People are bailing out of equities. Thursday’s stock market action could fairly be called a rout. What to do?

Most of the time, equities go up. It’s better to buy them when their price has just fallen a lot. You buy them cheaper that way. And hanging around for the bottom might make a lot of money, but in the long term the natural propensity of share prices to rise will probably give you a good deal.

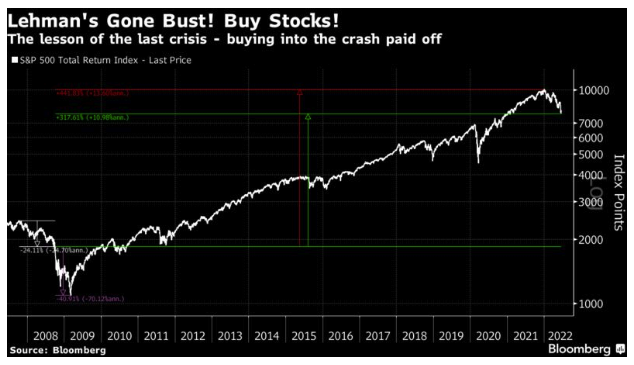

These arguments, when employed during similarly fraught circumstances in the post-Lehman crash of 2008, proved to be valid. On Oct. 1, 2008, Lehman had been bust for two weeks, Congress was objecting to the bank bailout, the S&P 500 was already down by about 25% and any number of horrors seemed possible. It’s a good comparison to where we are today. Had you bought then, you’d have had to withstand a loss of more than 40% over five terrifying months. But you would have been made whole by the end of 2009. And by the top of the market at the end of last year, you’d be sitting on a 440% total return. Even now, you would have more than quadrupled your money. And that was after buying when capitalism’s survival seemed more imperiled than at any time since the end of the Second World War, and after totally failing to time the bottom:

So why not just keep buying, at least on a dollar-cost averaging basis? A lot depends on how much time is on your side. I’m 14 years closer to retirement now than I was then (and so is everyone else), and that argument is less convincing now. There’s also the critical argument about monetary policy. Fourteen years ago, the imminent danger was a deflationary slump, and the coast was clear for central banks to prime the pump with easy money for years and years. That is no longer true. It’s also valid to say that someone could have sold just before Congress’s vote on the bailout initiated a total market crash in October 2008, sheltered in cash, and then bought at the end of the following year without having lost out on anything. Cardiologists would probably recommend that course of action.

But the basic points remain that stocks usually go up, being out of the market carries risks, and stocks are a better buy for the long term when their price has just come down. The bar for getting out of the market should be high. So is there a bullish case we’re missing? The most forthright bull argument I’ve seen this week was published Monday by JPMorgan Chase & Co.:

We maintain our positive view. May is a template for the year, record dispersion provides opportunities. We remain positive on risky assets due to near record-low positioning, bearish sentiment, and our view that there will be no recession given supports from U.S. consumers, global post-COVID reopening, and China stimulus and recovery. The war in Eastern Europe is a significant risk for the cycle but will likely converge to a settled solution in H2. We believe that markets will recover year-to-date losses and result in a broadly unchanged year.

Falling share prices since that note came out have made that call look even more bullish. At present, it would require the S&P to gain almost exactly 30% in little over six months. That’s a stretch. But it’s not out of the question.

The above paragraph, written by JPMorgan’s strategist Marko Kolanovic, neatly summarizes the points you have to believe to be bullish at this point. In turn, they are:

- Sentiment: There are certainly plenty of measures that are close to extremes. You could argue that nothing really looks like true capitulation yet, but that would be to fall into the trap of trying too hard to wait for the bottom, and allowing the perfect to be the enemy of the good. Yes, it looks like a decent idea to buy into what is currently very depressed sentiment.

-

The economy: The bullish view is predicated on a “no recession” call (from a house whose CEO has warned of an economic “hurricane”). A lot depends on definitions of recession, but the chances of avoiding something that most of us, and most of the corporate sector, experience as one are looking ever slimmer. Hence Thursday’s sharp fall for equities, coupled with a decline in bond yields — a move that shows that perceived recession risks are rising. In detail:

-

U.S. consumers: Yes, they definitely still have a lot of money in their pockets. That is good news for growth, but it is likely to come at the expense of rising prices. Arguably the greatest reason why inflation has bubbled over is exactly the reason why it’s still reasonable to hope we will avoid a serious recession. But that in turn means higher bond yields, which makes it harder to justify holding stocks. (Although Kolanovic is surely right that dispersion creates opportunities.)

