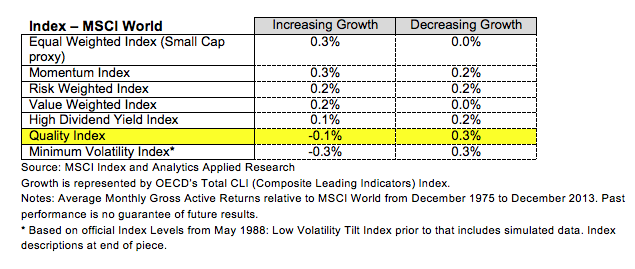

Quality May Hedge Risk Of Decreasing Growth

Relative outperformance of MSCI factor indexes across monthly periods of increasing and decreasing growth compared to the MSCI World Index (market cap weighted), Dec 1975-Dec 2013

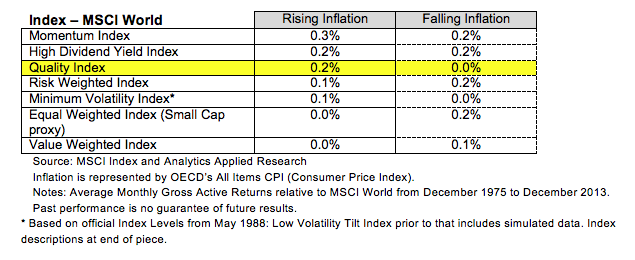

Quality Could Protect Against Short-Term Inflation

Relative outperformance of MSCI factor indexes across monthly periods of rising and falling inflation compared to the MSCI World Index (market cap weighted), Dec 1975-Dec 2013

Over longer time horizons, Quality displayed strong counter-cyclical relative performance in response to both economic growth and inflation. However, Quality’s responses to inflation suggest that it is impacted in different ways over the short and long term. Whereas Quality has been an effective hedge during periods of rising inflation in the short term, over longer periods this does not appear to be the case (since Quality securities are characterized by, among other things, stable nominal cash flows, higher inflation could have a negative impact on real cash flows and returns).

When Mixing Growth And Inflation, Quality Delivered

Market Vectors Allows Investors To Access QualityCould there be a better way to invest in international and emerging markets than just buying the entire broad market?

Countless academic studies and articles have researched “Quality” as a factor in investing and identified it as a potential driver of outperformance with relatively lower volatility over traditional market indexes. Many investment professionals, including active managers, have long used Quality to identify companies that have been consistently profitable and increase their earnings over time while seeking to avoid excessive debt. Quality, as defined by MSCI, screens for companies that have demonstrated historically high return on equity, stable annual earnings growth, and low financial leverage. Although there is no guarantee these companies can maintain their historical characteristics, such fundamentals may indicate a level of strength relative to other companies and offer an innovative way to approach these markets.

While Van Eck Global is a firm advocate of Quality as a factor, we are also aware that its performance differs across various economic scenarios. Investors are increasingly taking the state of the economy into account when making their asset allocation decisions; therefore, we believe it is important to show how Quality performs against other factors across different economic growth and inflationary environments, as well as Quality’s relative performance through transitions from one economic environment to another. With the help of research from MSCI, we have sought to validate what we have learned about Quality from our almost 60 years of investment experience.

We have seen that MSCI’s Quality factor has historically been an effective hedge in periods of decreasing growth, generally outperforming more pro-cyclical factors such as Small Cap, Value, and Momentum over the short term. With a negative correlation (-0.43) to growth markets, Quality can be considered defensive: it has tended to underperform, on a relative basis, during stronger economic times.

Many investors are also increasingly questioning the effect of inflation on their portfolios, so when considering periods of short-term inflation, Quality has also historically served as an effective hedge.

We believe it is also important to understand Quality’s performance in economic environments that combined strong or weak economic growth with rising or falling inflation. Once again, MSCI’s analysis confirms our belief that Quality can be a strong defensive hedge, posting strong relative performance during historical periods of slow growth regardless of whether inflation is rising or falling.

Finally, in relative terms, how has Quality performed when different economic environments transition from one to another? MSCI’s data shows that, historically, we have seen that an investment in Quality generally outperformed during periods of slowing growth. For periods when inflation also remained low as well, then Quality again outperformed.

We launched our family of four MSCI-linked factor ETFs earlier this year as the latest additions to our suite of Market Vectors International ETFs so investors could integrate Quality into their portfolios when economic conditions are appropriate. Market Vectors MSCI International Quality ETF (QXUS) and Market Vectors MSCI Emerging Markets Quality ETF (QEM) may benefit by tracking indices that apply MSCI’s Quality screens to broad international and emerging markets.

Quality screens can also be applied to dividend-oriented strategies, as in the Market Vectors MSCI International Quality Dividend ETF (QDXU) and Market Vectors MSCI Emerging Markets Quality Dividend ETF (QDEM). Indexed to MSCI High Dividend Yield Indices, constituents are identified by MSCI as quality growth companies that have historically offered a higher dividend yield relative to their respective parent (broad market) indices and that had a track record of providing sustainable and consistent dividend payouts.

Quality In A Changing World

June 17, 2014

« Previous Article

| Next Article »

Login in order to post a comment