[Editor's Note: Ed Slott will be hosting a complimentary webcast on this topic with Financial Advisor on July 30. Click here for more information.]

The SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019) recently passed overwhelmingly in the House, but as of this writing it sits in Senate limbo.

This bill includes numerous retirement-related provisions, but buried at the end of the bill, under Title IV are the “Revenue Provisions” where Congress tells us how they plan to pay for them. It’s by essentially eliminating the so called “Stretch IRA.” Under current law, the “Stretch IRA” means that after the death of an IRA owner a designated beneficiary can extend distributions, and the tax deferral over their lifetime.

For example, a 30-year old beneficiary can stretch distributions on an inherited IRA over 53.3 years. A designated beneficiary means an individual with a life expectancy (not an estate, charity or most trusts) who is named on the IRA or company plan beneficiary form. Certain trusts can also qualify as a designated beneficiary if the trust qualifies as a “see-through” trust under the tax code.

The SECURE Act would change all of this. The stretch IRA would be eliminated and replaced with a 10-year payout for most IRA or plan beneficiaries (but the current rules are grandfathered for deaths before 2020—those beneficiaries could still do the stretch).

Under the SECURE Act, there would be exceptions for a group that would be known as “Eligible Designated Beneficiaries” which include the surviving spouse, a minor child (but not a grandchild), a disabled beneficiary (subject to the strict IRS requirements), a chronically ill person, or an individual who is 10 or less years younger than the deceased IRA owner.

So now what?

Which clients are most affected?

What should advisors be telling their clients with IRAs and other company plans?

First, even though these are only proposals at this point, advisors must begin planning as if this will be enacted, because it will be at some point. Congress believes that retirement accounts should be for retirement, and not be employed as an estate planning vehicle for future generations. They have a point there and that’s why this provision has been coming up for years.

Congress is also convinced this will bring in a windfall of revenue. It won’t, but that doesn’t matter to them. In fact, this will drain revenue as it will move clients to do the better, more tax-efficient planning that they should have been doing all along.

With better planning, clients’ heirs can actually end up with larger inheritances and less tax.

IRAs were never fantastic estate planning vehicles, especially the larger ones that are left to trusts. The tax rules are thorny and the trusts often did not qualify as a designated beneficiary, undoing the estate plan.

Now is the time for pro-active advisors to address these planning issues with clients so they will no longer have to worry about the uncertainty of their estate plans. Advisors can create alternative plans right now that will have long-term sustainability, without wondering what Congress will or won’t do next.

Which IRAs Would Be Affected By The Elimination Of The Stretch IRA?

Most people won’t be affected by the 10-year payout replacing the stretch IRA, because most don’t have multi-million dollar IRAs. The smaller IRAs are likely to be consumed during the IRA owner’s lifetime for living expenses and through required minimum distributions (RMDs). Since people are living longer, lifetime RMDs may exhaust much of the IRA before it even gets to the beneficiaries.

Even if a chunk of these IRAs are left over for beneficiaries, at worst, the beneficiaries can still spread distributions over the 10-year payout period, smoothing the tax bill over those years by using the lower tax brackets. This won’t have a major tax impact, and a good share of these beneficiaries probably would not have stretched these inherited IRAs over their lifetimes, which is why the official revenue projection is not accurate. These beneficiaries would not have stretched their inherited IRA funds over more than 10 years anyway.

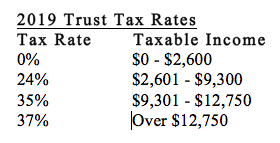

It’s the large IRAs that will be affected most. These are the $1 million plus IRAs—the multi-million dollar IRAs. Most of these funds will be left for the next generation and would be exposed to heavy taxation under the proposed 10-year payout, especially if they are left in trust, which most large IRAs are for post-death control and protection. The tax bill can accelerate quickly if the inherited IRA funds are taxed at trust tax rates.

Most people don’t have million-dollar IRAs, but every financial advisor has clients who do. These are the clients to focus on now.

These large IRAs are often left to trusts so they can be protected for (and from) beneficiaries. Naming a trust as the IRA beneficiary can provide post-death control for beneficiaries that a client might be concerned about, including beneficiaries who are minors, disabled, unsophisticated, spendthrifts, those who might be vulnerable or those who clients worry might squander or mismanage the funds or be subject to lawsuits or other financial problems. These are all good reasons to name a trust as the IRA beneficiary. The trust can provide the post-death protection and control desired, but it may come at a heavy tax cost since inherited IRA funds held in an IRA trust can be subject to high trust tax rates (except for a Roth IRA where RMDs paid to the trust would be tax-free).

The trust beneficiaries can also minimize the tax bill if they qualify for the stretch IRA through the trust (if the IRA trust qualifies as a “see-through” trust under the tax rules). This allows trust beneficiaries to spread RMDs they receive from the trust over the lifetime of the oldest trust beneficiary.

Two Types Of IRA Trusts

IRA trusts can either be conduit trusts or discretionary trusts. Both of these will be in peril under the tax proposals.

