I. The Issue

Countless surveys and studies have established that many Americans are concerned about running out of money in retirement because people are living longer, and that there is growing recognition that annuities are a critical part of retirement income planning because of their lifetime income characteristic, which can serve as an insurance against longevity. Yet there are few guidelines on how annuities should be utilized in order to achieve the goal of maximizing the income potential of a retiree's retirement savings.

A case study was undertaken to address three questions that would determine the optimal use of annuities for retirement income. The first question addresses how much income can be expected from annuities designed for lifetime guaranteed income; the second question addresses which type of annuities would be best for retirement income; and the third question addresses how much retirement savings should be allocated to annuities to ensure against running out of money in retirement.

This paper summarizes the findings of the study. A detailed report of the study can be accessed on the author’s website www.plenarisadvisory.com.

II. The Case Study

The financial profile of a prototypical single female retiree and a select sample of annuities constitute the data base for this case study, as follows.

1. Retiree’s financial profile:

• Retirement age is 65.

• Total retirement savings is $1 million.

• Initial retirement budget is $80,000 per year, including taxes, and is indexed to increase by 3.5 percent each year for inflation.

• Social security benefit, the only guaranteed retirement income, is $32,032, which is adjusted for age 65 from the current maximum benefit of $34,332 for full retirement age of 66. The benefit is indexed to increase by 2 percent per year.

• Retirement savings are assumed to be invested in the equity market at an average return of 5 percent.

• Any budget shortfall is to be covered by the investment returns of the savings account.

• All retirement financials are projected to age 100 as longevity is at issue.

2. Select sample of annuities.

• The sample annuities include three fixed indexed annuities (FIA), and one deferred income annuity (DIA), which all offer fixed rate income benefits. No variable annuities were included in this study as the income benefits from such annuities are based on market performance which is too variable and unpredictable for income planning purposes.

• The premium amount for all deferred annuities is $100,000.

• The data for the three FIAs were derived from actual policy illustrations identified herein as FIA A, FIA B and FIA C.

• The data for the DIA were derived from the annuity website www.immediateannuities.com.

• Income benefit data for SPIA are included in the study for comparing the relative cost of deferred and immediate annuities. All data for SPIA are also derived from www.immediateannuities.com.

• Income data for the deferred annuities are organized according to three deferral durations: 10-year, 15-year and 20-year.

• Income benefit payout dates are set for age 60, 65 and 70, which are the most common ages for retirement.

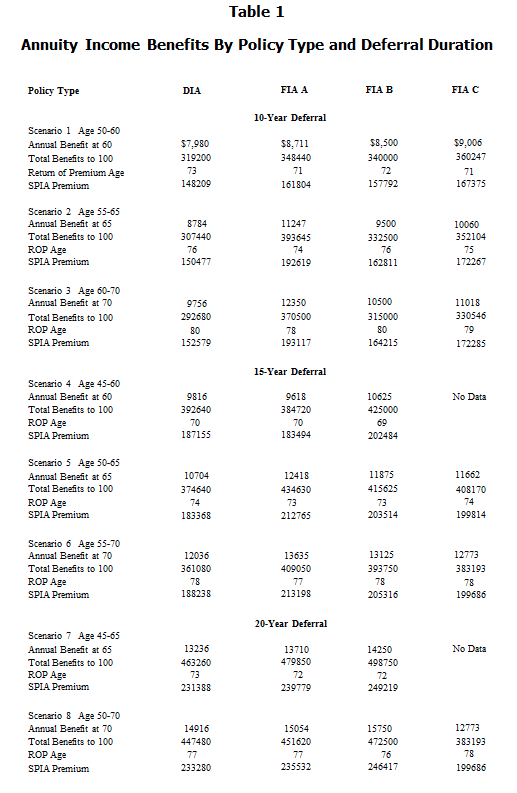

• Given the three deferral durations and the three benefit payout dates, a total of eight benefit scenarios are identified for comparative analysis as laid out in Table 1.

• In addition to income benefits, Table 1 also displays the results for the return of premium (ROP), which is the date by age the retiree can recover the total premium outlay.

