, I think the worst is behind us in terms of outflows,” Foux said.

This article was provided by Bloomberg News.