Our political leaders of both parties seem to have agreement that our military forces need more than just a facelift. Some serious allocation of funds has been included in the budget to the tune of hundreds of billions of dollars.

The investment community from institutions to hedge funds and individual investors are tempted to cash in on what seems to be a bonanza. We would like to give a word of caution that not all defense companies are created or treated equally. While we believe that many of these companies will benefit from the contracts they already have and the ones they are expecting, we suggest that advisors and investors seek the ones with adequately diversified portfolios that can weather the large fluctuations in revenue resulting from military contracts, which are lucrative, but subject to change as the needs of the end users change.

Companies that do not rely solely on military contracts and have robust and diverse portfolios can maintain high revenue and profitability during the cycles of defense contract droughts. It is important not to forget, however, that companies with highly technical, innovative and unique systems will also continue to do well.

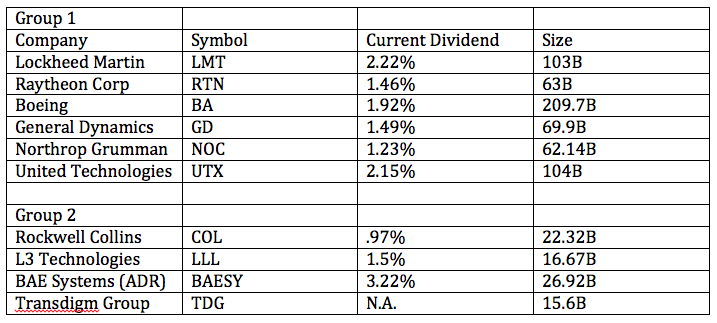

We put together a list of companies which are defense related that will do well in the next few years.

We classified them in two tiers or groups based on size, history and financial strength. We think these two groups will fair well in the next few years, however advisors and investors should do some homework and consult.

Comments By Company

We will limit our comments to the first group, which is the largest and most sought after.

Lockheed Martin (LMT)

The company is a leading designer and manufacturer of military aircraft. It is known for building the finest military aircraft in the world used by over 70 countries to maintain peace through air supremacy. The company is very innovative in the area of energy laser weapon systems. It has the expertise and experience in the areas of advanced beam control with adaptable countermeasure devices to bring down surface-to-air and air-to-surface threats. We cannot imagine future star-wars systems without the innovative designs and applications of the laser energy systems. Expect revenues to rise.

Raytheon (RTN)

Raytheon Company is a technology and innovation leader specializing in defense, civil government and cybersecurity solutions. Founded in 1922, Raytheon provides state-of-the-art electronics, mission systems integration capabilities in C5I (command, control, communications, computing, cyber and intelligence), sensing, effects and mission support services. Raytheon is headquartered in Waltham, Massachusetts.

Boeing (BA)

It is a leading manufacturer of commercial aircraft—manufactures the 737, 747, 767, 777 and 787 liners. It also produces business jets and fighters such as F-15 and F/A-18, helicopters (CH-14, AH-64), guided weapons (Harpoon, joint direct attack munition), satellites, space launch systems and manages the International Space Station.

General Dynamics (GD)

The company showed softness at the end of last year but the recent 5.1 B contract with the Navy helped profitability. It operates four divisions: aerospace, combat system, marine systems, information and technology. The U.S. Government accounts for 60 percent of the revenue.

Northrop Grumman (NOC)

They are a leader in global submarine sensors, which is supposed to expand at a good rate from 2017 to 2025 to a market of over 325 billion. We think this will result in a sizable company price appreciation within that span of time.

United Technologies (UTX)

A diversified company into sectors or industry groups that operate independently and complement each other through the various economic cycles. The businesses are—Pratt and Whitney, which manufactures and services commercial and military aircraft engines; Otis, the world’s largest manufacturer and servicer of elevators and escalators; UTC Climate, which makes heating, ventilation and air conditioning equipment and an aerospace division.

Fraj Lazreg is the creator and lead portfolio manager of the Investors’ Advantage Portfolios.