III. The Data

Table 1 shows the eight benefit scenarios according to the type of annuity and the deferral duration of the study parameters set forth above. Each benefit scenario exhibits the actual income that can be obtained to date from the annuities included in this study.

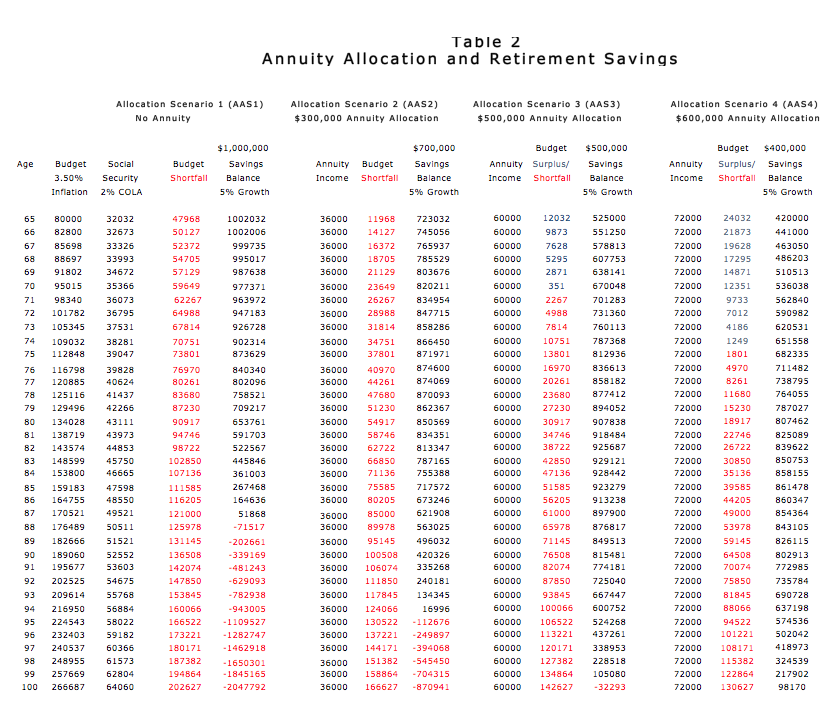

Table 2 outlines four annuity allocation scenarios for assessing the optimal allocation of retirement savings to annuities. Annuity Allocation Scenario 1 (AAS1) shows the outcome of a retirement plan that has no annuity allocation. Annuity Allocation Scenario 2 (AAS2) shows a 30 percent allocation, which is the allocation most commonly recommended by financial advisors. Annuity Allocation Scenarios 3 (AAS3) and 4 (AAS4) denote an allocation of 50 percent and 60 percent respectively to annuities from the retiree’s $1 million savings to demonstrate the impact of allocating a significant amount of savings to annuities.

IV. Findings

1. Annuity Income Benefits As Shown In Table 1.

• The most significant finding is that an average annual income of around $12,000 can be achieved from a $100,000 premium if an annuity is held for 10 to 15 years before withdrawal, which is a payout rate of 12 percent.

• There is a high correlation between deferral duration and income benefits, i.e., the longer the deferral, the higher the benefit. For the same $100,000 investment, a 10-year deferral may lead to a low benefit of $7,980 (Scenario 1), while the highest benefit of $15,750 would require a 20-year deferral (Scenario 8).

• If a retiree plans to retire between age 60 and 70, early planning is necessary to maximize annuity income, which can mean as early as age 45. But the availability of income annuity may be limited before age 45, as demonstrated in Scenarios 4 and 7 where there are no data for FIA C because the minimum policy issue age for FIA C is 50.

• While SPIAs can be purchased for immediate payout, they would cost more for the same benefit as deferred annuities. For example, in Scenario 5 where an annual income of $12,418 can be achieved with a 15-year deferral for FIA A, which is a payout of more than 12 percent, it would take an investment of $212,765 for a SPIA for the same income, which is a payout of 6 percent. So the cost for a SPIA can be twice as much as a FIA for the same benefit.