A conduit trust as the name implies pays out the RMD each year from the inherited IRA to the trust and from the trust to the trust beneficiaries. The trust is merely a conduit to the trust beneficiaries. The tax on the RMDs is paid by the trust beneficiaries, say, the children, at their own personal rates. They receive only the annual RMDs while the lion’s share of the inherited IRA remains protected in the trust for possibly decades depending on the ages of the trust beneficiaries.

A discretionary trust (a/k/a accumulation trust) also pays the RMDs from the inherited IRA to the trust, but here the trustee has discretion to pay the funds out to the trust beneficiaries or to hold part or all the funds in the trust to protect those funds. If funds are paid out to the individual trust beneficiaries, they will pay the tax at their personal tax rates. But if the funds are held in the trust, then the RMDs are taxed at high trust rates.

Both of these IRA trust planning mechanisms that currently employed will be drastically diminished if the stretch IRA is eliminated. Conduit trusts would essentially cease to exist.

Under the proposals in the SCEURE Act, there would no longer be RMDs each year based on a life expectancy. Any balance remaining in the inherited IRA at the end of the 10-year payout period would be the RMD at that point. All the funds would have to be paid out to the trust beneficiaries. That would cause all of those funds to be exposed to taxation, but even more important, the funds would lose their trust protection, which was the reason the trust was set up in the first place.

Conduit trusts would no longer work, and that includes Trusteed IRAs which some financial institutions use. Trusteed IRAs are conduit trusts, so inherited IRA funds would lose their trust protection in Trusteed IRAs, too. They would have to be scrapped or converted to discretionary trusts so that distributions could at least be spread out over the 10 years to somewhat lessen the tax impact. But with large IRAs this still might not be enough to avoid a big tax bill.

The only way to keep the inherited funds protected in trust would be to use discretionary trusts where the trustee can hold funds in the trust well beyond the 10-year period, as is the case under the current stretch IRA rules. But here too, at the end of the 10 years, all of the inherited funds will be forced into the trust and any funds maintained in the trust (not paid out to the trust beneficiaries) would be subject to tax at the high trust rates. The tax on these multi-million dollar IRA payouts would be exorbitant.

Traditional IRA trust planning would no longer be a viable estate planning strategy for these large IRAs. Other solutions would be necessary.

This is the conversation advisors need to have with their clients with large IRAs, whether they are being left in trust or not. Even if the funds are being left directly to beneficiaries, the tax will still be owed by the end of the 10 years.

Here Are 5 Solutions To share With Large IRA Clients Now:

1. Beneficiary Planning

Advisors should re-evaluate the clients’ IRA or plan beneficiaries. Most beneficiaries will be stuck with the proposed 10-year payout, but there are exceptions. The big one is the surviving spouse. The surviving spouse is exempt from the 10-year payout. Surviving spouses can still do a spousal rollover and keep taking RMDs over their lifetime. This can extend the tax deferral longer than leaving the funds to a younger beneficiary.

A 75-year old spouse can actually have a longer tax deferral than a 23-year old beneficiary. Under the current rules, the 23- year old could stretch RMDs over 60.1 years, but would now be stuck with only a 10-year payout if the stretch IRA is eliminated. The older surviving spouse would have a longer tax deferral. Make sure clients name contingent beneficiaries. If laws or situations change, there would be more post-death flexibility since the primary beneficiary could disclaim and the named contingent beneficiary would receive the funds.

2. Tax Bracket Management

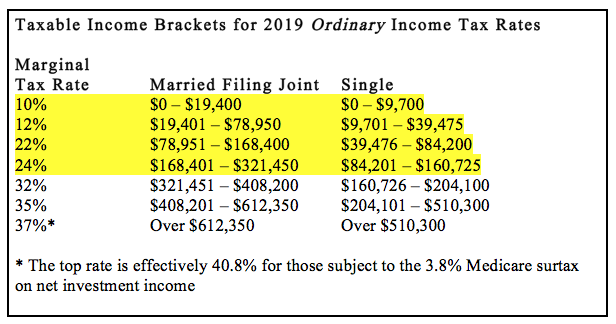

This can be done during life by accelerating distributions from IRAs even before RMDs begin. The Tax Cuts and Jobs Act expanded the lower tax brackets. Each year, lower brackets can be used up lowering the long-term tax impact. These lower tax brackets should never be wasted. If they are not used, they are lost forever. Plus, these more advantageous tax brackets won’t last forever. They are slated to end after 2025, or maybe even earlier depending on future tax law changes. That’s why they should be taken advantage of now. Large amounts of IRA funds can be withdrawn without exceeding the 24 percent tax bracket each year.

Once RMDs begin, the tax can also be offset by using QCDs (qualified charitable distributions). For those who give to charity, using QCDs can offset the RMD income. The IRA funds are directly transferred to a charity and excluded from income. QCDs are only available to IRA owners and beneficiaries who are age 70½ or older.

Beneficiary Tax Benefit Multiplier

Naming several beneficiaries can also greatly lessen the tax impact of a 10-year payout. For example, three beneficiaries who inherit can each spread post-death IRA distributions over the 10 years, taking advantage of the lower brackets on 30 different tax returns (3 returns each year, over 10 years). That could dramatically reduce the tax hit even on a large IRA. But still, after the 10 years the funds are all distributed to the beneficiaries and are no longer tax-sheltered.

3. Roth IRA Conversions

Roth IRAs have no lifetime RMDs, but the elimination of the stretch IRA will also apply to inherited Roth IRAs. Advisors will have to evaluate if a paying the tax on a Roth conversion will be worth it as an estate planning strategy if the funds must all be distributed in 10 years after death.

The Roth conversion tax benefit will depend on the projected tax rates when IRA funds would be withdrawn, if not converted. If the tax rates will be higher in retirement or for beneficiaries who would have to withdraw all of the funds in 10 years, a Roth conversion might pay. The Roth conversion could help avoid the accelerated income tax to the beneficiaries, since the inherited Roth funds would be received tax free.

Roth IRA conversions would work well when a trust is the beneficiary, because it would remove the potential trust tax problem addressed above. Even if the inherited Roth IRA funds would have to be all paid out to the trust after 10 years, the funds could still be held and protected in the trust for as long as the client (or trustee) desires without having to worry about the high trust tax rates. The Roth funds that are paid to the trust would be tax free, but additional annual earnings would be taxable.

Roth conversions can still work well when the spouse is the beneficiary since a spouse can do a spousal rollover and keep the Roth funds growing tax free over her lifetime, with no RMDs. In addition, the surviving spouse can have a source of tax-free income, keeping taxable income low.

4. Life Insurance

By far, life insurance would be the optimum strategy to replace the stretch IRA, especially for the largest IRAs where more IRA funds would be left to beneficiaries resulting in big tax bills. Life insurance could remove that tax problem, plus provide more funds to beneficiaries and more post-death control with trusts. The stretch IRA elimination would make IRAs less desirable estate planning vehicles and life insurance a better choice.

This would work best for IRA funds that will not be needed during lifetime, where the plan is to get as much to the beneficiaries as possible with maximum control and minimum tax.

Transition IRAs To Life Insurance

IRAs would be transitioned to life insurance by taking lifetime taxable distributions over time (beginning even before RMDs begin) and taking advantage of the lower tax brackets over several years, minimizing the taxes.

Advisors should take full advantage of the IRA “sweet spot.” This is the period between ages 59½ and 70½ (or maybe even age 72, which is proposed under the SECURE Act). During this time RMDs are not yet required and distributions are not subject to early distribution penalties. This allows the maximum flexibility for distribution planning. Funds distributed from an IRA can be invested in life insurance that can be left to a trust, instead of leaving the IRA to the trust. This can avoid dealing with the IRA trust problems outlined above that will be created under the proposal.

Life insurance is a much more flexible and tax-efficient asset to leave to a trust since unlike IRAs, there are no complex trust rules, no RMDs, no IRA custodial issues and the life insurance that will be paid to the trust will be tax free. The trust could be set up to simulate the stretch IRA without worrying about life expectancy tables or types of beneficiaries. The trust can be customized to whatever level of protection and control the client desires. Life insurance can provide the two big estate planning benefits—post-death control and no trust tax problems. This will be the solution most will use going forward to replace large IRAs, or even smaller ones where control might be desired.

5. Charitable Trusts

This is another potential solution if the client is charitably inclined. IRA funds would be left to a CRT (charitable remainder trust) that would pay annual income to the beneficiaries for a term of years or for life – similar to a stretch IRA. The payments would be taxable based on the tax tier rules of IRC Section 664(b) where the first funds out would be taxable as ordinary income, then capital gains, tax-exempt and lastly, tax-free return of principal.

The IRA distribution to the CRT would be income tax free, so all of the inherited IRA funds would be earning income. The downside here is that after the beneficiary dies the funds go to the charity. The beneficiary would have to live at least an average life expectancy to match the amount that he would have received if he inherited the IRA directly. If the beneficiary dies early, there is no successor who can continue the payments. The remaining balance would belong to the charity. In addition, there would be no lump-sum payment options, say if the beneficiary needed to dip in to the funds or needed a larger amount of money than the annual payments from the CRT, but then again, the client may want that protection. There would also be trust tax returns and administration costs each year. The CRT would only be worth it for large IRAs where there is a charitable intent.

Bottom Line For Financial Advisors—Get Busy!

Advisors need to get busy identifying the clients who will be most affected and begin having conversations about providing solutions. The top target will be the largest IRAs and specifically those IRAs currently being left to IRA trusts. These plans will no longer work as well as under the current rules, and may not work at all. Life insurance would be a better solution in addition to lifetime beneficiary and ongoing tax-bracket planning. Whether or not the law changes, clients need stable long-term estate plans for their retirement savings. That planning needs to begin now.

Ed Slott, CPA, is a recognized retirement tax expert and author of many retirement-focused books. For more information on Ed Slott, Ed Slott’s 2-Day IRA Workshop and Ed Slott’s Elite IRA Advisor Group, please visit www.IRAhelp.com.