Slipping markets have investors understandably nervous about when it will turn. Tariffs and trade wars, volatility that’s back with a vengeance and the recent election season aren’t making it any easier.

Other than flat fixed income or moving to the sidelines altogether—what, if anything, can advisors do to help clients weather the current market madness?

Equity options are one of, if not the, fastest growing investment products available on the market today.

While they have been around for decades, over the last 15 years, the daily volume of options traded has increased by an average of 12.6 percent per year.

The potential benefits of incorporating equity options into a portfolio have long been tainted by the perspective that options trading is “risky.”

Working with specialized money managers, advisors can implement options strategies that will add shock absorbers to a portfolio. While no investment strategy is without risk, options are primarily used as a vehicle for risk transfer—if employed correctly, they can transfer risk out of your portfolio and smooth out your investment returns while generating additional income at the same time.

The BXM Index

The CBOE Buy-Write Index (BXM) is the primary benchmark for covered call writing strategies.

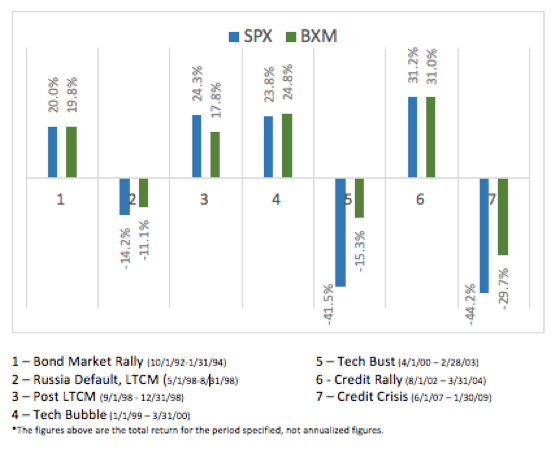

Since its inception, the BXM has performed well compared to the S&P 500, and it has done so with less volatility.

While the S&P 500 would be expected to outperform buy-write strategies in an aggressively rising market, when the markets are trading sideways or selling off, the BXM has an opportunity to outperform the S&P 500.

The premium generated by writing covered calls can create additional cash flow when markets are flat, as well as provide a buffer against downside movement in a falling market.

The strategy is a viable choice for investors looking to generate income on their portfolio of equities, while also reducing volatility and padding downside market exposure.

Covered Call Premium

The premium generated from writing covered calls not only reduces portfolio volatility and losses in a falling market but can also generate meaningful income especially when coupled with a portfolio holding dividend paying stocks.

A significant portion of the yield generated from covered calls stems from the historical tendency for Implied Volatility (as measured by the VIX) to exceed realized volatility.

This is a good thing for the seller of the option, who is being compensated for selling volatility and thus receives more than they would have if Implied Volatility was lower.

Covered Call Strategy

When used correctly, covered calls can play four key roles in a portfolio.

• They can generate additional cash flow on equity holdings when markets are trading flat, down or calmly up.

• Selling covered calls also provides a buffer against downside movement and can be viewed as a limited hedge on the underlying stock. If the stock sells off, the premium received on the covered call lessens the impact to the portfolio.

• Writing covered calls is a proven way to reduce overall portfolio volatility.

• Lastly, covered calls retain the potential for some capital appreciation.

Tailoring Covered Call Strategy For Concentrated Holdings

Another use for covered calls is to generate additional cash flow/income on a concentrated stock position, or even utilizing calls to start paring the position back.

Take, for example, an investor who has inherited a sizable holding of one stock from a relative. They may want to keep the securities for reasons ranging from avoiding capital gains tax, to an ongoing belief in the company, or even nostalgia for the family member who gifted them the shares.

Writing covered calls on their concentrated holding can generate additional income and provide a buffer in case the shares sell off. It can also be a way for the investor to get “paid” to start paring back their position, by writing covered calls at the money and increasing both the premium received as well as the likelihood of having shares called away.

Covered Calls In Today’s Market

While the market overall has risen significantly in the past two years, performance has widely varied across sectors.

Since the end of 2016, the S&P 500 Information Technology companies have seen a total return of 68.03 percent, while the worst performing sector (Telecom) saw a total return of -4.57 percent%.

Volatility, trade wars, rising rates—each of these factors would, by themselves, make a covered call strategy more attractive relative to traditional equity or fixed income portfolios. When all these factors combine, the effects are compounding.

The equity indices are back to record highs, and while smart to maintain exposure to the upside in a bullish market, we must also be mindful to protect the profits we have already made. Investors should ask themselves if they are properly positioned for the market to flatten or retrace.

Nick Griebenow is assistant portfolio manager for Shelton Capital Management’s separate account program utilizing covered call writing.