Amid the continued devastation and uncertainty brought on by the coronavirus pandemic, veteran value investor Tony DeSpirito, chief investment officer of fundamental active equity and lead portfolio manager of the BlackRock Equity Dividend Fund, is urging investors to keep an eye trained on a brighter future. That’s especially true for value stocks, which have lagged growth stocks for over a decade and have fallen even harder than the rest of the market so far this year.

“The market is reacting to short-term issues, not long-term problems,” he says. “That’s the difference between now and 2008, when there were a lot of excesses in the financial system. We just don’t have that now.”

As DeSpirito and others in the investment community attempt to quell fears and curb market panic, it’s hard for their intended audience to feel optimistic. Economies around the world are taking a broad hit from containment measures limiting trade and travel. The possibility of a liquidity crunch or deterioration in financial conditions remains very real. A recession is certainly possible, and with interest rates already scraping bottom the remaining running room for rate cuts to stimulate the economy is limited. It’s almost certain that corporate earnings will be hit hard.

On the other hand, he says, the economic and financial backdrop is much stronger and less risky today than it was going into the financial crisis of 2008. And while the ultimate depth and duration of the coronavirus’s economic impact are highly uncertain, he believes the shock is temporary. Assuming the U.S. and other countries are able to rein in the outbreak through decisive containment efforts and limit the economic damage through strong fiscal and monetary policies, the panic will eventually dissipate and economic activity will normalize.

DeSpirito advises investors to step back and remember what the economy has going for it. He points out that before the pandemic the U.S. personal savings rate was above 7% over the past decade. The unemployment rate was near multi-decade lows and lower- and middle-class households were finally enjoying wage growth. Company balance sheets, for the most part, looked sound. For years, low interest rates allowed companies to lock in cheap long-term financing, which helped boost earnings. And while 2020 will see lots of market volatility and moments of panic, the fourth year of a presidential term has historically coincided with positive returns for the S&P 500.

Buying On Weakness

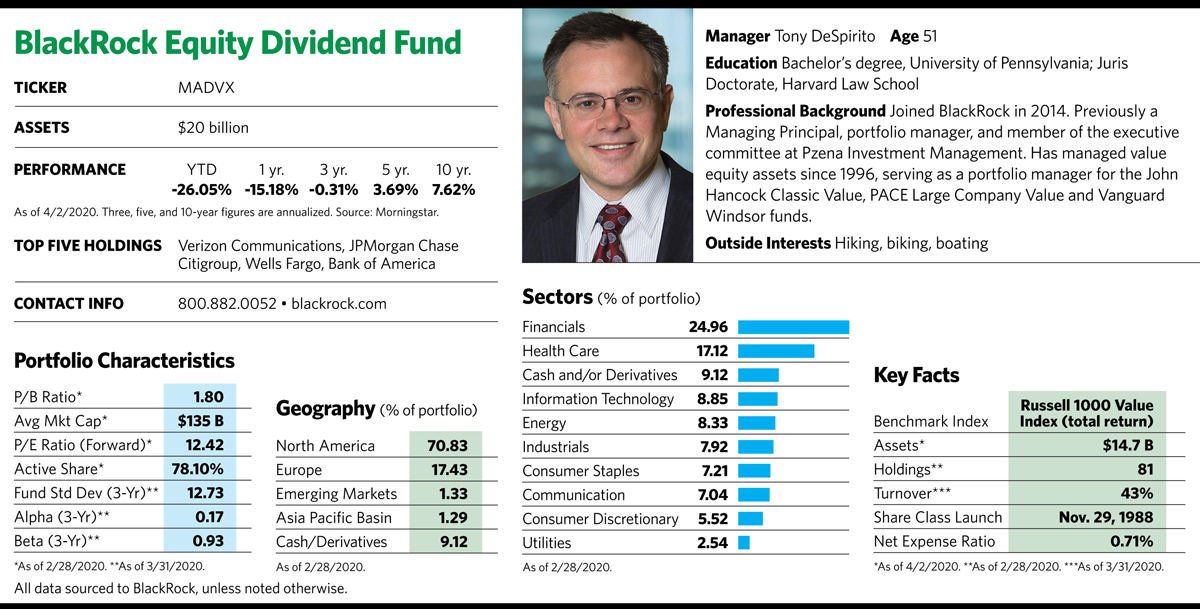

As the market drama plays out, the 51-year-old DeSpirito, who has managed value equity portfolios since 1996 for fund groups such as John Hancock and Vanguard, is taking advantage of depressed prices by gradually deploying the fund’s cash stake into stocks in sectors such as consumer staples, utilities, energy and financials. At the beginning of the year, cash stood at about 9% of assets thanks to end-of-year selling, providing more fodder than usual for selective downturn buying.

