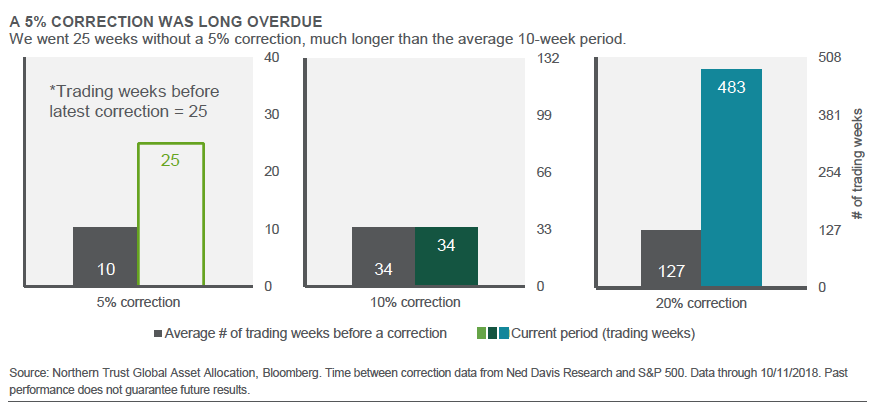

Central bank policy is usually a fixation of markets, rarely more so than during a tightening cycle. Recent commentary from Federal Reserve Chair Jerome Powell, along with that of regional bank presidents, has increased market volatility as investors worry that the Fed may go too far. As shown below, the recent 5 percent drop in equity prices was overdue and is therefore not unusual. Is the Fed’s move the primary cause of the market volatility, as President Trump has suggested, or are other worries driving investor behavior? Diagnosing specific catalysts behind individual corrections is challenging, and made more difficult by the increased trading done by rules-based investors. In our strategy meetings this month we highlighted two material changes that we think will drive markets over the next year.

The first change is that we now believe U.S. monetary policy will be restrictive in one year. Recent Fed commentary indicates that it thinks something on the order of an additional 125 basis points of tightening is in order, due to the strength of the economy. Fed funds futures currently incorporate roughly 75 basis points of this over the next 18 months, indicating some skepticism about the Fed’s ability to raise rates to this extent. If our expectation for slowing growth through 2019 comes to pass, that may help bring the Fed’s plans closer to market expectations. But the current rhetoric indicates a strong preference to continue the rate hikes, which we think will be harmful to growth and investor risk appetites – especially in emerging market economies. Other major central banks are sticking to their scripts, and the European Central Bank remains on track to end its asset purchase program this year but not raise rates until later in 2019.

The second change is our downgrade of emerging market political leadership from strengthening to weakening. China remains the epicenter of emerging markets, and the government is easing policy to support domestic growth. Recent policy changes such as cutting bank reserve requirements and income taxes will provide some offset to slowing growth. The Chinese government finds itself in a tougher place as a lonely voice for globalization at a time where countries are becoming more wary of the terms of trade – be it through the One Belt, One Road initiative or taking advantage of multilateral trade agreements. In the wake of this, China may need to recalibrate its approach to global affairs as it faces more resistance from the United States and possibly other countries over time.

Interest Rates

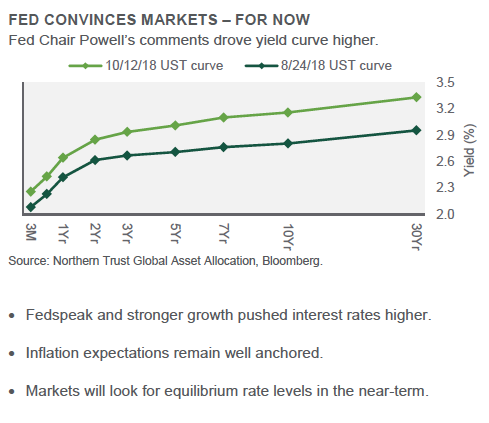

A more hawkish Fed – punctuated by Powell’s comments that “we’re a long way from neutral” – combined with firmer economic data and market technicals to drive U.S. interest rates higher. Fundamentally, higher interest rates have been driven more by higher growth expectations than inflation concerns. The 10-year U.S. Treasury yield increased by 0.35 percent over the past two months; higher real yields – generally driven by the growth outlook – represented 0.33 percent of that increase, while rising inflation expectations represented the other 0.02 percent. Technical pressures, including less overseas buying (as currency hedging costs increased) also played a part.

We believe U.S. interest rates have found a new, higher channel for now – but with risks of a return to lower levels over time. Economic growth over the past two quarters has been strong, but we expect this growth to slow as the effects of earlier-year tax reform begin to wear off and weaker growth in China and Europe pulls the United States down too. We worry the Fed is too anxious to extrapolate recent strong growth into the future – and views it as a green light for further rate hikes. If the Fed keeps pushing, longer-duration yields will eventually reverse course – and the Fed will be forced to as well.A more hawkish Fed – punctuated by Powell’s comments that “we’re a long way from neutral” – combined with firmer economic data and market technicals to drive U.S. interest rates higher. Fundamentally, higher interest rates have been driven more by higher growth expectations than inflation concerns. The 10-year U.S. Treasury yield increased by 0.35 percent over the past two months; higher real yields – generally driven by the growth outlook – represented 0.33 percent of that increase, while rising inflation expectations represented the other 0.02 percent. Technical pressures, including less overseas buying (as currency hedging costs increased) also played a part.

