As we close out the year, the economy looks to be at a tipping point. Although consumer confidence remains high and job growth has been better than expected, economic trends continue to deteriorate. And unlike the start of 2019—when the trends were favorable despite the worries—the path ahead for 2020 looks less clear.

The course of 2020 depends on how these trends evolve. To be sure, the risk of recession is real. But it’s important to keep in mind that we have been in this situation before during the recovery, only to see the economy pick up again. That scenario remains the base case, for a few reasons.

First, there are signs that the economic news may be improving. Second, despite the economic risks, the political risks are starting to subside. The impeachment inquiry is likely to be resolved in early 2020, as will Brexit and very probably the U.S.-China trade war. If so, the perceived risks would be reduced materially, which will help both the economy and markets. On the policy front, the Federal Reserve (Fed) has been reducing rates, which should create a tailwind that will grow throughout the year. On balance, there is a real possibility that the policy environment will transform from a headwind in 2019 into a tailwind in 2020.

Given these factors, the base case is for continued slow growth through 2020. Corporate revenue and earnings should continue to increase, probably by more than most analysts expect. If growth trends meet expectations and confidence levels remain steady or improve, financial markets are likely to be stable and may appreciate a bit.

Slow Growth Expectations

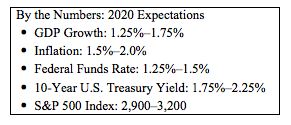

The economy looks a bit slower than it did at the start of 2019. Consumers are still spending, but businesses are investing less. Government spending growth should continue but not accelerate. Trade is not likely to be an additive force and might well end up as a drag. These factors should leave growth slightly slower overall for 2020, at around 1.25 percent to 1.75 percent.

Monetary Policy

The real monetary policy story of 2020 is likely to be that there is no story. With slower economic growth and with inflation around 1.5 percent to 2 percent, the Fed is likely to cut rates further. This move would leave the federal funds rate in a range from 1.25 percent to 1.5 percent by year-end 2020. In turn, the 10-year U.S. Treasury yield would be around 1.75 percent to 2.25 percent. Of course, should a recession occur, the Fed would take a more active stance.

Revenue And Earnings Growth