Perpetuating Wealth - By Catherine S. McBreen , George H. Walper - 02/1/2008

While having a substantial portfolio of stocks and bonds might be great for your retirement, giving you a feeling that you have enough assets to protect you throughout your lifetime, it might not be the best way to pass wealth on to the next generation. In fact, the wealthiest families in America didn't just pass on a trust full of stocks, CDs and bonds to their children. They passed on multiple types of assets, including real estate, venture capital and an interest in the family business- on top of a portfolio of stocks and bonds.

After many years of both quantitative and qualitative research with wealthy families, we have identified what the factors are that create "perpetual wealth." In other words, the multigenerational wealth that will continue to renew itself and protect and benefit these families. It is not the type of wealth that can be pilfered by the members of a generation that choose to live richly but not wisely. This formula is somewhat consistent regardless of whether the family has $5 million or $10 billion.

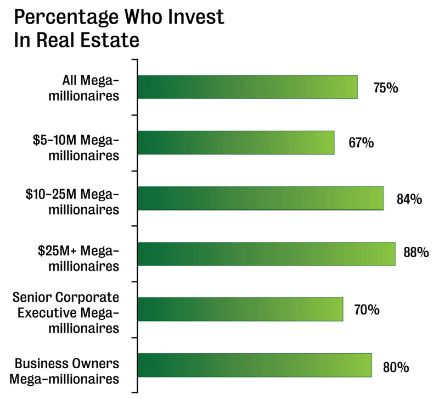

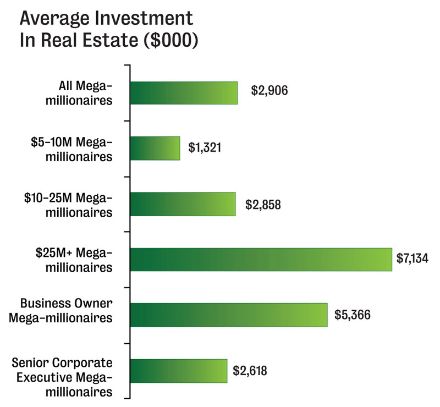

Families with multigenerational wealth generally have about 35%-45% of their portfolios in stocks and bonds, another 20% in real estate and 25%-35% in business ownership. The rest of the portfolio is made up of different types of investments and products such as insurance, pensions, IRAs, etc. As you can see, these portfolios are very diversified. This diversification, however, is among multiple investment types, not just multiple types of securities.

The challenge with passing on only a portfolio of stocks and bonds is that, in many cases, the future generations, because of the increasing number of heirs, eventually begin to dissipate the assets if they are non-renewing. In contrast, the portfolios of families with perpetual wealth have found ways to renew the income streams that originally created their fortunes.

After multiple years of research with wealthy families, we discovered that there were two key investments held by those who preserved their multigenerational wealth. They are:

Real estate

New businesses, especially those that the family members themselves are involved in.

These two strategies, in conjunction with the proper management of their portfolio of stocks and bonds, differentiated those families from others who did not preserve their fortunes..

The real estate part is relatively simple. Investment in income-producing real estate is a staple for many wealthy families and a great way to pass on intergenerational wealth. In interviewing numerous wealthy households, we found that most of them held several income-producing properties. Certainly part of the reason for this was that they wanted to diversify their portfolios. But another, more practical reason often was apparent. Many of these families felt they could live off of the income of the properties and not touch the principal of their other assets as they aged. They also often found that the properties offered a concrete way to pass on a legacy to children or grandchildren. The thought was that Julie or Bill or Sam could each have a property and choose to use the income or sell the building for the principal. While there may be, and often are, other assets that will be passed to the heirs, the real estate holdings seemed logical and safe to these households. In fact, our research shows that despite the recent challenges of the real estate market, investors continually see real estate as a "safe" investment.

The second holding, investments in innovative businesses and enterprises, was a little more difficult to describe. Generally, we found that these families involved their members in running and growing the family businesses as well as spinning off new enterprises often related to the primary ones.