Credit Markets

The recent rise in interest rates, combined with our expectation for continued credit fundamental strength, has increased our attraction to taking on credit risk in the portfolio. We most recently increased our allocation to investment grade fixed income by 3 percent, leaving us now 1 percent overweight. This combines with our continued 8 percent overweight to high yield.

The leveraged loan market’s growth has created some investor concern. Much of the growth has been driven by collateralized loan obligation demand. These buyers are more concerned about the loan characteristics fitting their model than about the credit and covenants. As a result, “covenant-lite” deals have grown substantially, which typically reduces default risk but also reduces recovery values. This loan growth has resulted in “first lien” obligations becoming a greater proportion of corporate capital structures – also potentially reducing the recovery value of high yield bonds. These concerns will be more valid when the credit cycle turns. But fundamentals suggest the cycle is still going strong, with interest coverage ratios high and default rates falling. Further, the loans market has grown into a separate asset class. An increasing number of loan issuers only issue in that funding market – not the high yield market as well. Per the chart, 59 percent of the leveraged loan market is completely separate from the high yield market. The loan market’s effect on high yield deserves consideration, but should be kept in perspective.

Equities

In the context of a more neutral risk appetite, we have further reduced our exposure to global equities. We now sit with a neutral allocation across the developed equity markets and a 3 percent underweight to emerging market equities. In the U.S., we are incrementally concerned that the market has not fully contemplated the potential tariff impact on those segments dominating returns year-to-date, including technology. In addition, pressure on (record) profit margins manifesting from higher input costs (commodities, logistics, labor and – more recently – interest rates) will limit the ability of earnings growth to materially outpace slowing revenue growth in 2019. Notably, valuations have improved this year as U.S. stocks have failed to keep pace with strong 2018 earnings growth, helping to provide downside support.

Meanwhile, we remain cautious on the tactical outlook for emerging markets. A seemingly resolute Fed – intent on further increasing rates – combined with the potential for growth in China slowing further as tensions with the United States persist, suggest a more guarded positioning. U.S. investors also are concerned with the Fed’s optimistic outlook, which has pushed rates – and stock market volatility – higher.

Real Assets

The fortunes of global real estate (GRE) and global listed infrastructure (GLI) relative to global equities are largely tied to the interest rate environment. GRE and GLI materially lagged the global equity markets this year through the month of May as interest rates moved higher. After a brief respite, during which interest rates stopped going up and both GRE and GLI pulled closer to even with global equities on the year, the relative performance pressures re-emerged. Recently, GRE and GLI have been better behaved – somewhat surprising given the recent spike in interest rates. This very recent outperformance may indicate two dynamics at play: GLI/GRE sentiment has finally bottomed out after a prolonged period of underperformance and investors outside the fixed income markets may be attributing the recent spike in rates to technical – or other temporary – factors.

We remain strategically allocated to global real estate and listed infrastructure for their diversification properties, but believe it will take some time for rates to settle into their new channel and, therefore, are not looking overweight these asset classes at this time. Meanwhile, we also remain tactically neutral natural resources. Expectations for slowing global economic demand should – all else equal – cap commodity price appreciation; but continued geopolitical dynamics – including the recent tensions between the United States and Saudi Arabia – support our strategic allocation.

Conclusion

As the Fed looks to move its policy toward neutral and beyond, we’ve also moved the overall risk level of our tactical asset allocation recommendations to neutral. This month, we lowered our recommended equity exposure by 3 percent, reducing U.S. equities by 2 percent and adopting a neutral position, while further reducing our emerging markets exposure to a 3 percent underweight. We’ve added the proceeds to investment grade bonds, reflecting our preference for corporate credit over equities and also our view that interest rates are unlikely to move materially higher from here. It is important to look at our recommendations from an overall portfolio perspective. While our high yield overweight is considerable, we view it as a risk asset, and it is the least risky of the risk assets. We think both the fundamental and technical picture for high yield looks attractive, including the current yield-to-worst of 6.5 percent.

In our base case scenario of a Slowdown to Channel Growth, we think corporate credit should perform well. In the recent uptick in market volatility, investment grade credit spreads have not budged and the spreads on high yield bonds are not showing signs of credit stress. In fact, our fixed income desk sees multiple buyers in the market today for every seller of a high yield bond. Our base case scenario of Rising Monetary Policy Disconnect highlights the contrast between the Fed’s plans and the market’s views on growth and financial market risks – which is putting some pressure on risk assets.

We think the upcoming U.S. midterm elections will garner a lot more attention in the media than in the financial markets. The Trump administration’s signature initiatives (tax cuts and regulatory relief) have been done primarily outside of the traditional legislative process. Additionally, investors aren’t expecting any significant legislation out of Congress, so a change in control within Congress in the midterms is unlikely to lead to much of a change in the economic or financial markets outlook. Instead, investors will be better rewarded by paying attention to our risk cases of Emerging Market Contagion and Central Bank Tunnel Vision. The near-term risks for emerging markets have increased in the wake of populist politics, and are complicated by the state of U.S.-China relations. Central Bank Tunnel Vision could lead to unwarranted interest rate hikes, which will bite into growth and financial markets. An uptick in the growth outlook for 2019 and beyond would be just the antidote to this risk case.

Jim McDonald is chief investment strategist at Northern Trust.