• There is a high correlation between the commencement of benefit and the time for the recovery of the premium outlay, which is the earlier the benefit claim, the earlier that the premium can be recovered. The recovery of premium means that after the annuitant has recaptured the premium payment through benefit payouts, the remaining income benefits can be considered a free ride on other people's money for as long as she lives.

2. The Best Income Annuities As Shown In Table 1.

• The data clearly show that deferred annuities offer higher income benefits than single premium immediate annuities. As noted above, it can cost twice as much for the identical income benefit for a SPIA as for a deferred annuity.

• Among the four deferred income annuities, FIAs consistently offer higher income benefits than DIAs in all benefit scenarios. This outcome directly contradicts the common belief that DIAs are simpler and cheaper products than FIAs, as the purported lower cost does not lead to better benefits.

• There are benefit variations for the same deferral duration and payout dates among the sampled FIAs. The reason for this is that each FIA has a different benefit structure that determines the benefit payout. FIA A has the best benefit growth for the first 10-15 years which is based on a 7.5 percent compound interest for 10 years and 2 percent for the next 10 years, while FIA B has a 20-year benefit growth schedule of 10 percent simple interest per year. It is therefore important for consumers to know which annuity can offer the best benefit for the expected deferral duration or investment horizon.

3. Optimal Annuity Allocation As Shown In Table 2.

• The data for annuity allocation in Table 2 are based on the results in Table 1 that an average income benefit of $12,000 can be achieved from an investment of $100,000 in deferred annuities with a deferral duration of 10 to 15 years. Accordingly, each $100,000 allocation to annuities represents an income of $12,000 in all allocation scenarios.

• The most notable result from the data in Table 2 is that the more allocation to annuity, the more likely that the savings will last through retirement and beyond. This finding is based on the fact that all retirement savings would be depleted by age 88 under the “no annuity” scenario. The savings would last to the mid-90s under the common advisory of allocating 30 percent to annuities. The probability of having enough retirement income to last through a long retirement to 100 is highest when 50 percent to 60 percent of retirement savings are allocated to annuities as in AAS3 and AAS4.

• The positive outcome of the allocation scenarios of AAS3, and AAS4 is clearly due to the fact that the guaranteed income from annuity and social security exceeds the income needed in the early years of retirement. This result suggests that allocating more retirement savings to annuity effectively preserves the non-annuity investment portfolio for a later date. It also suggests that guaranteed income such as annuity should constitute the primary source of retirement income at the outset of retirement in order not to exhaust a retiree's savings prematurely.

• The surplus of guaranteed income in the early years for AAS3 and AAS4 indicates that retirees can have the confidence of spending during their early “go-go” retirement years without diminishing their ability to have enough savings to last their entire retirement.

• While how much annuity should be allocated to retirement income is an individual decision according to a retiree's retirement goals, the data suggest that AAS4, where the savings split is 60 percent annuity and 40 percent equity investment, appears to offer the best outcome of all scenarios because the savings account has the highest balance at age 100.

• If there is sufficient guaranteed income, which includes annuities, the retiree can maintain the same living standard throughout retirement without exhausting her savings, even taking into account inflation adjustment.

• Higher allocation to annuity also results in the higher probability of leaving a legacy as demonstrated in AAS3 and AAS4 where the savings balance remains positive up to age 100, as compared with AAS2 where the savings allocation to annuity is lower, yet all retirement savings may be depleted in the 90s with no leftover for legacy. Another comparison can be made for the event of the retiree dying at age 85. Under AAS2, there is a potential legacy of $717,572. But the potential legacy of $923,279 under AAS3, or $861,478 under AAS4 is higher. The potential legacy for the no-annuity scenario is the lowest at $267,468. This finding contradicts the common belief that buying annuities for retirement would diminish the likelihood of a retiree leaving any legacy.

V. Implications For Retirement Income Planning

Based on the findings of this study, the following strategies can be employed to optimize the income benefits of annuities.

1. Integrate annuity in a retirement income plan because a retiree will have more income to last her lifetime than it would be the case otherwise.

