Traditional IRA trust planning would no longer be a viable estate planning strategy for these large IRAs. Other solutions would be necessary.

This is the conversation advisors need to have with their clients with large IRAs, whether they are being left in trust or not. Even if the funds are being left directly to beneficiaries, the tax will still be owed by the end of the 10 years.

Here Are 5 Solutions To share With Large IRA Clients Now:

1. Beneficiary Planning

Advisors should re-evaluate the clients’ IRA or plan beneficiaries. Most beneficiaries will be stuck with the proposed 10-year payout, but there are exceptions. The big one is the surviving spouse. The surviving spouse is exempt from the 10-year payout. Surviving spouses can still do a spousal rollover and keep taking RMDs over their lifetime. This can extend the tax deferral longer than leaving the funds to a younger beneficiary.

A 75-year old spouse can actually have a longer tax deferral than a 23-year old beneficiary. Under the current rules, the 23- year old could stretch RMDs over 60.1 years, but would now be stuck with only a 10-year payout if the stretch IRA is eliminated. The older surviving spouse would have a longer tax deferral. Make sure clients name contingent beneficiaries. If laws or situations change, there would be more post-death flexibility since the primary beneficiary could disclaim and the named contingent beneficiary would receive the funds.

2. Tax Bracket Management

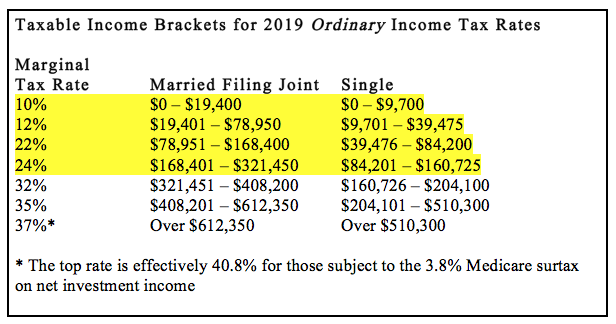

This can be done during life by accelerating distributions from IRAs even before RMDs begin. The Tax Cuts and Jobs Act expanded the lower tax brackets. Each year, lower brackets can be used up lowering the long-term tax impact. These lower tax brackets should never be wasted. If they are not used, they are lost forever. Plus, these more advantageous tax brackets won’t last forever. They are slated to end after 2025, or maybe even earlier depending on future tax law changes. That’s why they should be taken advantage of now. Large amounts of IRA funds can be withdrawn without exceeding the 24 percent tax bracket each year.

Once RMDs begin, the tax can also be offset by using QCDs (qualified charitable distributions). For those who give to charity, using QCDs can offset the RMD income. The IRA funds are directly transferred to a charity and excluded from income. QCDs are only available to IRA owners and beneficiaries who are age 70½ or older.