The Big Picture

This year already appears more promising for investors after the difficult environment experienced in 2018 for most asset classes, as volatility often creates opportunity. That said, increasing concerns in financial markets around slowing global economic growth, international trade and political uncertainty have created a more tenuous backdrop for many sectors in 2019.

After hiking short-term interest rates four times in 2018, the Federal Reserve seems prepared to keep increases on hold at least through early 2019. Although hard economic data has continued to be solid, the muted inflation environment provides leeway for the Fed to wait and see how the economy evolves. Chairman Powell affirmed that there is no preset path for rates and that the Fed will be nimble in shifting its policy if necessary to keep the economy strong. This encouraging dialogue is a positive for financial markets broadly, and a calmer interest rate environment is especially supportive for fixed income assets.

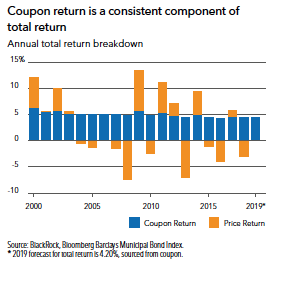

Given the steeper municipal yield curve relative to Treasuries, investors can still benefit from taking on duration (interest rate risk). Additionally, investors who buy and hold muni bonds throughout the year will be better positioned to capture coupon income, which we expect to make up the majority of total return in 2019.

Supply Is On Our Side

Although markets tend to focus on gross supply numbers, what actually influences market performance is net supply—i.e., the total amount of new issuance minus the total amount of debt that is called, refunded or reaches maturity. Net supply turning negative generally provides a powerful tailwind for muni bond performance.

On the whole, 2018 was a net negative supply year and we expect the same in 2019. Forward supply estimates are only marginally higher than last year, and Congressional gridlock is likely to impede the approval of government spending on infrastructure projects. Additionally, the heavy selling among banks in 2018 ahead of tax and accounting-related changes, which added significant “shadow supply,” should be nearly played out at this point.

After back-to-back years of disrupted seasonal trends, we foresee a more traditional year coming up, which likely means more predictable patterns around both supply and demand. From a strategy perspective, we would lean toward longer duration (i.e., taking more interest rate risk) heading into periods of net negative supply, and shorter duration when supply is poised to outpace demand.

Don’t Discount Retail Demand

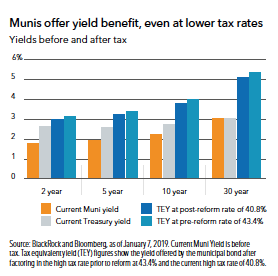

Demand for municipal bonds is supported by the multiple benefits of investing in the asset class—the most obvious being the tax advantage. The recent tax reform has had little impact on the tax equivalent yield provided by municipal bonds versus Treasuries. As April approaches, it will become more evident that individuals have experienced little, if any, tax cut after the State & Local Tax Deduction (SALT) curtailment is factored in. This effect will be especially pronounced in high tax states including Connecticut, New Jersey, New York, Massachusetts, Maryland and California.

Another driver of demand for munis is a renewed appreciation for the stability of the asset class as the prolonged period of ultra-low volatility is clearly behind us. Municipals tend to have higher credit quality and provide consistent levels of income over time. While price return is sensitive to macro trends across fixed income markets, coupon return has historically provided a stable portion of total returns in the municipal market.

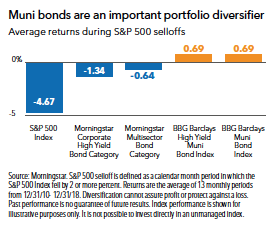

The S&P 500 Index lost more than 4 percent in 2018, while the S&P Municipal Bond Index posted a 1.36 percent gain. The negative correlation of municipal bond and equity returns underscores the importance of muni bonds as a portfolio diversifier and a ballast to equity and equity-like risk.

Credit Perspectives: What To Watch In 2019

State and local government sectors could come under pressure this year if the U.S. economy slows enough to constrain revenues from sales and income tax receipts. State governments may be forced to rein in their spending, most likely impacting Medicaid and K-12 education, and pension underfunding remains a significant concern. At the local level, property tax receipts tend to perform relatively well during a slowdown; however, local governments often bear the brunt of state spending cuts. We prefer revenue bonds over general obligation bonds as the latter can be vulnerable to risks stemming from state and local budget negotiations.

The high yield municipal market may experience a period of minor spread-widening due to an influx of supply as Puerto Rico returns as an investable name. Upon finalization of the bankruptcy process in mid-January, the restructuring of the commonwealth’s government debt and sales tax bonds, known as COFINA bonds, will result in an exchange whereby holders of defaulted debt will receive new bonds. We expect Puerto Rico bonds will gradually regain acceptance with traditional market participants over time. Any weakness caused by the supply increase could create attractive buying opportunities in the short term; however, certain credits that were bid up while Puerto Rico was absent from the market may experience a longer term negative impact. Broadly, we believe high yield muni bonds are an important contributor to income generation in a diversified portfolio.

Hospitals and health-care providers are facing headline risk due to the Affordable Care Act (ACA) having been ruled unconstitutional at the end of 2018. If the ruling is upheld, the loss of Medicaid coverage and consumer protections for many patients would have a negative effect on these industries as the potential for bad debt increases and patient volume declines. No immediate impact to ACA exchanges is anticipated in 2019 as the Act remains in effect throughout the appeals process, which will not conclude until 2020 at the earliest.

Investment Ideas For 2019

1. Stay invested. Sitting in cash means missing out on coupon payments. A buy-and-hold approach to municipal investing provides better potential for total return, which we expect will be made up largely of coupon return versus price return throughout this year.

2. Position tactically. Seasonal patterns should be more true to form this year. Increase duration ahead of negative net supply periods and reduce duration when supply is poised to outpace demand.

3. Diversify opportunistically. Consider high tax states including New Jersey, New York, Massachusetts, Maryland and California, where the SALT curtailment will have the largest effect on individual tax payers.

4. Don’t dismiss high yield. We wouldn’t recommend an overweight currently given uncertainty around Puerto Rico issuance, but we believe some exposure can be beneficial for income generation within a well-rounded portfolio.

Peter Hayes is head of the Municipal Bonds Group at BlackRock. Sean Carney is head of municipal strategy at BlackRock.