After an extraordinary year, 2021 looks set to see the return of some semblance of normalcy, should the positive signs over a vaccine for Covid-19 become reality.

This would be welcome for corporate bonds, with continued policy support, search for income and pockets of attractive valuation giving a broadly positive outlook overall.

Added to the potential for vaccines to be approved and distributed, the US election outcome has removed uncertainty and raised the possibility of an economic stimulus package, albeit the size and timing is uncertain. These factors together have at least provided optimism that a far more positive year is in the offing. But there remain questions around both and we expect central banks to remain highly supportive.

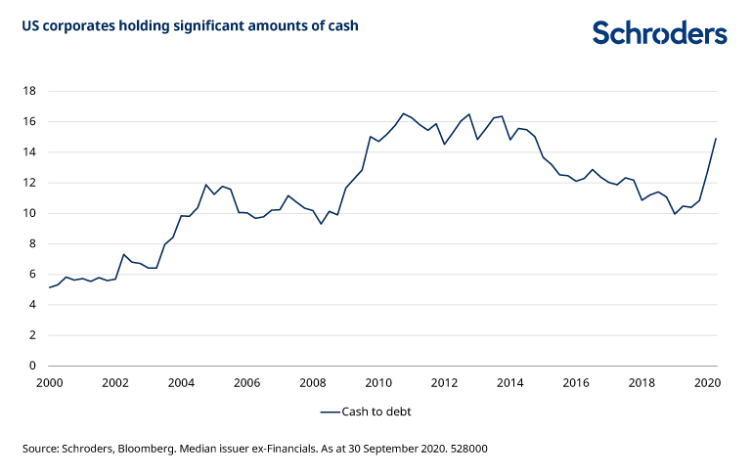

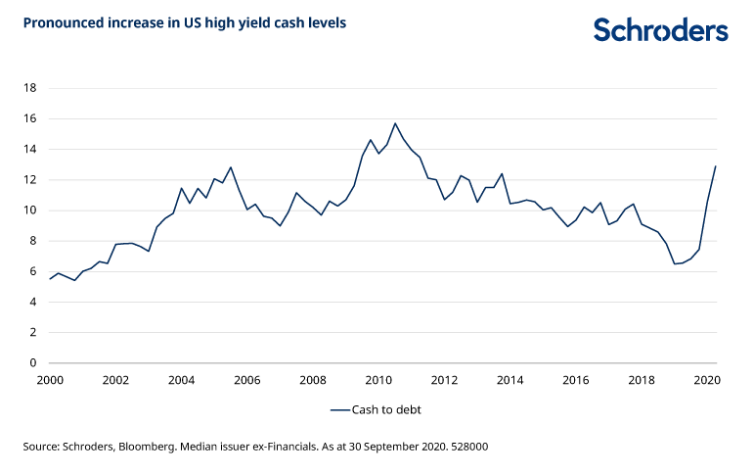

We go into 2021 with corporate debt at record levels. Companies raised huge sums through bond markets in 2020, to ensure they could get through the crisis. Indications are that this has peaked, corporate cash levels have increased, and balance sheets could start to improve.

Some companies will have overreached, however, and it will be important for credit investors to differentiate in 2021.

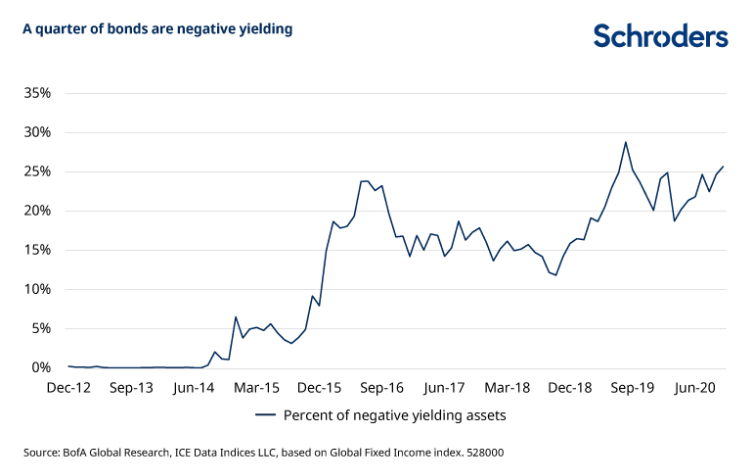

The search for yield will likely remain a theme, with a substantial proportion of global bonds either zero or negative yielding. Credit yields have fallen significantly since March (yields and prices move inversely), in some cases entirely retracing the negative moves seen in the crisis.

