About 10 years ago, the roots of financial wellness (FW) stemmed from the need for HR departments in corporate America to better educate and engage their workforce.

Without financial wellness, productivity suffers, and employees spend too much time dealing with personal financial issues; not doing their job.

Fortunately, much has changed. HR departments have accepted help from the financial services industry to help drive better outcomes. The goal: better financial and health literacy—and happier, and healthier employees who are better equipped to manage the health and financial risks.

Over the last few years, financial wellness has spread its wings beyond employee engagement. It’s become a hot topic of conversation for independent financial advisors, especially those serving the sweet spot of pre- and recent retirees, who often engage advisors after age 50.

“Wellness is an ongoing process, not just a destination,“ says Steve Gresham, managing principal of The Execution Project. “As advisors, your clients both want and need help staying the course. We are working to bring the industry together to tap into digital tools that can help advisors better meet the needs of their clients.”

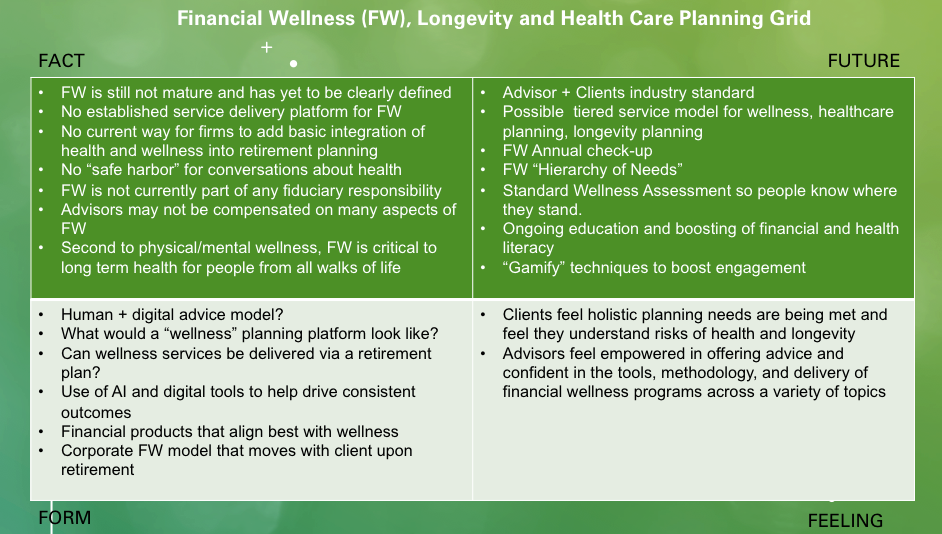

For FW to be effective for advisors and clients, it may be instructive to help simplify this complex topic into a grid (see below) and focus on key issues and questions. The four quadrants of the grid are: fact, form, feelings, future, and feelings.

Facts lay out the current state of FW; form looks at FW delivery platforms; future aspires what holistic FW might be; and feelings convey emotions for both clients and the advisory community.

According to Frank McAleer, Next Chapter Advisory Council member and senior vice president of wealth planning at Raymond James Financial, defining and designing a FW service offering has become increasingly important to the financial services industry. “Simply stated, it all relates to our clients and helping them achieve the ultimate goal of holistic planning efforts that being ‘peace of mind.’ Most clients want the assurance that all life event possibilities have been accounted for and that they are adequately prepared. Lastly, it’s vital that these solutions be delivered to clients in a succinct and efficient manner.”

The Next Chapter Advisory Team Has Begun Work On Four Financial Wellness Projects

Over the next year, Next Chapter* seeks to engage the financial services community and bring alignment along six vitals projects. The first effort centers on financial wellness—and weaves in the all-important aspects of longevity planning and health-care planning.

Four Possible Projects:

1. Seek an industry standard definition of “financial wellness” and create a bullet point checklist for the key issues clients need to understand to be fully prepared for longevity—Financial Wellness—A Client’s Guide.

2. Create a hierarchy of financial wellness—a parallel to Maslow’s hierarchy—ranging from the basics to the most advanced needs and issues.

3. Work with advisory firms (mid to large, across the U.S.) to provide a best practices case studies of how financial wellness is delivered.

4. Craft a DIY financial wellness checklist/annual check-in.

Seeking Support From The Advisor Community

Finally, we know we can’t take this on alone. We need your help. To build alignment across the industry, Next Chapter seeks use for:

• Alignment and integration of financial wellness. Who is including health with wealth?

• Service model solutions for incorporating health-care planning and wellness

• Scoring of client conditions in health and wellness topics

• CFP and “fiduciary” interpretation of advisory role in wellness and health

• Delivery of wellness information and tools in the retirement plan market

• Product efforts and offerings, e.g., Raymond James “Longevity Wheel”

Raymond James’ McAleer believes that achieving a FW industry standard offering that is easy to understand, access and implement will require teamwork and, above all, alignment. “We are successfully working alongside competitors and product providers within the financial services industry to ensure continuity for the past year within the Next Chapter initiative. For example, it has been gratifying to work with potential partners, such as Eversafe in the caregiving and elder fraud prevention arena. We have done this successfully at Raymond James as we continue to build our stable of longevity planning resources.”

If you or others at your advisory firm can provide details on any of the above scenarios based on your work with existing clients, please contact Steve Gresham at [email protected].

“The broadening of our dialog with clients to include all topics of financial wellness will allow us to reframe our value proposition to clients away from driving investment results to ensuring that their entire financial lives are managed effectively. Let’s do this together,” says Gresham.

*Working for the greater good, a group of more than 30 industry leaders built Next Chapter—a think tank/take action team focused on retirement. It’s sponsored by the Execution Project, Financial Advisor and the Money Management Institute, and we are working on behalf of the MMI’s 180+ member companies and FA’s 200,000+ advisors.

David Conti is a New Hampshire-based writer, editor and content marketing consultant. Previously, he was editor at Fidelity Wealth Management and now writes about personal finance, retirement and wealth topics.