As always, he is zeroing in on durable but underappreciated businesses with strong lines of defense such as brand strength, cost positioning strength and robust R&D investments. He also looks for companies with growing dividends, which he says are a signal to the market that a company’s management has confidence in its business.

When a company’s dividend growth is fueled by positive earnings trends and good free cash flow generation, that suggests it has superior, efficient operations. Of the 55 stocks that the BlackRock Equity Dividend Fund held for the full calendar year of 2019, 46 of them grew their dividends during the year, at a median annual increase of 6.1%.

Dividend growth is particularly relevant today, in a world characterized by low interest rates and a scarcity of attractive yield for income-oriented portfolios. “If you buy a Treasury security yielding 1%, that’s all the income you’re going to get,” he says. “On the other hand, we expect dividend income on stocks in our portfolio to double every decade. That means if a stock is generating $3 a share in dividends, we’re looking for that to double to $6 a share in 10 years. That growth in income is not something you’ll get with a bond.” Now that yields are approaching all-time lows, minimizing the potential for future price appreciation, government bonds have also become a less effective portfolio ballast than they were in the past.

He also leans toward companies with quality characteristics, such as strong balance sheets and ample free cash flow. The stocks of such companies are better able to weather market volatility, which has increased dramatically since last year and is likely to continue as the coronavirus cloud, U.S.-China trade tensions, and election year uncertainty add to investor concern and uncertainty.

Sector Views

Financial stocks, which constitute the fund’s largest sector, have been trounced as falling rates raise concerns about bank profitability. Yet DeSpirito points out that many banks are in their best fiscal shape since the financial crisis. The U.S. bank stocks in the fund that delivered significant dividend increases of 17% or more in 2019 include JPMorgan Chase, Citigroup, Wells Fargo and Bank of America. Those that stood out in dividend growth were Citigroup, which has grown its dividends by 55% over the last three calendar years, and Bank of America, which has grown its dividends by 38% over that period.

DeSpirito says he prefers money center banks to regional players because the former’s lines of business are diverse and federal regulations require them to hold substantial capital. He also likes insurance brokers, given their ability to raise premiums on business customers.

The aging population supports DeSpirito’s longer-term thesis for health-care companies, the second-largest sector for the fund. In 1985, roughly one in 12 adults in the U.S. was over the age of 65. By 2025, that number will be one in five, or 20% of the population. According to BlackRock’s estimates, people’s health-care costs roughly triple after they turn 65, and the demand for health products and services is unlikely to be affected by things like geopolitical tensions and trade wars. Political concerns have also begun to fade since presidential hopeful Bernie Sanders, a proponent of “Medicare for all,” has become less likely to clinch the nomination. “It’s a stable sector with an attractive valuation,” DeSpirito says.

Historically, health-care stocks have participated in rallies while also showing resilience in down markets. In 2019, they lagged the broad market but were still up an impressive 23%. And in 2018, when global equity markets were down 9%, the sector was up 2%.

DeSpirito is trying to combat sinking oil prices by focusing on what he considers the highest quality picks in the beleaguered energy sector. He prefers European integrated oil companies to those based in the U.S. because they represent the better value. Because ESG investing is better established in Europe than the U.S., many pension funds avoid the sector, he says. As a result, European oil companies are selling at even cheaper valuations than their U.S. counterparts.

The key in all these sectors and others, he says, is to avoid “disrupted” companies—those likely to suffer as new technologies take hold. To participate in the retail sector, for example, DeSpirito prefers dollar-store type outlets rather than upscale retailers. Their low $10 average ticket size, bargain basement prices and loyal clientele are more difficult for Amazon to replicate than retailers selling higher-end goods.

Turning Point For Value?

The Russell 1000 Value Index has lagged its growth counterpart by roughly 4% annually over the 10 years ended January 30, 2020. This bifurcated market has created an unusually wide valuation spread between growth and value stocks.

DeSpirito thinks value may finally be able to close the gap for several reasons. Historically, value stocks have been known to play catch-up after a particularly sharp fall.

There’s also the longer-term picture. Over the past 50 years, large-cap value stocks have returned 13.5% annually while large-cap growth has returned 10.2%.

For now, though, DeSpirito’s focus is on the big picture. He believes signs point to a market drubbing that will be measured in months, rather than years.

“Once we get past the coronavirus-related rout, a strong snapback is quite possible,” he says. “I can envision a booming stock market a year from now.”