2. Treat annuities, along with other guaranteed income, as the primary retirement income source, particularly in the early retirement years. It means allocating as much retirement savings as necessary to annuities to cover most or all of the retirement budget. This strategy does not only provide potential surplus income in the early years to enable a good start to retirement, it also serves to delay the use of non-annuity savings for as long as possible, and to allow such savings to grow.

3. Ideally, the guaranteed income should cover the budget requirements for about 10 years as in AAS4, so that the remainder of the savings will need to cover the budget shortfalls for only 20-25 years instead of 30-35 years. This strategy also reduces the risk of a market downturn (a bad sequence of returns) at the inception of retirement.

4. Use deferred annuities as much as possible, as they are more cost effective than immediate annuities. Deferred annuities are often considered to be illiquid with investments being “locked up” for many years. The reality is that if annuities are meant to be retirement income, they should be treated like social security and company pensions, which are illiquid and inaccessible for other purposes.

5. Among deferred annuities, use FIAs which are shown in real cases to offer higher income benefits than DIAs. FIAs are often considered expensive and complicated. Yet the higher income benefits from FIAs indicate that such belief is more myth than reality, since the supposedly cheaper DIAs do not lead to higher benefits.

6. Utilize the fixed rate component of the FIAs for benefit growth, as it is guaranteed for income planning. As noted above, FIA A offers a 7.5 percent annual compound growth for 10 years, while FIA B offers a 10 percent simple interest growth per year for 20 years. These fixed rates compare favorably with the equity return forecast by industry experts that indicates a potential 4-6 percent return in the future. (Christine Benz, Experts Forecast Long-Term Stock and Bond Returns, 2019 Edition, January 10, 2019. www.Morningstar.com)

7. Using deferred annuities means planning early, which may involve 10 to 20 years before retirement. Planning early can also lead to a "buy early and use early” strategy that enables a retiree to recover the premium outlay sooner from benefit payouts, which is an antidote to people's concern about losing money from investing in annuities because of early death.

8. Select different policies for different investment horizons to maximize income benefits, as some policies offer better benefits for a 20 year than a 15 year horizon, as is the case with FIA B in this study because it allows the annuity to grow in benefits for 20 years.

9. Look for annuities that offer death benefit and return of premium provisions in the event an annuitant has not enjoyed all the benefits of her investment due to death, as such annuities are effectively a no-loss retirement income vehicle that can enhance a consumer's confidence in using them for retirement income.

10. Prioritize retirement income over legacy concerns. Many retirees reject annuities in the hope that there will be some leftover from their retirement savings at death if they do not invest in annuities. As the data show, a retirement income plan without annuities will actually result in savings being depleted early, and there is a real danger of running out of money during retirement if equity investments underperform.

11. The variability in income benefits among the different types of annuity means that consumers must shop carefully for the right kind of annuity, and not to rely on common beliefs that may be more myth than reality.

VI. Conclusion

In recognition that annuities can mitigate longevity risks, this paper seeks to develop a framework for optimizing annuity income benefits that will enable a retiree to have a successful retirement without outliving her savings.

The overarching finding of this study is that, along with social security and employer pensions, annuities should be considered part of the guaranteed income that serves as the primary source of income for retirement at the outset of retirement, and that sufficient savings should be allocated to annuities to ensure that retirees would not deplete their savings prematurely.

As a matter of strategy, early planning is the key to optimizing the use of annuity for retirement income. Early planning means purchasing annuities 10 to 20 years prior to retirement with available retirement savings. Deferred annuity is unquestionably the way to go for getting the most income benefits for the least amount of savings.

In a nutshell, the best retirement income strategy that utilizes annuities is “plan early, buy early and use early.”

In an article by David Blanchett on the cost of retirement, he states that retirement is the "most expensive" purchase one can ever make. (David Blanchett, Estimating the True Cost of Retirement, June 20, 2015. www.retirement-insight.com) This is the correct conclusion on the issue of retirement income. We need to approach the issue with the objective that we must “buy” enough income to last our retirement. Annuity is front and center in the effort to secure our retirement, as there are few viable alternatives.

Eva L. Levine, JD, CFP, RIA, is the principal of Plenaris Advisory based in San Jose, California. The firm offers comprehensive financial planning in the San Francisco Bay Area.