We assess the consumer and regions around the world that may benefit if oil prices remain low in part 2 of our series, “Potential Winners of Low Oil.” Sectors, industries, and even countries adversely impacted from the sharp drop in oil prices since mid-2014 are easy to spot, and their struggles have made headlines for more than a year. However, identifying potential winners from a prolonged period of low oil prices is more difficult to assess. Still, consumers, specific regions, and countries may benefit from these low prices.

Prior to the drop in oil prices that began in late 2014,[1] the average household spent almost 4% of its total income, roughly $2,500, on gasoline each year. This number does not include natural gas or heating oil expenses, where lower prices may translate into additional cost savings.

Based on a more than 50% drop in the price of gasoline (from $3.70 per gallon in mid-2014 to $1.74 in February 2016), the average household is now saving approximately $1,200 per year, or an additional $100 per month in disposable income. Lower oil prices are putting money in consumers’ pockets.

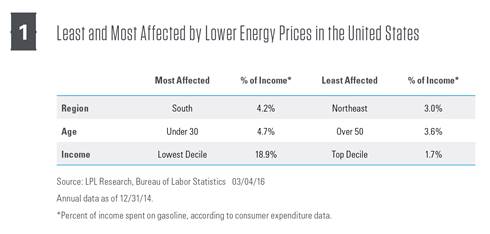

Digging deeper into consumer expenditure (CE) data reveals how consumers from different regions, age groups, and income levels may benefit from lower energy prices. Although 2015 data have yet to be released, expenditure data change slowly; therefore, the trends highlighted in Figure 1 are roughly stable.

REGIONAL, DEMOGRAPHIC, AND INCOME FACTORS: SOUTH A BIG BENEFICIARY

On a regional basis, consumers in the South may benefit most. Southern consumers tend to spend a larger share of income on gasoline. At the opposite end of the spectrum is the Northeast, where public transportation is more common and consumers spend less on gas.

The regional differences are also supported by income trends. A greater percentage of lower-income households reside in the South versus the Northeast, which tends to have higher average incomes. To some degree, average incomes reflect cost of living differences; however, both regional characteristics and income levels suggest consumers in the South are more likely to benefit from lower oil prices.

Unsurprisingly, the lower-income consumers spend a much higher percentage of their income on energy and are obvious winners of low oil on Main Street. For higher-income earners, energy savings are less impactful.

Age also plays a role, with the youngest group surveyed (those below 30 years old) spending a higher percentage of income on gasoline; the over 50 group spends the least, although these data are also impacted by older consumers’ generally higher incomes.