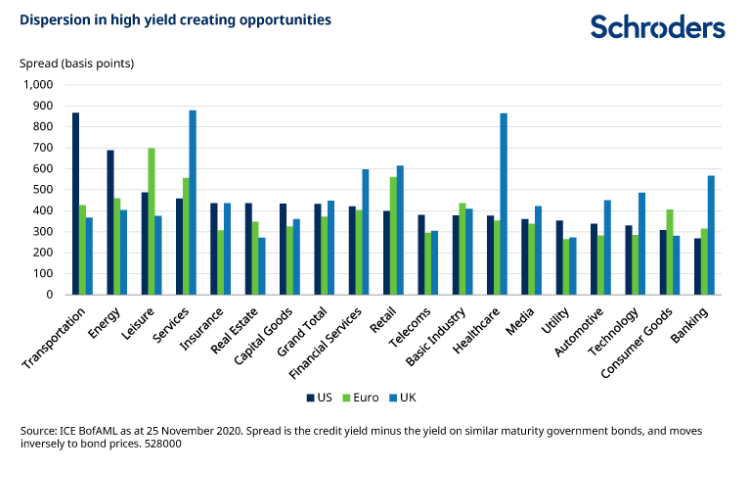

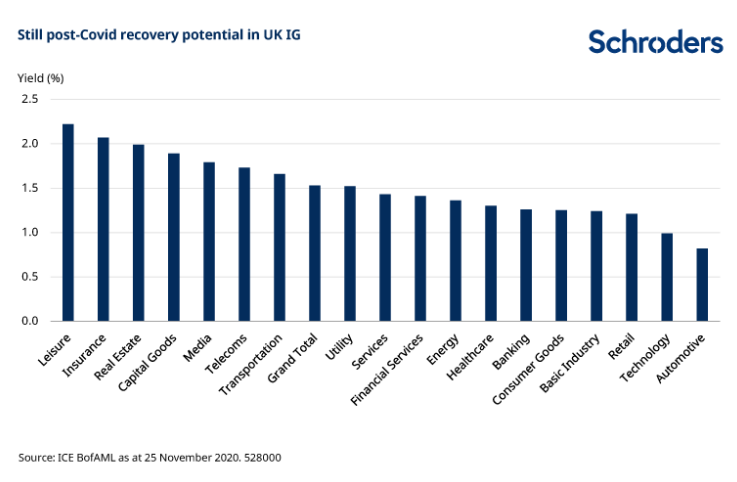

There are still pockets of value though, in all corners of the market, and security selection opportunities due to differentiation in company and sector valuations. Sectors most affected by Covid have potential to further recover. High yield and emerging markets broadly look appealing, but require a judicious approach.

Policy Backdrop Remains Supportive

While the potential for vaccines and a US economic stimulus paint a positive picture for 2021, there remains plenty of uncertainty. With numerous countries still in lockdown, a fragile recovery, unemployment markedly above pre-Covid levels and low inflation, it is likely central banks will continue policy support.

The Federal Reserve is expected to increase its balance sheet, mainly through purchases of Treasury bonds and other financial securities, to the tune of $2 trillion in 2021. This figure is lower than in 2020, but more than double the level seen in any year prior to that.

The expectation is that gradual normalization in the economy and societies will result in moderately higher government yields over the course of the year, but policy measures should limit any upward moves. This will be broadly supportive for corporate bonds.

Julien Houdain, Global Credit Portfolio Manager, said: “The fragility of the recovery at present means central banks need to maintain policy support, which should be helpful to corporate bonds. One of the biggest foreseeable risks is that policy measures are reduced or withdrawn too soon.”

Search For Income

Interest rates and yields have been pushed even lower in 2020. For many investors, the usual income generating options, savings accounts, money market funds or government bonds, offer either negligible or zero income, or even negative yield (which means a guaranteed loss of capital, if held to maturity).

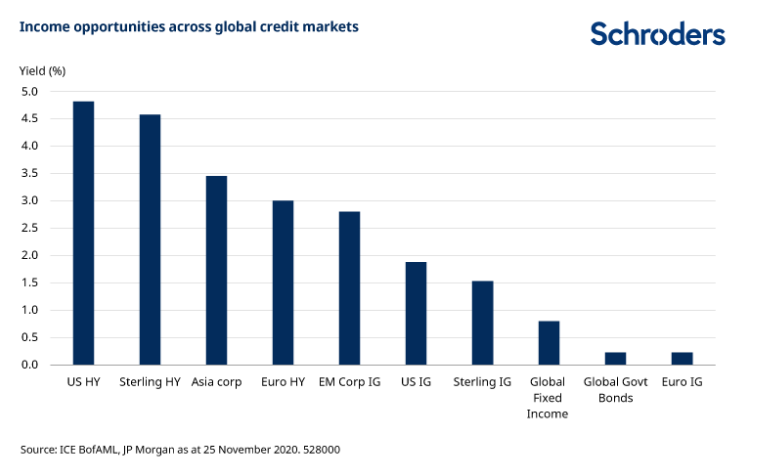

With income opportunities remaining at a premium, corporate bonds should remain in demand. Inflows into investment grade credit since March have been highly consistent. Yields have dropped as the market has recovered, to low levels in some cases, but credit remains a source of income, especially in the context of globally low yields.

Rick Rezek, Global Credit Portfolio Manager at Schroders, said: “We believe the search for yield will push investors out along the risk spectrum, as it has in previous years, and this will benefit investment grade corporate bonds.”

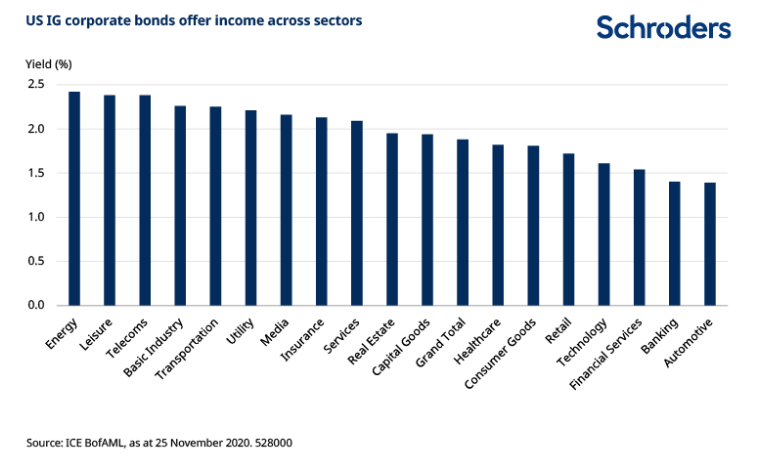

“While yields in certain parts of the global corporate market are quite low, particularly in Europe, other portions of the market such as US dollar do offer higher yields, even taking inflation into account. Positioning, at sector, regional and company level, will be a critical determinant of returns in 2021.”

Pockets Of Value Amid Growth Normalization

While credit has broadly rebounded strongly since March, there are still clear pockets of value. Some sectors have been affected worse than others by lockdowns, and have lagged in the rebound. These could perform particularly well, especially if vaccines are rolled-out quickly.

Martha Metcalf, head of US credit strategies, said: “High yield has the potential to deliver good returns in 2021 from present valuation levels and the variation and dispersion in valuations means there are opportunities to generate returns through security selection. If the development of vaccines enables a normalisation in growth and company revenues, this is a potential kicker, but it will be very important to remain selective and focused on company analysis. In the meantime, many issuers have bolstered their liquidity and are positioned to navigate this challenging environment.”

Angus Hui, Head of Asian and EM Credit, sees a similar dynamic at work. “Asian corporate earnings have shown some recovery from the trough in the first half. There is divergence, however, with investment grade companies generally doing better than high yield. Security selection will be key.”

Solid Base For Improvement In Corporate Fundamentals

The rise in corporate debt to record levels has raised concerns for some. The increase in debt came about largely due to the severity and indiscriminate nature of the crisis. Companies had to ensure they had enough liquidity (literally sufficient cash to cover short-term costs and liabilities). With the help of policymakers this issue has been substantially addressed, though there are still potentially more insolvencies to come, and the large issuance has been readily absorbed by investors.

We think this underlines the need to be selective in 2021. The level of balance sheet debt has now stabilized and companies are mostly sufficiently able to cover their interest payments. Many companies have accumulated cash “war-chests” and cut dividends, and we could see companies start to reduce the level of debt on their balance sheets. Some companies will emerge from the crisis in reasonably good shape, but others may have overreached.

“Company revenues have suffered in 2020, but there have been encouraging examples of company revenues either holding up well in the crisis or rebounding quickly,” said Rezek.

Hui said: “In 2021, credits which are deleveraging (reducing balance sheet debt) and which have sustainable corporate strategies are likely to be the outperformers.”

Security Selection Focus

With the arrival of Covid vaccines, there is potential for 2021 to be a much more positive year for the global economy and we could even see a return to more normal levels of activity. This and other factors should see broadly helpful conditions for credit and financial markets.

Credit markets, across the board, have a good chance to build on the strong recovery seen since March, and there certainly remains some selective value. Covid-affected sectors could regain ground and those more exposed to growth will benefit if the vaccine roll-out goes well. But there are still plenty of question marks and intermittent setbacks are quite likely.

“We should start to see a clearer picture of which businesses will come through the crisis well, some will benefit due to the changes effected by Covid, but some will struggle,” said Metcalf. “With debt at record highs, a selective and discriminating approach will really be key.”

Houdain said: “The market looks suited for security selection. Areas affected by Covid have good recovery potential, there is some notable value in high yield and emerging markets, while we remain positive on longer-term themes such as real estate, technology and sustainability.”

James Molony is a fixed income specialist at Schroders.