The common assumption among many wealth management industry observers is that private equity investors have overinflated the price of RIA firms. On the surface, it’s easy to see how this perspective has taken root.

Since it’s no secret that over the last decade private equity firms have aggressively pursued deals in our space, it seems logical to conclude that mounting competition boosted demand and caused RIA valuations to spike—all of which put owners in the driver’s seat, allowing them to sell their firms at extraordinary premiums.

That, however, is not really what has happened.

Don’t Confuse Deals With Premiums

Without a doubt, RIA M&A activity has increased dramatically. According to our data, 2019 was the seventh straight record-setting year in terms of the number of deals completed, with 203 transactions recorded in ECHELON’s RIA M&A Deal Report. That was up 12.2% over the previous year, and, all told, the annual growth rate is higher than 15% since 2015.

While some of the largest deals during this time were carried out by private equity firms, an overwhelming majority of them had no private equity involvement at all. What’s more, just because there were more deals, it doesn’t mean that sellers have been successful in persuading buyers to pay unreasonable prices.

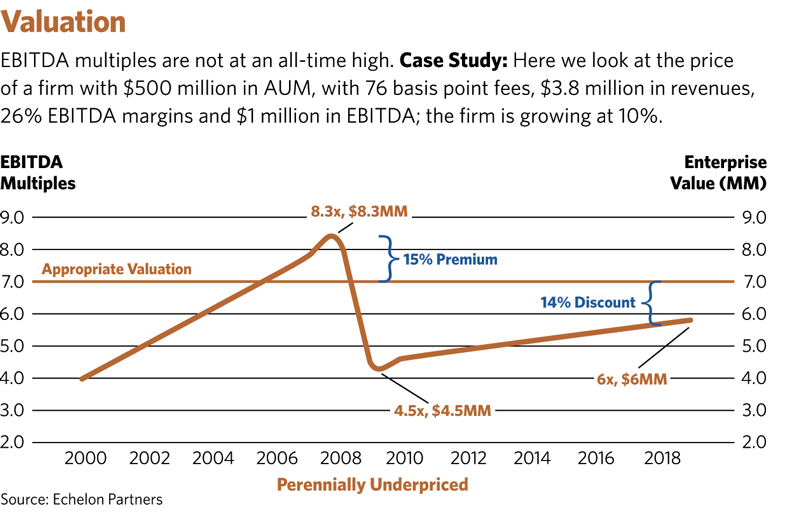

Going back over a decade, in fact, many RIAs have actually been underpriced based on earnings multiples (see chart)—even as there was a historic, decade-long run-up in the stock market.

The Professionalization Of Wealth Management

Private equity’s near-term legacy, therefore, is not that it has caused the RIA market to overheat. Rather, it is that these professional buyers have pushed wealth management firms to establish more structure, discipline and organization, a trend that has benefited everyone in the industry.

Granted, a large number of firms would have actively professionalized their operations anyway, including the emerging group of next-gen advisors—those who have begun to replace the original firm founders who never strayed from their lifestyle practice business model. However, the entrance of private equity money has hastened this trend considerably.

Indeed, as consolidators and integrators made deals, they hired longtime industry leaders to oversee their acquisitions and fulfill a range of C-suite level responsibilities. At the same time, they also poured resources into first-rate technology solutions that improved the quality, delivery and accountability of their services.

To keep up, much of the competition adapted, which drove an industrywide modernization effort. The outcome is that RIAs have never been more professionally run.

The Elephant In The Room

The obvious question in the now suddenly harsh economic market environment: What will happen to M&A activity in the future?

In the short term, credit could be more challenging to come by, even with historically low interest rates, as lenders likely become more cautious. If that happens, some deals may be more difficult to complete, including many first-time purchases, which often require personal guarantees.

Some sellers, therefore, may try to wait things out, even as they are increasingly ready to scale back their day-to-day involvement, having grown tired of the administrative burdens that come with running a firm.

Many others, though, may not have that luxury. The sad reality is that as advisors continue to age, scores of them will have health issues that threaten their option to continue to work—an issue that only gets exacerbated by the coronavirus outbreak. Thankfully, for their sake, private equity money and other acquirers will provide them with options.

In the longer term, there is a silver lining: Thanks, in part, to how private equity has strengthened and professionalized the entire industry, RIA firms have never been more prepared to take on this challenge. So, if there is indeed a lull in activity, it’s unlikely to linger for too long.

Carolyn Armitage is a managing director with Echelon Partners, a Manhattan Beach, Calif.-based firm that provides M&A advisory, valuation, consulting and investment banking services to registered investment advisor firms across the country.