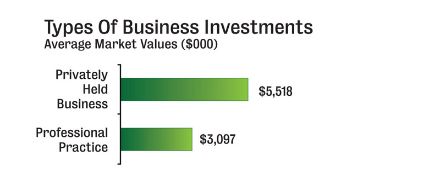

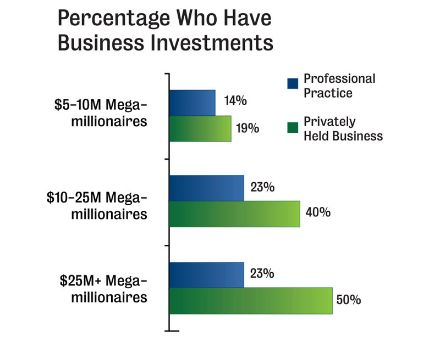

On the other hand, it was difficult to pass along a family "practice." Why? Generally, a business, large or small, promotes a product rather than a service. The product can be multiplied, reproduced and changed, but sales are primarily dependent on the product. A professional service, however, such as medicine or law, is based on the individual skills of a person. While a child may be brought into a law practice or medical practice, it is up to that child to ultimately demonstrate knowledge and develop his or her own client base. Unlike the family that is selling widgets, a practice cannot be easily handed down.

That's

not to say that doctors and lawyers are not wealthy. Our research over

the years shows, however, that the wealth of doctors and lawyers often

caps at the $10 million to $15 million level, while the wealth of

business owners often far exceeds that. Fifty percent of those who are

worth $25 million or more own a privately held business, as do 40% of

those in the $10 million to $25 million segment.

How can someone who does not have a family business find new enterprises? By observing needs in the industry or community in which one works or lives. It may be as simple as investing with others in a dry cleaning service that is needed in a particular neighborhood. We don't recommend giving up your day job for every innovative opportunity. It may mean investing in limited partnerships or other types of venture capital that you feel is creating a product or service needed in the industry in which you work. Most importantly, it means researching and feeling comfortable that the product or service is truly in demand and that the related business plan is solid. It does not mean just writing a check and keeping your fingers crossed that there will be a good outcome.

What Role Does The Advisor Play?

We

found that most individuals do not turn to an advisor when making

decisions about real estate or innovative enterprises. In fact, in most

cases, wealthy individuals make these decisions independently. The real

estate investments may be self-directed or done through a relationship

with a real estate specialist. The investments in innovative

enterprises, or even in venture capital opportunities, usually occur

through friends and family. The advisor or advisory firm managing the

family's stocks and bonds, meanwhile, is generally not involved in

these types of investments.

There is a good reason for this lack of involvement. It may be that they do not have the expertise to advise on other types of investments. Or it may be that the family members simply haven't asked them to become involved.

As we conducted interviews with multiple wealthy families, it became clear that many of these individuals did not think about their financial advisor as someone who could assist with multiple types of investments. In many cases, they did not think about their advisor as important in assisting with multigenerational decisions. Clearly they saw a role for the estate attorney and accountant, but financial advisory firms were often considered more for the transactions they could make. This attitude varied, of course, based on the type of advisory firm used by a family. If the family had a financial planning firm or family office involved, they were much more likely to have included their advisor in an all-encompassing approach. But there are still thousands of wealthy individuals with $10 million and more that do not know how or when to include an advisor.

So how can an advisor help a family create multigenerational wealth? When is it appropriate to get involved? How does a firm develop the appropriate expertise?

For

many of these households, it is simply about asking the initial

questions. Passing along a family business can be a complicated issue.

The clients may feel comfort in involving an objective outside opinion

in making the right decisions.

Providing some type of real estate solution and expertise is also critical when reviewing an overall portfolio. If one's firm does not have the requisite expertise, an affiliation or referral network should be established. Not only do your customers probably own real estate, they may ultimately want advice on how to pass it on to the next generation.

In order

for families to continually renew their own wealth, they must be

encouraged to have a "think tank" atmosphere and to push themselves

into new and sometimes risky ideas. Our research with households of

more than $25 million of net worth indicates that these wealthy

households are more willing to take risk than those of lesser wealth.

While it may be easier to take on risk when one already has substantial

assets, it must be remembered that those who have created perpetual

wealth have continued to invest in substantive enterprises and not just

rely on market returns.

George H. Walper Jr. is president and Catherine S. McBreen is managing director of Spectrem Group (www.spectrem.com), a Chicago-based strategic consulting firm specializing in the affluent and retirement markets. They also are the authors of Get Rich, Stay Rich, Pass It On: The Wealth Accumulation Secrets of America's Richest Families.