-

Global post-Covid reopening: On balance this is likely, despite the shutdowns in China and the infuriating way the virus refuses to go away in North America or Europe. People everywhere seem to have reached a determination not to let the pandemic interfere with their lives anymore, if they can avoid it. It’s also true that the sectors most harmed, such as airlines and hotels, are barely above their lows relative to the market. But according to Johns Hopkins University, the 5,000 global deaths in the last five days were the lowest since the third week of March 2020, and more than 90% below their peak, and summer is almost upon us. And yet attendance in the workplace is still 20% below pre-pandemic levels in the U.S., and significantly down in most of the developed world. It’s reasonable to hope that reopening gains are still ahead and have been underpriced, though it’s not a sure thing;

- China stimulus and recovery: Yes, it could definitely happen. Fresh liquidity from China would wash through the world. But the problems with supply chains need to be addressed, and the implosion in the real estate sector must inevitably create damage. Bonds due in three years from China Evergrande Group, the stricken property developer, currently yield 140%. And a big attempt to juice the Chinese economy at this point would involve a huge U-turn, as the People’s Bank of China is trying to put the country’s house in order by reducing liquidity. Michael Howell, the liquidity guru at Crossborder Capital Ltd., states bluntly that China’s financial system is reason for negativity, not for buying stocks:

The biggest driver behind declining EM Liquidity is the ongoing monetary tightening by China’s People’s Bank (PBOC). The World economy will fall into recession as China’s monetary squeeze bites harder. Non-oil commodity markets will skid

- Ukraine: This situation could yet turn everything, in either a positive or negative direction. The drip of news for the last few days suggests that Russia is gaining an upper hand, and a much stronger negotiating position. That could mean a settlement in which Russia gets to hold on to all of the Donbas and the West stops sending arms to Ukraine. Such a settlement would relieve uncertainty, but it would remain very difficult for normal economic relations to resume. Could the Ukraine situation resolve positively for stock markets? Yes, definitely. But the tail risks are huge. It’s hard to say that the damage created by the conflict is being mispriced at present.

I’m thankful for the contrarian viewpoint, which usefully sets out what needs to happen for a recovery to be complete by the end of this year. It could happen. But the odds are that it won’t. I would regard the JPMorgan scenario as a possibility in a range of different scenarios, certainly not the base case. Others might differ, but Kolanovic has handily set out what needs to happen for a 30% rally this year. If you can wait longer, the arguments for continuing to put some money into the market remain as valid as ever.

The Only Game In Town

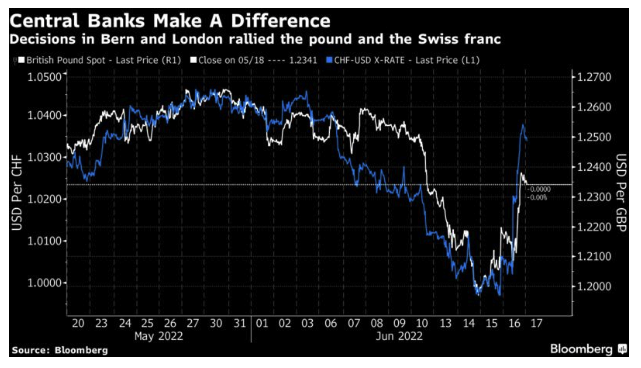

Yes, central banks matter. A lot. Early Thursday, the Swiss National Bank surprised everyone by hiking 50 basis points, and the Bank of England made a “hawkish” (in that it stoked expectations of more to come) increase of only 25 basis points. As a result, their currencies rocketed against the dollar, with the Swiss franc enjoying its best rally versus the euro since the SNB abandoned an attempt to peg the currency in early 2015. Even so, the pound remains weaker than before the U.S. CPI figures dropped last Friday, and the Swiss franc still isn’t back to its high for this month: